In May 2013, it was reported that Mama Ngina was Kenya Power's 4th largest individual shareholder with 2.2mn shares trading at Sh16.55 a share.

After 7 years of mismanagement and fraud, KP's shares now trade at Sh1.90 with Sh25bn+ lost in value.

businessdailyafrica.com/corporate/comp…

Transcentury, founded by Kibaki's Muthaiga pals, listed in 2011 at Sh50/share (Sh13bn) and issued an $80mn Eurobond.

Then TCL got into RVR & Kibaki left power.

By 2013, the shares were at Sh35 and now trade at Sh1.80 (Sh675mn) with plans to exit NSE.

nation.co.ke/kenya/news/how…

East African Cables, an NSE darling and once owned 70% by Transcentury hit an all-time high of Sh614 a share in 2006.

Chinese competition and excessive debt have however seen the company falter with shares now at Sh1.83 and a market cap of Sh468mn

businessdailyafrica.com/markets/market…

Housing Finance seemed poised to ride the 'housing boom'.

With a weakening economy, even the roughly 25,000 mortgage holders have struggled to stay afloat.

HF's shares hit a high of Sh37 in 2014 before dropping to the current Sh4.00/share.

theeastafrican.co.ke/tea/business/t…

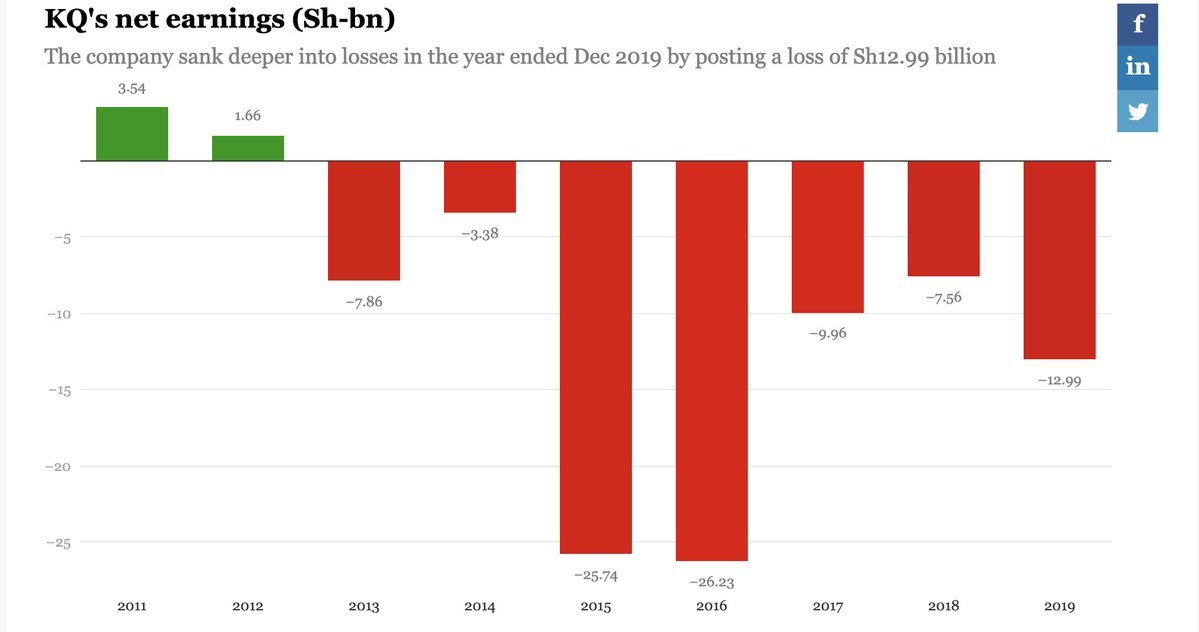

In June 2013, Kenya Airways made a Sh7.86bn loss and announced that shareholders would not receive a dividend for the first time in 14 years.

With annual revenues at Sh98.8bn, KQ was the third largest firm in sales behind Kenol Kobil and Safaricom...

businessdailyafrica.com/corporate/KQ-f…

Then in June 2014, CEO Titus Naikuni stepped down and in March 2015 the airline announced a record Sh25.74bn loss.

With survival looking bleak, KQ shares were suspended from the NSE in July 2020

nation.co.ke/kenya/life-and…

In August 2020, Kenya Airways announced a Sh14.33bn net loss for the half year to June 2020.

This brings the airline's total losses over the last 7 years to Sh108,050,000,000 even as the govt moves forward with a nationalisation plan.

businessdailyafrica.com/corporate/comp…

Home Afrika shares rallied to Sh25 when it listed in July 2013

By Sept, the share price had fallen 50%

It's been a downward slide since, with the firm cycling through CEOs, struggling with unfinished projects and its shares now trading at 44 cents.

businessdailyafrica.com/markets/Home-A…

In October 2013, supply difficulties led Bridgestone to ending its partnership with Sameer Africa.

In 2016, the NSE-listed Sameer closed its Yana Tyre manufacturing plant and in May 2020 shut down the distribution business, eliminating 125 jobs.

nation.co.ke/kenya/business…

In May 2014, Tata Chemicals Magadi Soda, founded in 1911, announced that it would scale down its operations leading to a loss of 200 jobs and Sh4.4bn in forex earnings.

The company blamed high operating expenses including power costs, for its woes.

nation.co.ke/kenya/news/200…

In July 2014, Hong Kong Shanghai Banking Corporation (HSBC) formally exited Nairobi, three years after it set up operations. This, it said, was part of the group’s restructuring that has seen it scale down operations in all its markets.

businessdailyafrica.com/markets/HSBC-s…

Earlier on, we learned that 5 govt-owned sugar firms owed about Sh100bn in loans as mismanagement and dumping of illegal sugar escalated:

-Nzoia Sugar: Sh37bn

-Miwani Sugar: Sh28bn

-Muhoroni Sugar: Sh27bn

-Chemelil Sugar: Sh5bn

-Nyanza Sugar: Sh3bn

theeastafrican.co.ke/tea/business/f…

In September 2014, the Nation reported that the iconic Mumias Sugar had been looted dry.

At its peak, the NSE-listed firm had 60% of the market, Sh2.6bn in profits and a share price of Sh60.

Mumias is the story of corporate looting at its finest.

nation.co.ke/kenya/business…

As Mumias failed, 70k farmers uprooted their cane, thousands of jobs were lost, Sh12.5bn in loans defaulted & Sh72bn+ in stock value erased, not to mention billions in failed govt bailouts.

Workers received Sh20,000 each in terminal dues in Dec 2019.

nation.co.ke/kenya/news/how…

Still in September 2014, Eveready announced it would shut down its Kenya manufacturing operations and instead import products from Egypt.

99 employees at its Nakuru manufacturing plant were sent home.

nation.co.ke/kenya/business…

In October 2014, Cadbury's shut down its Kenya manufacturing operations in what was said to be a global supply chain realignment.

The move impacted 300 jobs working at its Nairobi plant.

businessdailyafrica.com/corporate/Cadb…

In early 2015, Telkom Kenya had 1,600 employees.

By December 2015, the company had let go of 500 in a layoff, with more leaving in latter years.

With the Airtel merger talks failing, Telkom looks to continue trailing Safaricom for years to come.

standardmedia.co.ke/kenya/article/…

In August 2015, Dubai Bank, founded in 1988, was placed under receivership when it was found to be insolvent with over half its loans, including Sh495mn owed by Cyrus Jirongo, deemed irrecoverable.

Dubai went down with Sh1.7bn in depositor funds.

standardmedia.co.ke/business-news/….

In April 2016, Chase Bank was placed under receivership amidst claims of financial impropriety, putting 1,300 jobs and assets of over Sh100bn at risk.

The bank was later taken over by SBM of Mauritius.

nation.co.ke/kenya/business…

In May 2016, two years after being put under receivership, flower giant Karuturi laid off 2,600 workers. It had struggled for years to service a Sh400mn debt owed to Stanbic Bank.

standardmedia.co.ke/business/artic…

Still in 2016, Peter Kuguru, founder of Softa Bottling put out feelers for a strategic partner but later shut down his factory after failing to weather stiff competition.

At one point, the 20-year old co. had 10,000 workers working at 1,000 depots.

businessdailyafrica.com/economy/Kuguru….

In 2018, Britam laid off 110 of its employees as it adopted automation and sought to cut costs

The company recently announced a Sh2.4bn half-yr loss with Benson Wairegi, who has been CEO for most of his 40-year tenure announcing his retirement.

businessdailyafrica.com/corporate/comp…

In November 2018, NSE-listed fashion retailer went into administration after it collapsed into insolvency with debts of Shs1.0bn.

In May 2019, the chain shut down all stores bringing to and end a 60-year presence on the Kenyan market.

citizentv.co.ke/business/deaco…

In April 2019, KCB paid Sh10 to acquire Imperial Bank.

The bank collapsed in 2015 as rampant theft by management in collusion with regulators led to the loss of over Sh35bn in deposits, impacting hundreds of jobs, livelihoods and Sh70bn in assets.

standardmedia.co.ke/entertainment/…

By August 2019, things were already difficult and 15 listed companies announced that they were not making enough money signalling tough times ahead.

2020 materialised all their worst fears.

standardmedia.co.ke/business/artic…

Interestingly enough, banking sector wages and profits have continued to grow even as they laid off over 7,500 employees in the four years from 2015 to 2018

Between 2015 and 2017, the banking sector laid off 6,020 employees with 1592 more in 2018

businessdailyafrica.com/economy/394623…

Then came Nakumatt.

CEO Atul Shah tried every excuse to explain its failure - from the 1998 fire to the Thika Road demolition to the Westgate attack.

The supermarket chain, established in 1979, was once a landmark across many towns in East Africa.

thecitizen.co.tz/magazine/Nakum…

The reality for Nakumatt, which went down with over 60 outlets, 7,000 jobs and Sh30bn in supplier debt, is however a lot more simpler.

It appears that it was never really a supermarket by the time it came tumbling down.

nation.co.ke/kenya/news/nak…

In September 2019, Choppies supermarkets announced plans to close down its 12 stores and exit Kenya

"Choppies Supermarket has revealed plans to exit the Kenyan market four years after acquiring Ukwala stores for Sh1 billion."

businessdailyafrica.com/corporate/comp…

Since 2000, Mobicom had been Safaricom's biggest dealer, raking in over Sh5bn annually.

In 2010, Mobicom switched to Telkom

As the Telkom-Airtel merger fell apart in September 2019, Mobicom laid off over 800 employees citing unfavourable conditions.

the-star.co.ke/business/2019-…

In October 2019, Finlays Flower Co. announced its exit rendering 1,700 workers jobless and taking with it a Sh1.8bn annual contribution to the Kericho county economy.

standardmedia.co.ke/business/artic…

In Oct 2019, Sportspesa laid off all 400 workers, a month after Betin laid off 400 of its own.

"Embattled betting firm SportPesa has sent home all its 400 employees in the aftermath of a lost battle with the government over renewal of its license."

citizentv.co.ke/business/sport…

Later in the same month, Air Afrik announced 200 job cuts following the loss of a Sh2bn plane-leasing contract with the government of South Sudan.

citizentv.co.ke/news/air-afrik…

Also in October 2019, Securex announced that it would let go of 222 workers following the loss of a number of assignments during the year.

the-star.co.ke/business/2019-…

In November of 2019, Silverstone Air announced that it was getting rid of all its pilots and crew, with an imminent shutdown of its operations.

In January 2020, the airline announced operational redundancy and a wet lease of its aircraft.

the-star.co.ke/business/kenya….

At the end of 2019, over 7,000 employees had been laid off from notable employers who cited restructuring, reduced profits, hostile business environment, and high cost of labor and production as the reasons for the retrenchment of workers.

mwakilishi.com/article/kenya-…

45-year old Uchumi, whose name was once interchangeable with 'supermarket' went public in 1992 and the shares hit a high of Sh52 in 1995.

In 2015, the chain had 4,500 employees and 40 branches.

theeastafrican.co.ke/tea/news/east-…

As the years went by, Uchumi had to contend with growing competition, rampant theft & mismanagement, turning it into the Frankenstein of retail.

The shares currently trade at 30 cents and the chain has only 7 branches with Sh3.6bn owed to suppliers.

nation.co.ke/kenya/nation-p…

Tuskys hasn't fared very well either. As family squabbles took centre stage, the supermarket chain has lurched from crisis to crisis with the only plausible end in sight being a strategic investment or an Uchumi-like meltdown

businessdailyafrica.com/corporate/comp…)%20over%20two%20years.

Still with the carnage in retail, In April 2020, Shoprite closed its Waterfront Mall store in Karen followed by its Nyali store in early August where it laid off 115 employees.

reuters.com/article/us-sho….

Things have gone sideways very quickly for Shoprite which bragged of its regional experience and liquidity advantage, describing the Kenyan retail sector as being in disarray, when it entered in 2018.

qz.com/africa/1219070…

Having discovered oil in the South Lokichar Basin in March 2012, Tullow Oil embarked on an early export pilot scheme in June 2018.

And even though the $12mn earned went into offsetting production costs the dream of oil riches lingered in the air.

nation.co.ke/kenya/news/exc…

But in Dec 2019, Tullow's parent co. ran aground, management stepped down and the stock lost 50% of its value.

In Jan 2020, the co. announced 325 layoffs before presenting GoK with a Sh204bn invoice and plans for a possible exit later in the year.

citizentv.co.ke/business/tullo…

A Force Majeure issued in May 2020 as Tullow contested a Sh5,000,000,000 tax demand by KRA was recently lifted after the govt rejected it.

With oil prices bouncing along the bottom due to the pandemic, Kenya's oil dreams remain just that; dreams.

the-star.co.ke/business/kenya…

In May 2020, East African Portland Cement announced layoffs after a Sh3.2bn loss in 2019 and a negative asset position of Sh9.5bn.

Years of mismanagement and a softening construction sector had taken its toll.

theeastafrican.co.ke/tea/business/k…

In June 2020, Mediamax announced it was letting go of about 100 employees followed by Nation Media Group also announcing layoffs that had long been in the works as traditional media faltered in the face of digital challengers.

standardmedia.co.ke/nairobi/articl…

And finally in August 2020, Unilever intimated that it may scale down its Kenya operations significantly.

"The jobs of more than 60,000 Unilever Tea workers are in limbo as the company rethinks its tea business following huge losses"

nation.co.ke/kenya/news/60-…

It's not been all doom and gloom however, with Kenya ranking second in tech investments on the continent with $564mn in funding raised

With technology taking centre-stage, the country is certainly positioned to reap greatly.

techcrunch.com/2020/03/04/did…