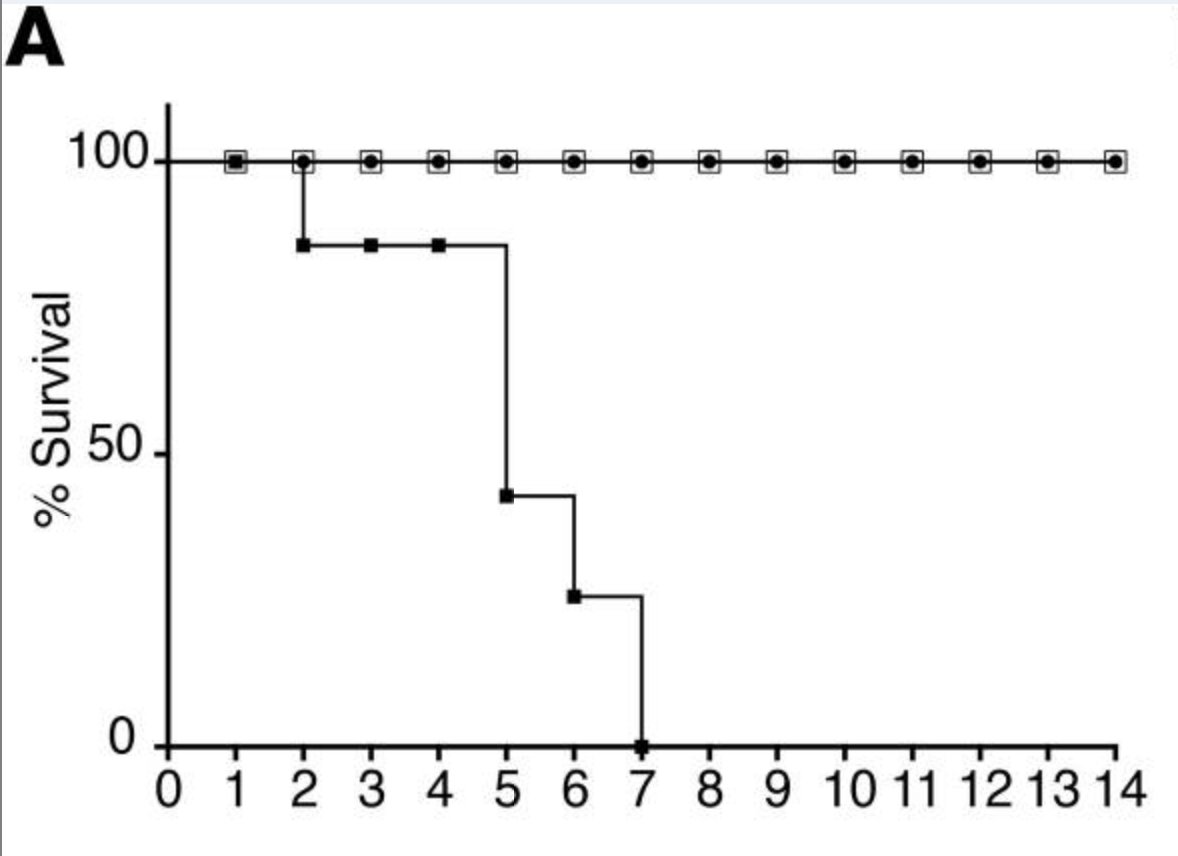

1/ I discuss w/ @charliekirk11 the latest research on T-cell immunity and how it relates to high % of asymptomatic cases and a new threshold for herd immunity.

This info is suppressed even at the level of scientific journals.

Speaking along w/ @drsimonegold & Dr. Keith Rose.

This info is suppressed even at the level of scientific journals.

Speaking along w/ @drsimonegold & Dr. Keith Rose.

2/ Podcast on T-cell immunity continued...

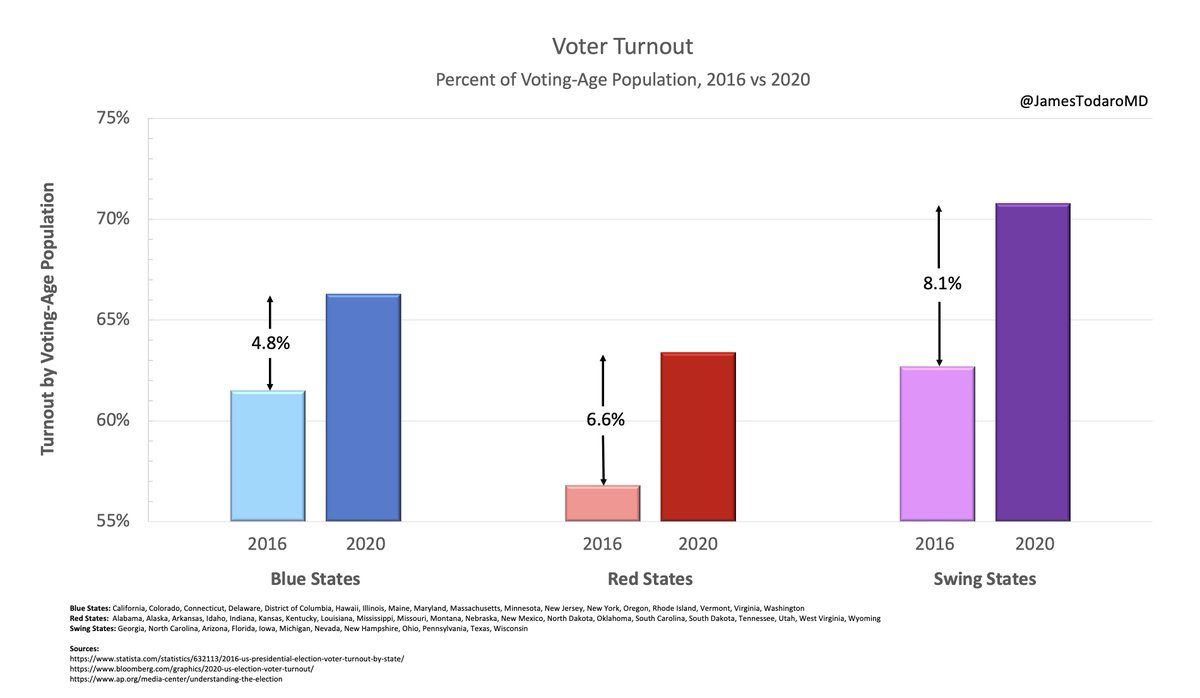

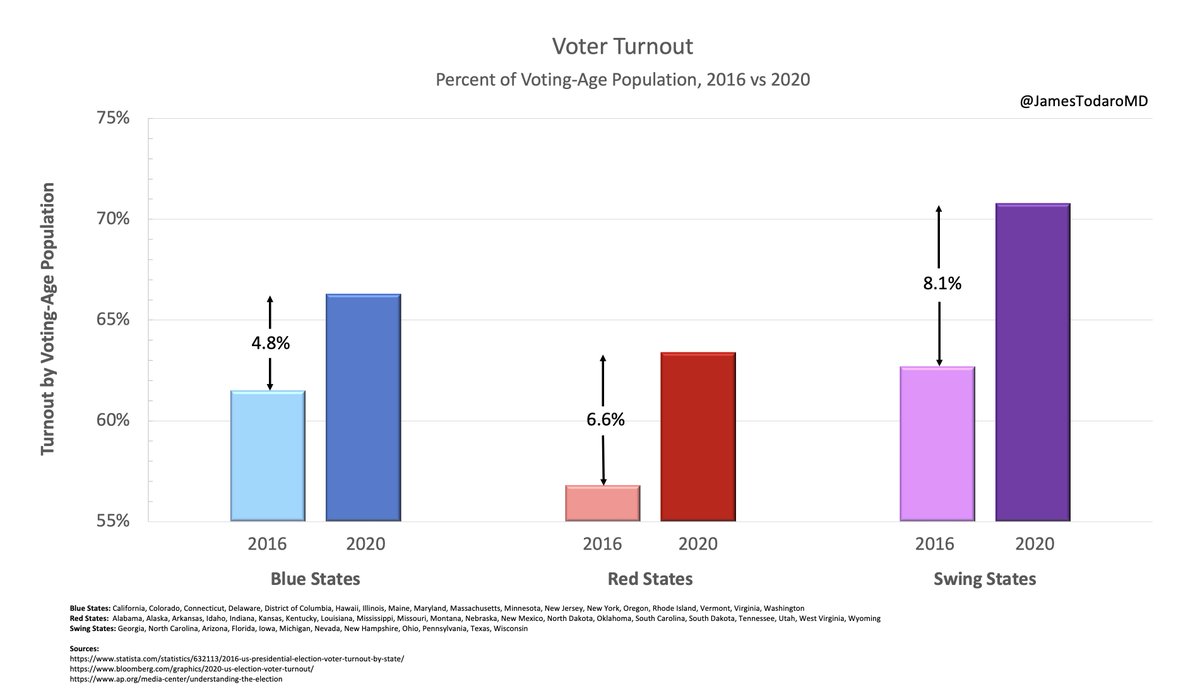

It's unlikely that all these cities/regions reached a similar peak prevalence of infections at about 20% despite lockdowns and mask ordinances coming at different times.

It's unlikely that all these cities/regions reached a similar peak prevalence of infections at about 20% despite lockdowns and mask ordinances coming at different times.

3/ Continued...

Censorship of discussion on a lower herd immunity threshold for COVID-19 is occurring not just on social media platforms but also in academic journals.

This degree of censorship is not how we advance science and medicine.

Full podcast: charliekirk.com/podcast/3-doct…

Censorship of discussion on a lower herd immunity threshold for COVID-19 is occurring not just on social media platforms but also in academic journals.

This degree of censorship is not how we advance science and medicine.

Full podcast: charliekirk.com/podcast/3-doct…

• • •

Missing some Tweet in this thread? You can try to

force a refresh