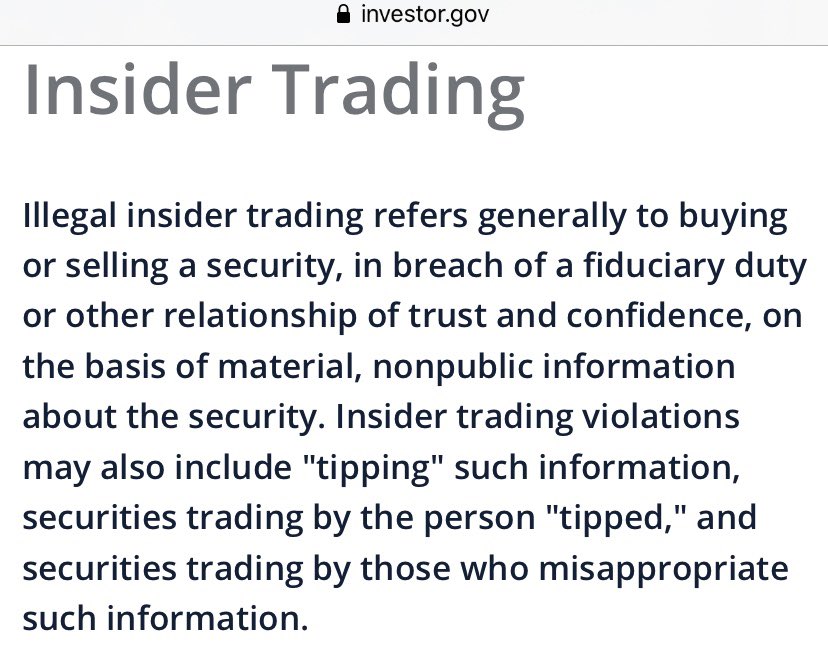

Let’s talk a little about insider trading, beginning with the Securities and Exchange Commission’s (SEC) definition. (1)

@RepMaxineWaters

@RepMaloney

@SenSherrodBrown

@RepKatiePorter

@senatemajldr

@SecElaineChao

@courierjournal

@Joe_Gerth

@SEC_Enforcement

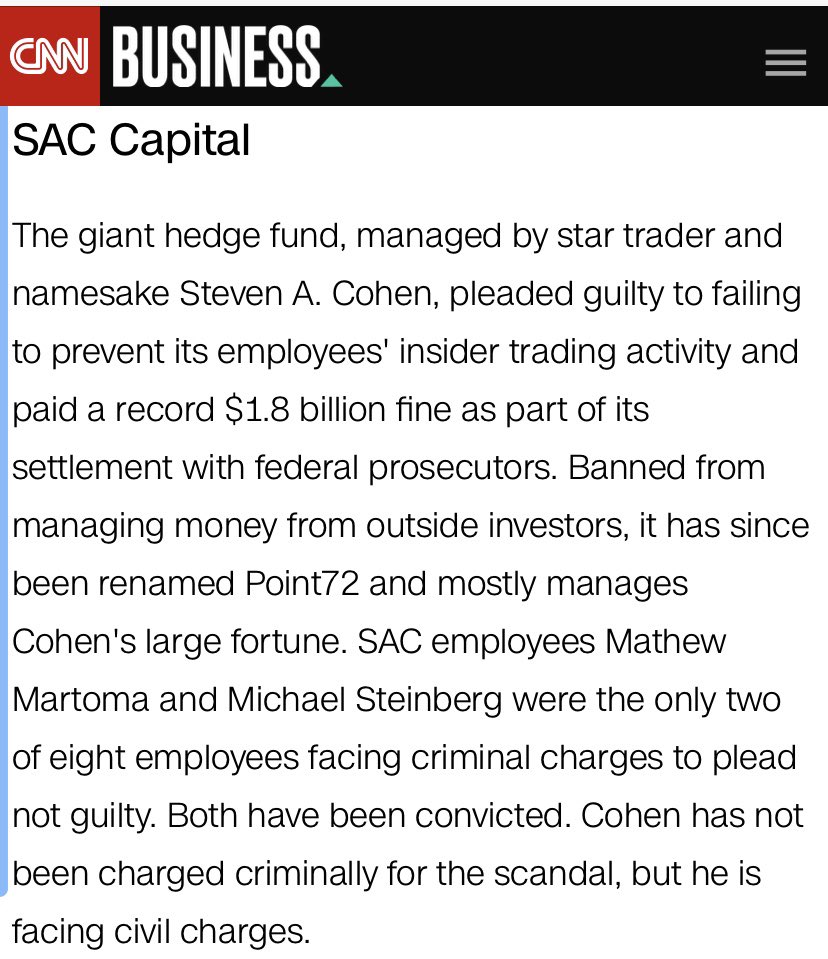

This brief CNN slideshow highlights five notable insider trading cases; SAC Capital, which paid a $1.8 billion fine, is one of them. SAC Capital’s CEO, Steven A. Cohen, wasn’t indicted. Incidentally, he’s now a major contributor to Republican PACs. (2)

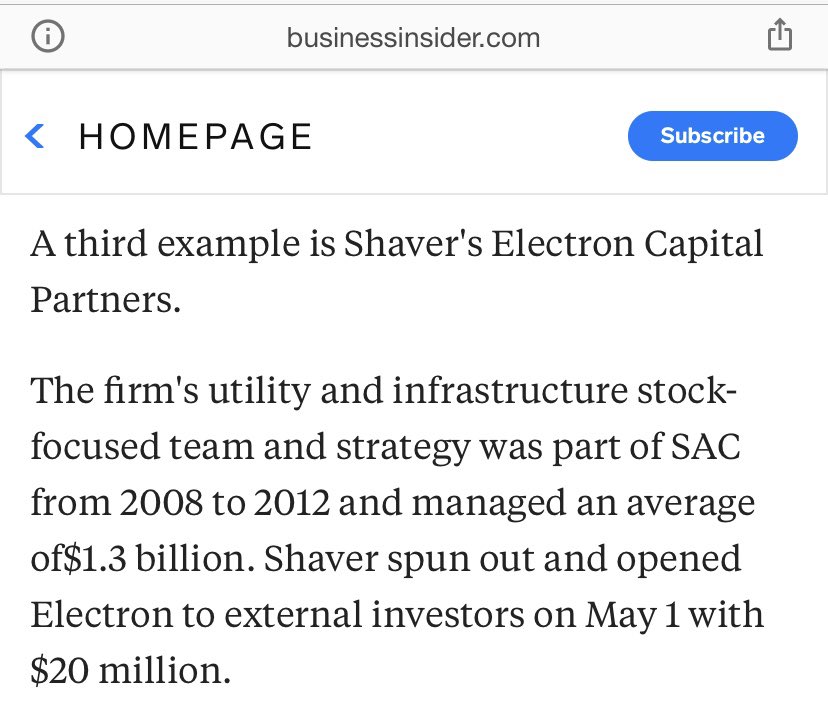

This Business Insider story notes that some SAC Capital portfolio managers moved on to greener pastures. One who did is infrastructure portfolio manager James O. (“Jos”) Shaver, manager of Electron Capital Partners. (3)

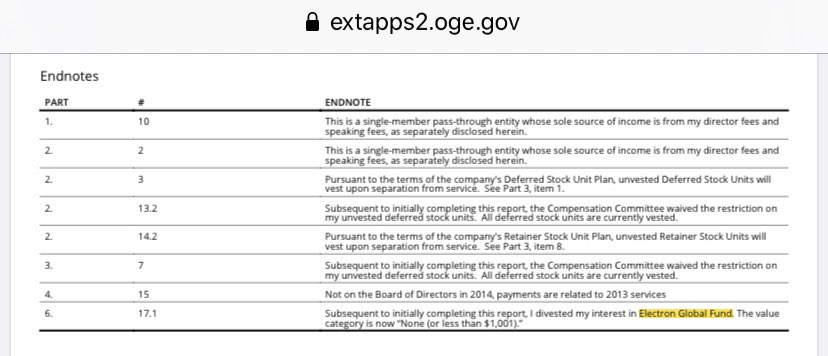

Electron’s investors aren’t publicly known, but one investor in Electron’s Cayman Islands-registered fund was Secretary of Transportation, Elaine Chao. Chao reported divesting her “$500,001-$1,000,000 before completing her initial financial disclosure. (4)

Coincidentally, Secretary Chao was tasked with the rollback of LNG safety regulations on April 10. (7)

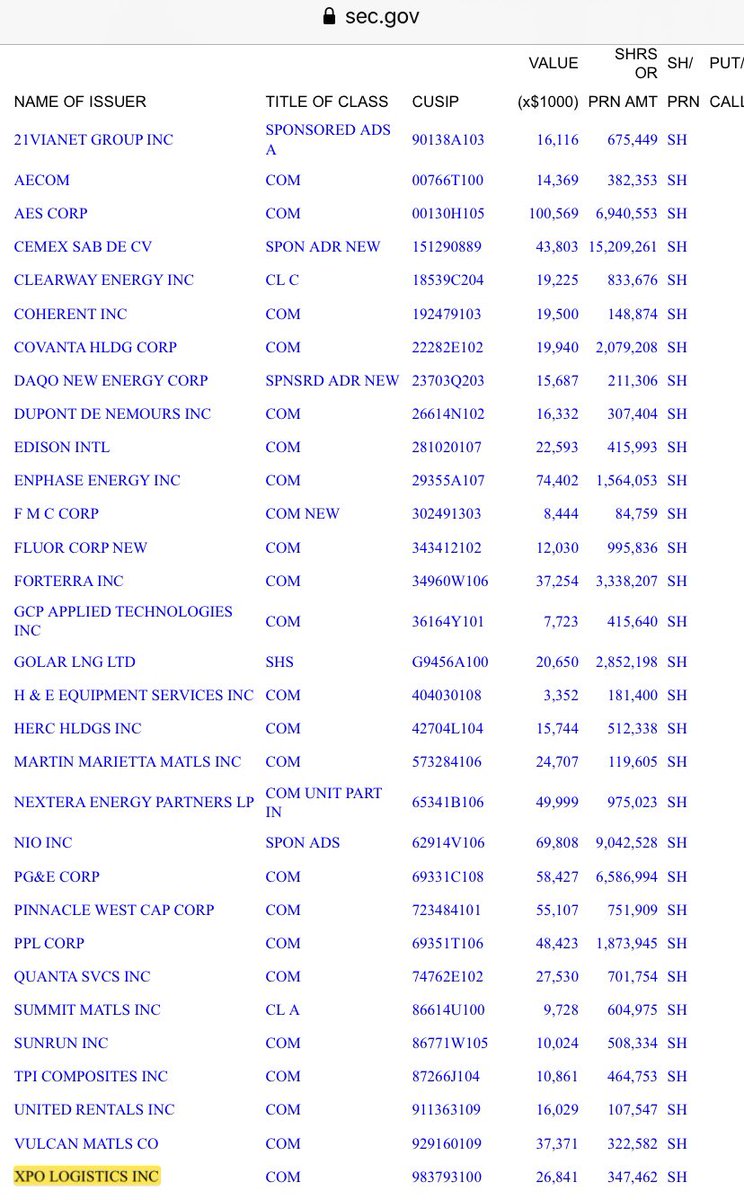

Two weeks ago, Electron reported a $26,841,000 purchase of (USPS contractor) XPO Logistics stock. The purchase was made between May 1 and August 1. (8)

Recall that on August 12, CNN reported Postmaster General DeJoy’s $30,000,000 stake in XPO Logistics. (9)

Given reporting that Secretary Chao established a longtime McConnell operative as a liaison between her ofice and her husband’s for Kentucky DOT grant awards... (13)

Suspected securitied fraud, including insider trading, can be reported to the U.S. Securities and Exchange Commission here: (16)

Secretary Chao’s communications can be requested under the Freedom of Information Act here:

(End)

Footnote: On May 15, 2019, Electron also reported $23 million in Vulcan Materials holdings. Secretary Chao divested her Vulcan Materials holdings three weeks later, one year after she was to divest it. Electron currently holds a $37 million Vulcan stake.