Suppose we are trading with trend

& took breakout trade

u enter long above the high of the breakout candle.

Its usually a high momentum candle

making it too far away from the base of the break out level.

Hence SL will be wide

Which will severely affect the position size

For safety,

if u decide to keep SL below the previous swing low,

once again risk in the trade is way too high

and

u will have to content with smaller position size

with huge risk.

That’s not a right approach.

What else can be done?

U need to develop a method

which accounts for the potential mean reversion after breakout move

If u allow the stock to pull back to the mean

&

plan ur entry on reversal after the pullback,

SL will be so very tight that

u will be able to find a new higher price support point

(which is just below the low of the pullback move).

Ur entry will just above the reversal candle pattern high in the pullback.

So how to formulate a method considering all these points??

Read on...............

Following is a systematic approachto formulate a method

which upon the trades can be taken with minimal risk.

It’s just one case study among many approaches out there is the market.

Let’s divide the approach into 4

Here in this method, there was two potential entry points

1. First one was to make long entry at breakout

2. Another one was to enter near pullback to 20 SMA

u chose not to enter at breakout.

The reasons are three

1. u cannot assess if the breakout will sustain or not. Becoz, the scrip has just came out of a pullback

and

have only 1 HH and 2 HLs.

This simple pullback might end up as a lengthy correction.

Here the risk is much more under control

as volatility near the pullback end will be very less

that we would be able to take safe long entry

much closer to 20SMA

&

keep SL below it.

Pros in this approach is

1. During pullback bars r less volatile making SL much smaller

2. No rush as pullback isn’t as hot as breakout. Even cheapest bids fills

3. Even initial entry can be divided into parts as price will stay enough time near to 20 SMA

Why 20SMA, not 50SMA?

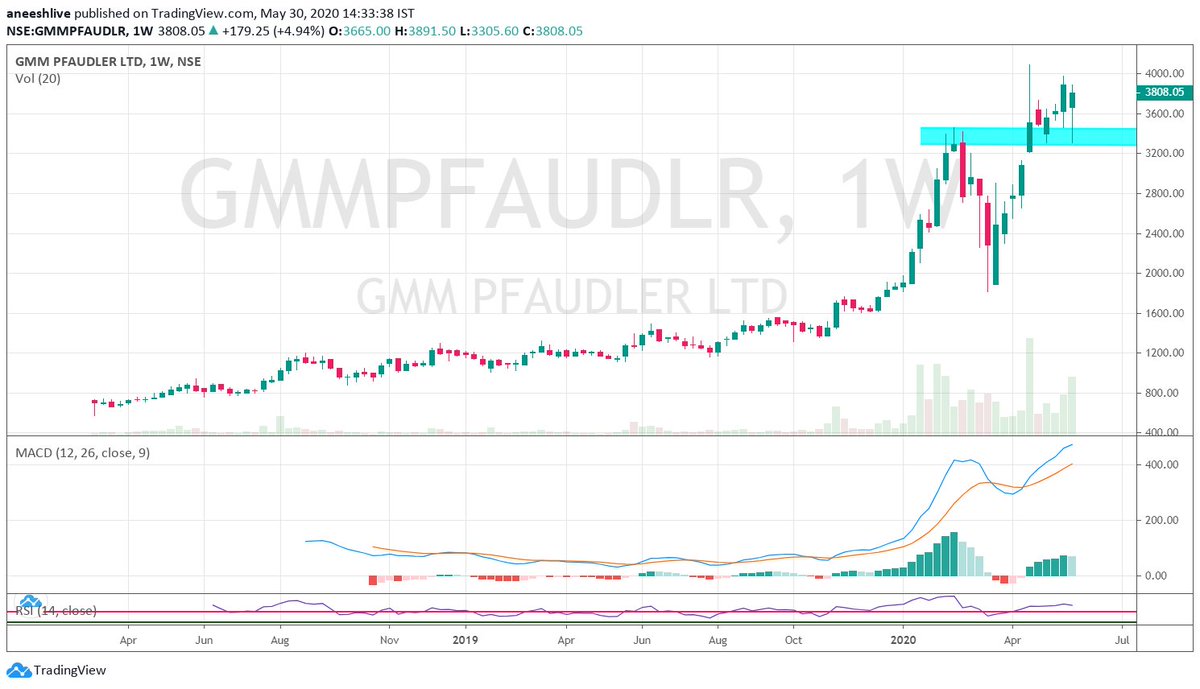

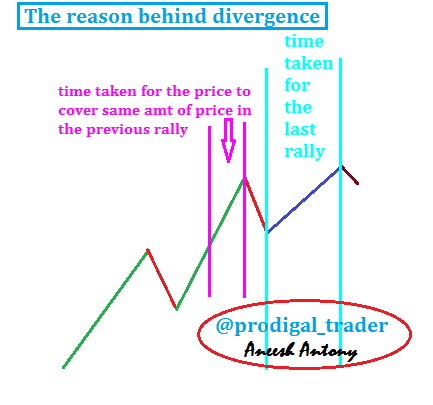

Here the principle is based on the concept that during breakout price would be too far away from short-term moving average. Price can’t stay away from MA much longer.

Either price would stall so that MA catches up

Or

Price fall to MA

This principle of mean reversion applies on a short term average only

If u consider 50SMA

that’s too much of an MA length to consider

as price would need unreasonably higher amount of time to reach 50SMA

And in that case it won’t be mean reversion anymore.

That would be a correction

and

strength in the trend which we were looking to rely upon

would be long gone.

This approach can be applied in any time frame stating from weekly to 1min.

Everywhere, in all markets, in all scrips, in all timeframe

u would see the price

revert to short-term moving averagesuch as 20SMA

before making further upmove

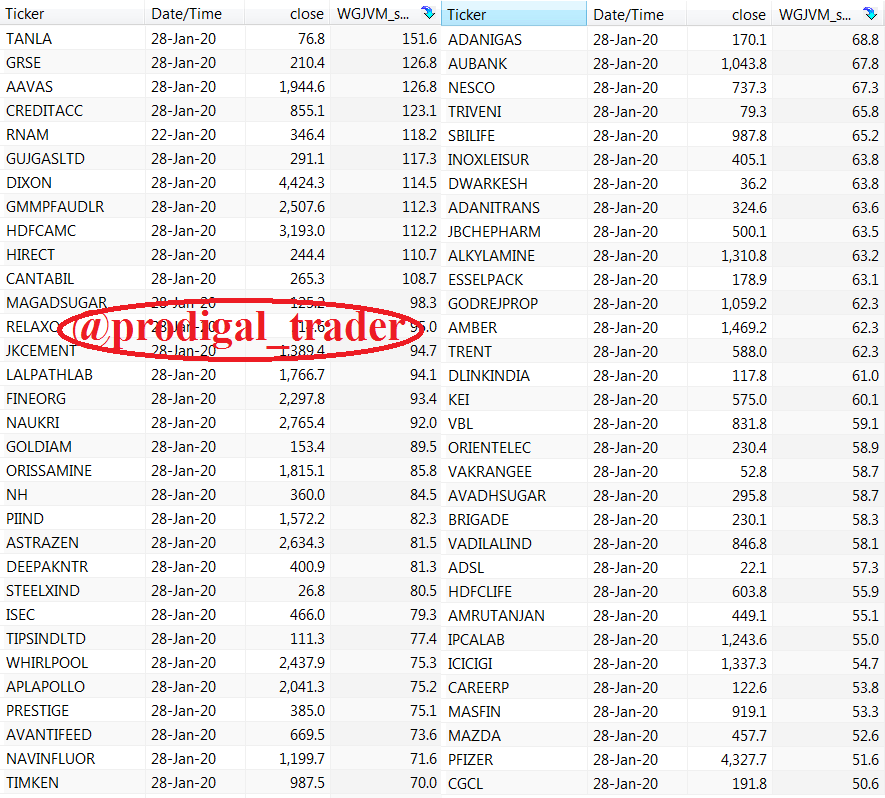

You dont need to make a scanner so

End of the thread.

Donot treat the write up as a strategy,

use it as an approach towards formulating a risk controlled method developemnt.

Wish u good luck.