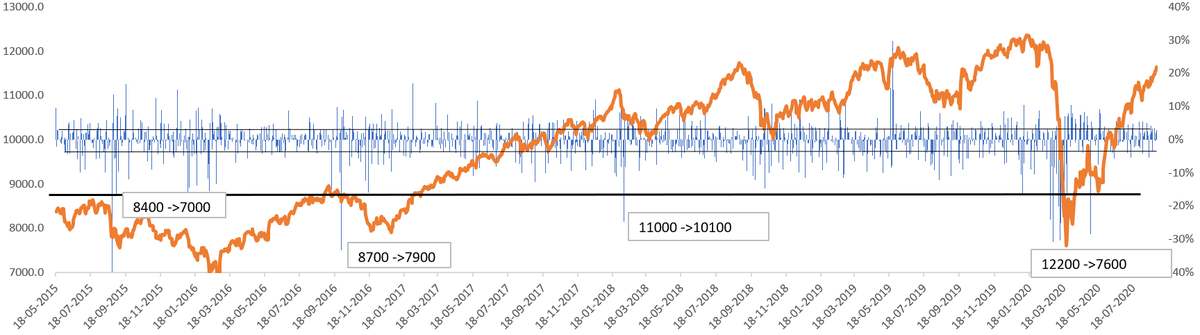

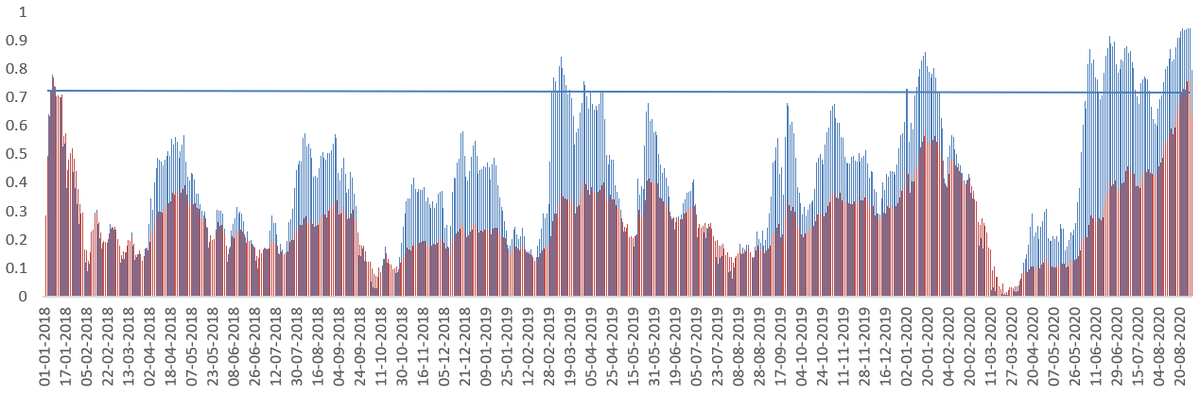

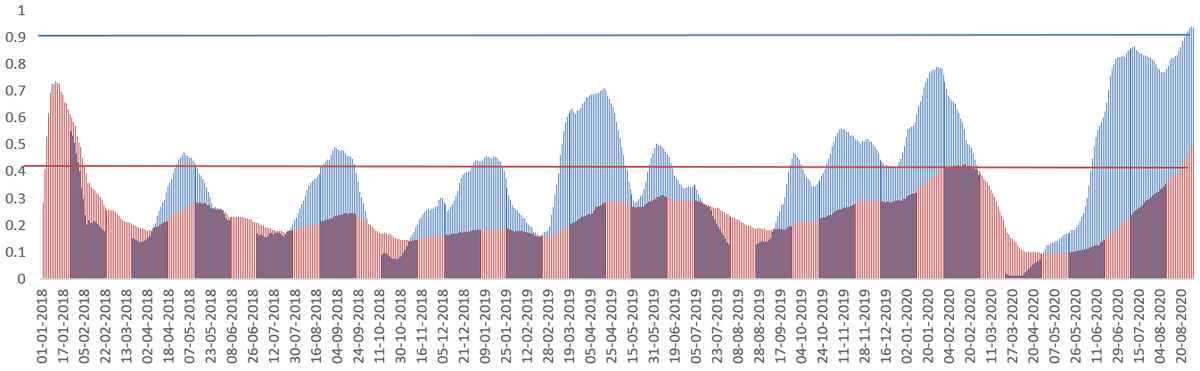

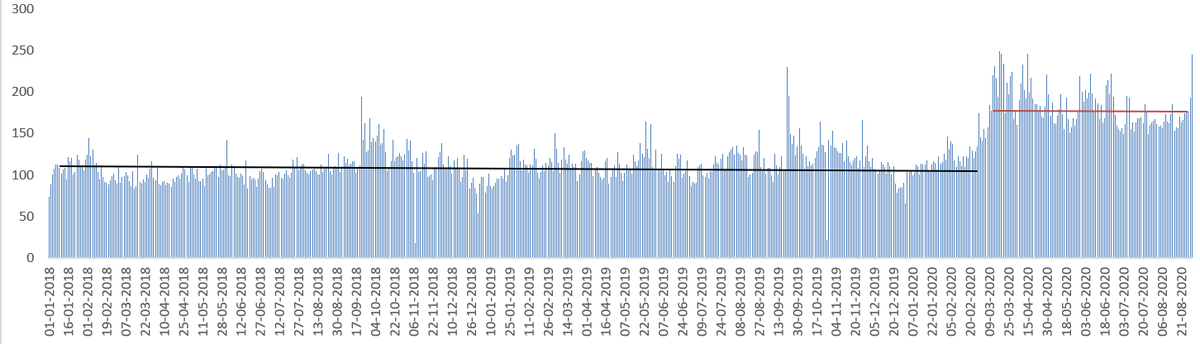

Blue bar: Close>50 DEMA, Red: Close>200 DEMA (DEMA: Day Exponential Moving Average)

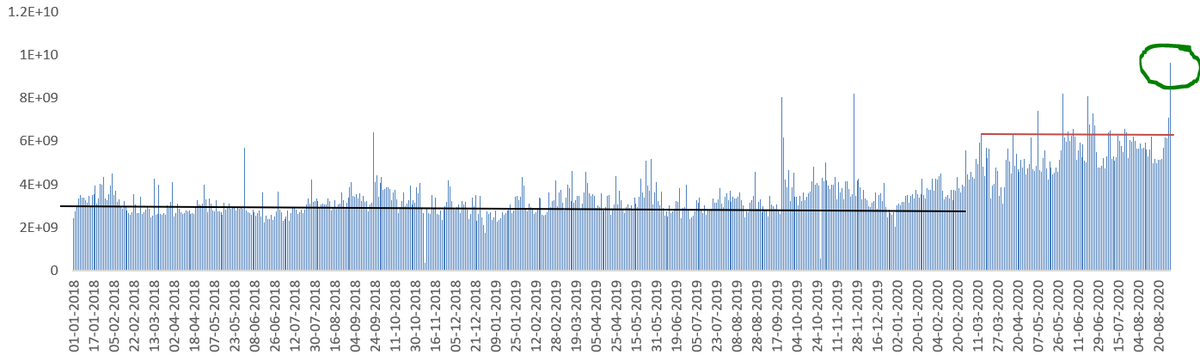

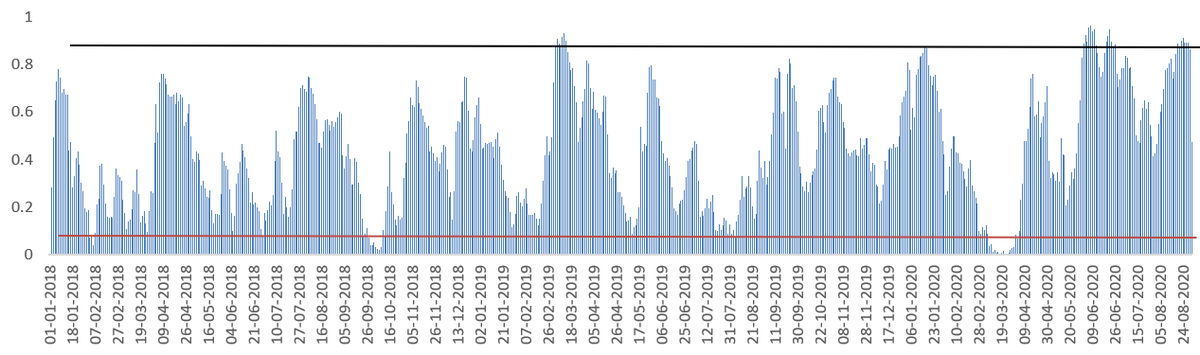

There has been clearly visible shift in count of trades since 12th March 2020. Prior to that , average count of daily trades were ~105 Lakh, this has gone up to ~185 Lakh which is a whooping 80% jump with ~same no. of companies

Likewise there has been clearly visible shift in daily turnover. Also, turnover on 31st Aug was highest of 2.8 years with huge spike