$ADYEY $AYX $BABA $CRWD $DAO $DDOG $DOCU $ETSY $FSLY $MELI $OKTA $ROKU $SE $SHOP $STNE $SQ $TWLO $VRM $ZM 1797.HK

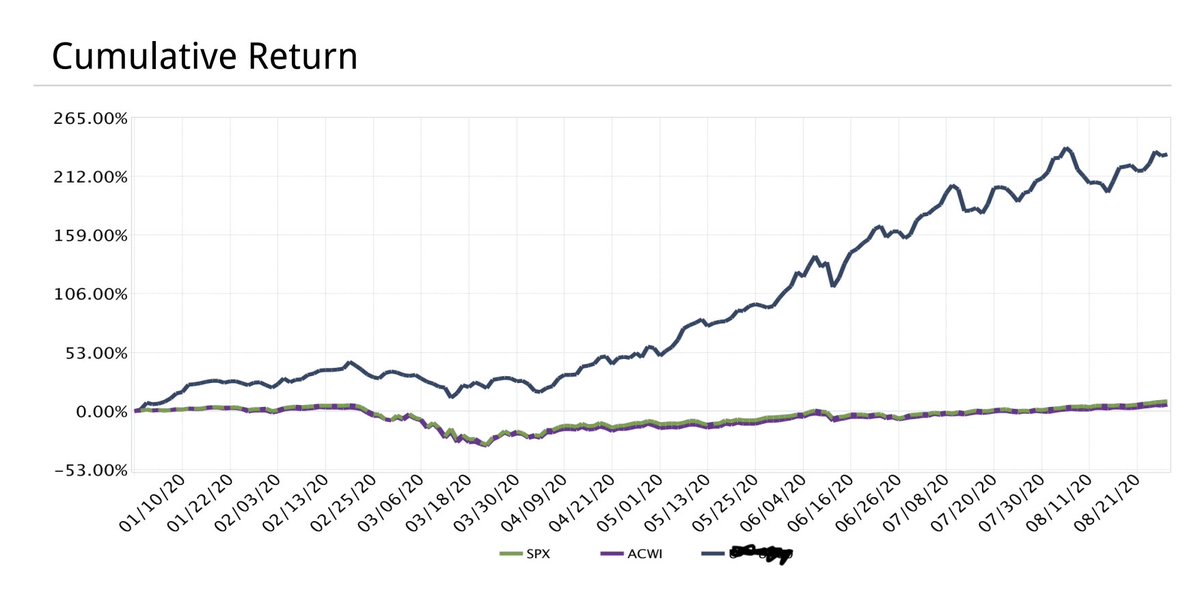

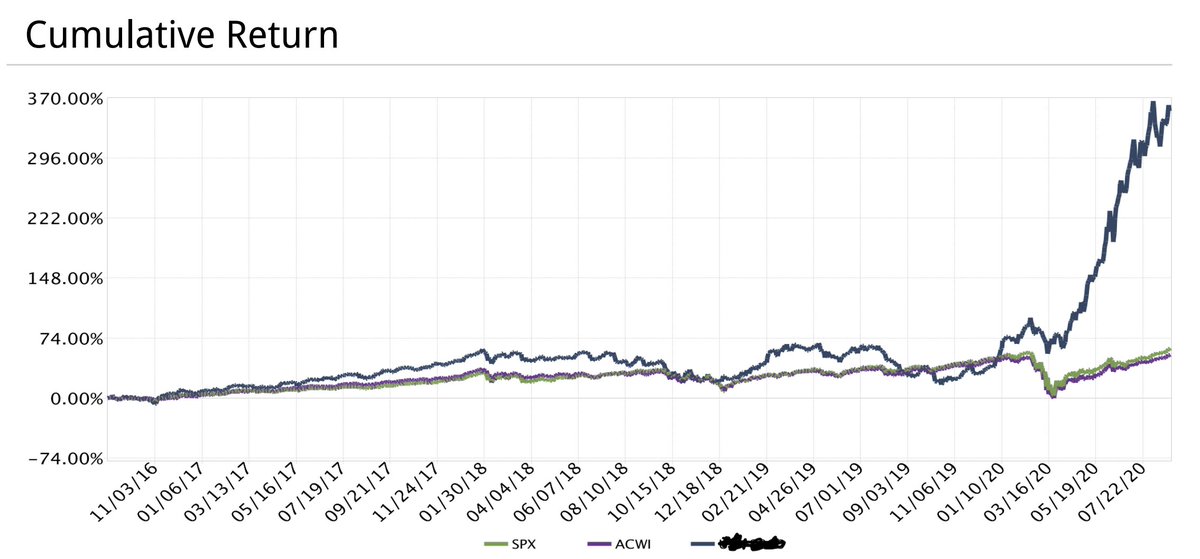

Return since 1 Sept '16 -

Portfolio +364.41%

$ACWI +41.09%

$SPX +61.24%

Contd...

Despite my best effort to sabotage my returns, August turned out to be another strong month for my portfolio.

Earlier in the month, after the big run up off the March low, I decided to try out something new i.e. market timing.

Needless to say, the market gods...

Fortunately, I was able to put aside my own bias and when my stocks refused to decline meaningfully, I promptly re-invested my entire cash.

This market timing...

1) I am most comfortable when fully invested

2) Market timing is super hard (at least for me)

It goes without saying, I won't be raising cash again...

First, once the $LVGO $TDOC 'merger' was announced, I immediately sold my shares and moved on.

Elsewhere, I invested in $FSLY, trimmed my software exposure and significantly increased my exposure to ecommerce...

In terms of the stock market outlook, although we can have a near-term...

After all, we are still only 5 months into this new bull-mkt and it is my strong belief that this uptrend...

For my part, I'll just remain fully invested and if needed, will simply hedge...

Finally, I am of the view that the leading companies from ecommerce, fintech and software will continue to generate outstanding operating results and although the ride may not be smooth, it will be very rewarding.

Hope this has been helpful.

THE END.