For a primer on the topic, check out my thread below.

The "stag" refers to economic stagnation - low growth and high unemployment.

The "flation" refers to inflation.

Putting it together, "stagflation" is an economic condition defined by the presence of low growth, high unemployment, and inflation.

In the US, inflation doubled in 1973 and hit 11% in 1974. GDP fell for 5 consecutive quarters and unemployment hit 9% in 1975.

Prices are rising but incomes are not. So consumers cannot afford the same amount of goods or services they could before.

Economists even created the Misery Index to quantify the suffering, defined as the sum of inflation and unemployment rate.

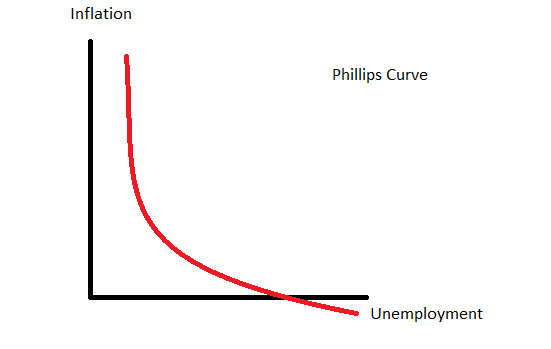

Central banks love steady inflation (and fear deflation!).

With inflation as a normal condition, it is not surprising that stagflation has been seen in most recessions.

The first observed instance was precipitated by the oil price shock (a “supply shock”).

But stimulative monetary policy (low rates, money printing) has obviously played a role in subsequent instances.

Deflation now, stagflation later? Perhaps.

It will be talked about a lot, so I hope this helps you understand the basics.

That was Stagflation 101!