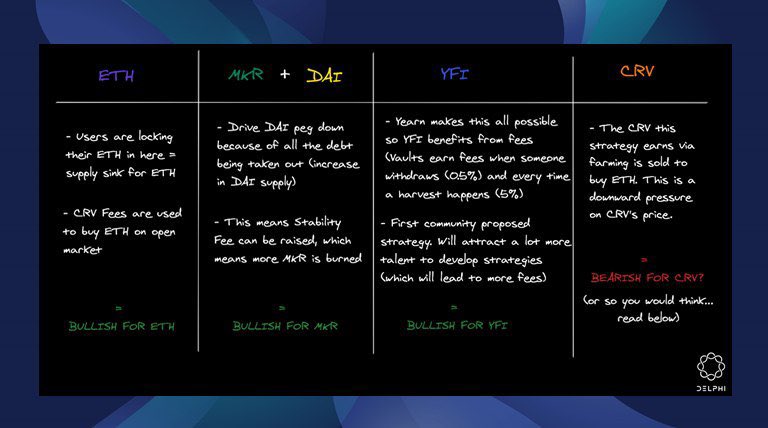

In a recent Delphi Daily, I take a look at what yETH's impact on the space is and why it perfectly demonstrates how powerful YFI truly is. (thread below)

Full Disclosure: @Delphi_Digital holds $YFI

delphidigital.io/reports/yeth-n…

yVaults are essentially token containers which then use those tokens to farm based on optimum strategies available to generate the highest-APY yield for the tokens deposited.

Kind of like a roboadvisor for DeFi.

yETH essentially makes idle ETH an extremely productive asset.

To make sure yETH's CDP stayed above MakerDAO's min. collateralization ratio of 150%, yETH maintains a 200% collat. ratio.

But that's not all.

If its CDP needs to be rebalanced, there are incentives in place (a small commission) for anyone to call the rebalance function.

🔹Vault is currently earning ~92% APY

🔹Already ~345k $ETH locked in yETH

🔹At the current ETH price, that's over $140 million!

🔹DAI utilization rate for ETH is at 82% (MKR holders just voted to raise ETH's debt ceiling)

The creation of it also perfectly demonstrates how powerful @iearnfinance truly is.

Developers who submit new strategies that are implemented get 10% of the 5% performance fee $YFI charges.

As you can see below, a simple proposal can generate significant income for a developer.

Over the next few weeks, expect to see hundreds of new proposals suggested.

🔹easy to use

🔹very fee efficient

🔹clearly product--market fit

🔹yields are extremely attractive

🔹generates $ for token holders w/ limited supply

Oh my...

@learn2yearn