1/ Time for some charts! 📊📈

Check out how @MakerDAO compares against other DeFi projects listed on Token Terminal. 👇

Check out how @MakerDAO compares against other DeFi projects listed on Token Terminal. 👇

2/ For MakerDAO, the revenue comes from interest paid on DAI borrows:

- GMV (outstanding borrows)

- Take Rate (weighted avg. interest rate)

- Revenue (GMV * Take Rate = total interest paid)

- GMV (outstanding borrows)

- Take Rate (weighted avg. interest rate)

- Revenue (GMV * Take Rate = total interest paid)

https://twitter.com/tokenterminal/status/1297613399405277185

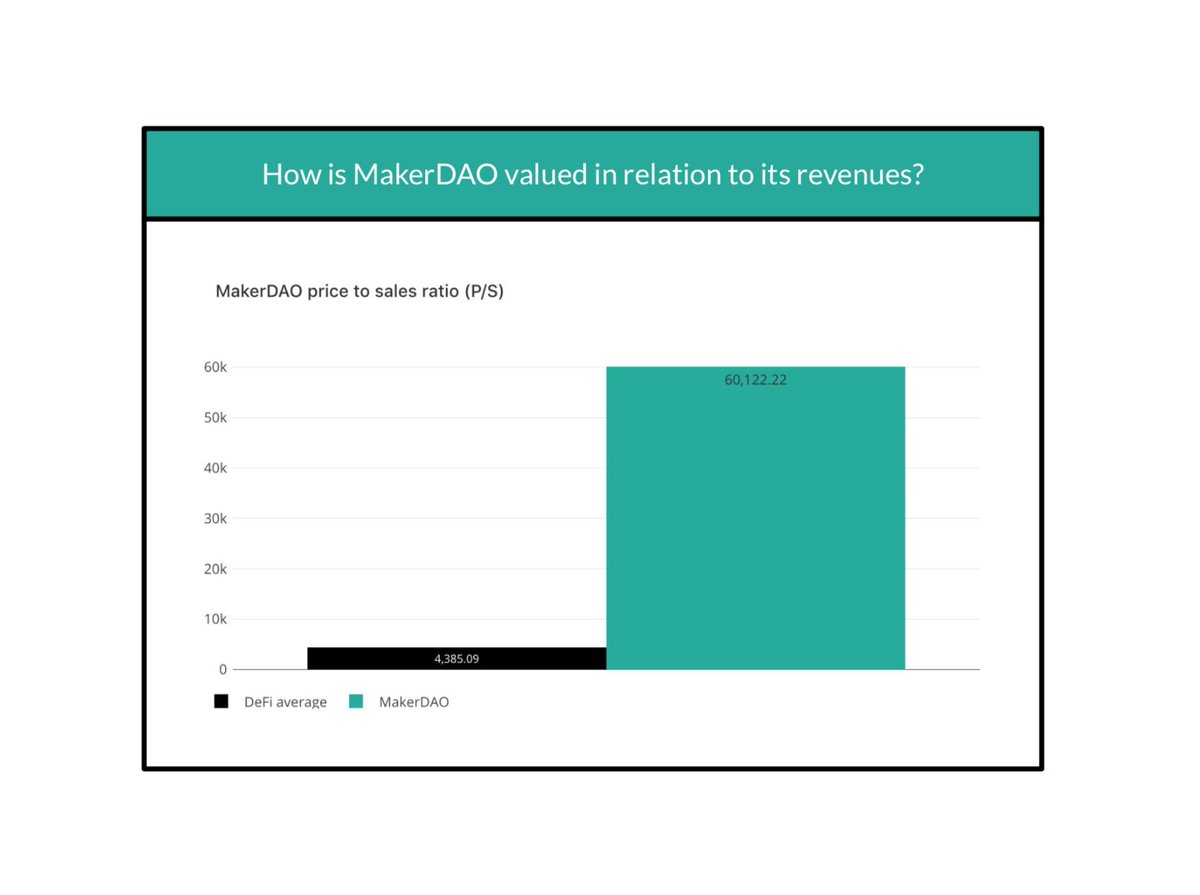

12/ Note:

- revenue data starts from the launch of MCD.

- here DeFi average excludes MakerDAO.

- chart is capped at 5,000 P/S.

- revenue data starts from the launch of MCD.

- here DeFi average excludes MakerDAO.

- chart is capped at 5,000 P/S.

• • •

Missing some Tweet in this thread? You can try to

force a refresh