Fundamentals for crypto. Available also on the Bloomberg Terminal App Portal at APPS TOKEN GO.

8 subscribers

How to get URL link on X (Twitter) App

@MinswapDEX is now live on Token Terminal.

@MinswapDEX is now live on Token Terminal.

Reliable onchain data & transparent stakeholder reporting matter

Reliable onchain data & transparent stakeholder reporting matter

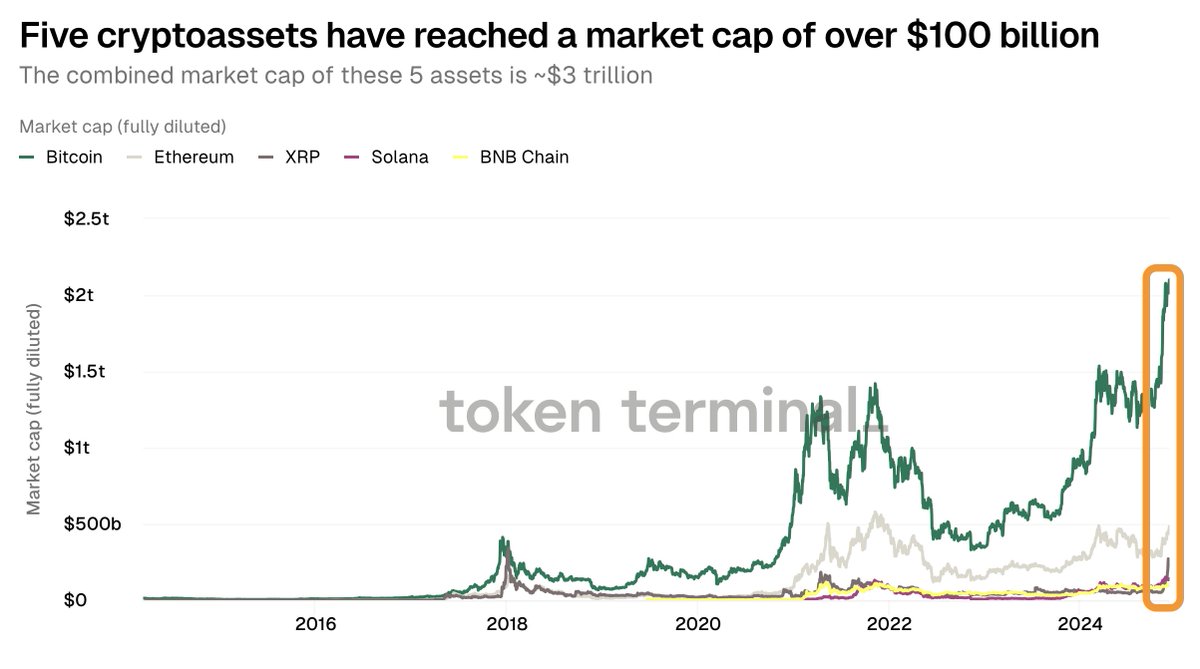

People value cryptoassets

People value cryptoassets

chart created w/

chart created w/https://x.com/tokenterminal/status/1856834858745561348

Great interview on the topic w/ @robbiemitchnick

Great interview on the topic w/ @robbiemitchnick

1⃣ Metrics

1⃣ Metrics

2/ There are currently six different ways to interact with on-chain data on Token Terminal:

2/ There are currently six different ways to interact with on-chain data on Token Terminal:

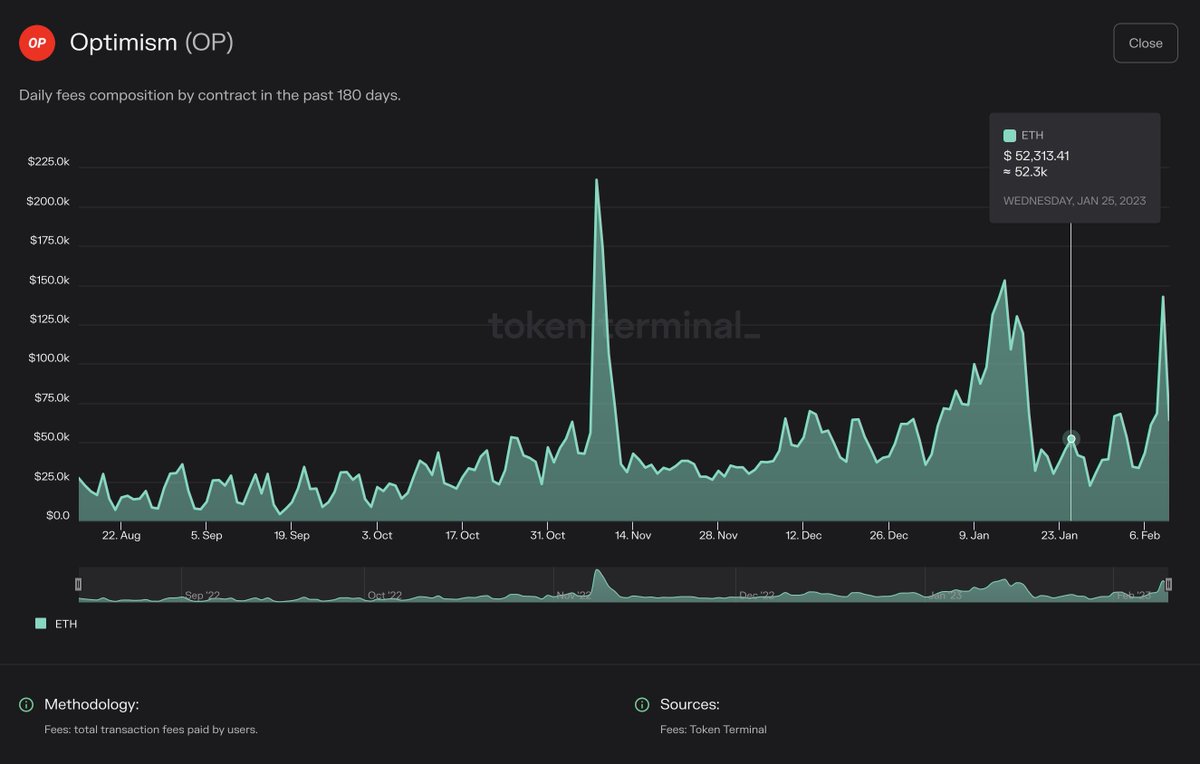

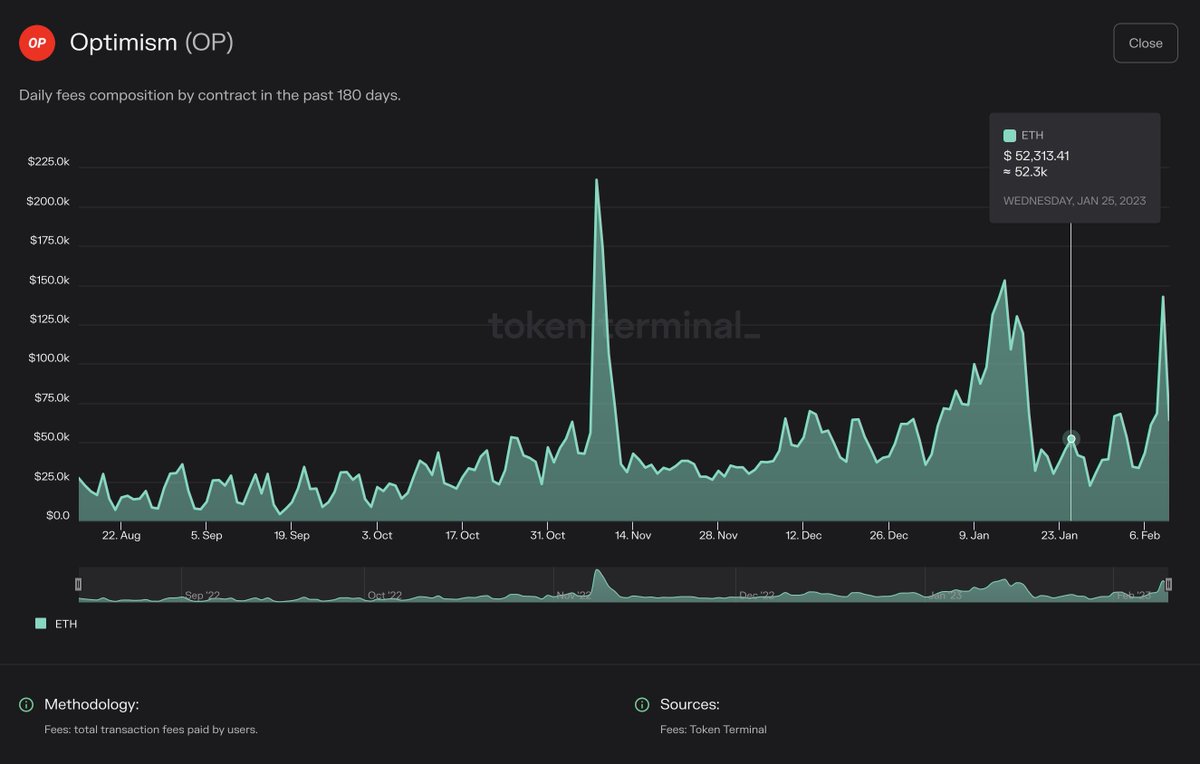

🔗 Optimism chart:

🔗 Optimism chart:

🎙️ Link to the episode:

🎙️ Link to the episode:

2/ To drive transparency & accountability in the markets, trad. publicly-traded co's release quarterly fin. statements that break down their financial performance for all stakeholders.

2/ To drive transparency & accountability in the markets, trad. publicly-traded co's release quarterly fin. statements that break down their financial performance for all stakeholders.

https://twitter.com/jump_ripatel/status/1604147374791835648

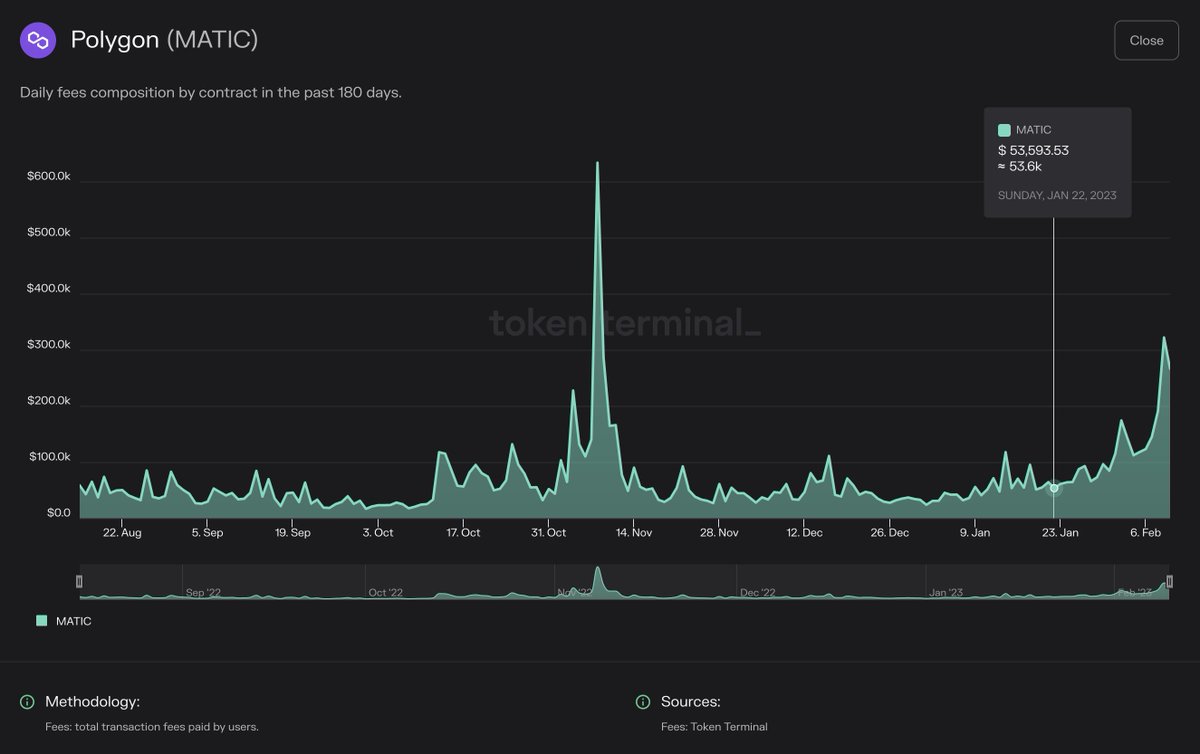

Updated chart including other projects ⤵️

Updated chart including other projects ⤵️

https://twitter.com/0xngmi/status/1604108742311780352

Re Solana:

Re Solana:

2/ Our core belief is that fundamental analysis will drive investor behaviour in crypto during the next cycle.

2/ Our core belief is that fundamental analysis will drive investor behaviour in crypto during the next cycle.

🧐 How to navigate between the dashboard & tokenterminal.com?

🧐 How to navigate between the dashboard & tokenterminal.com?