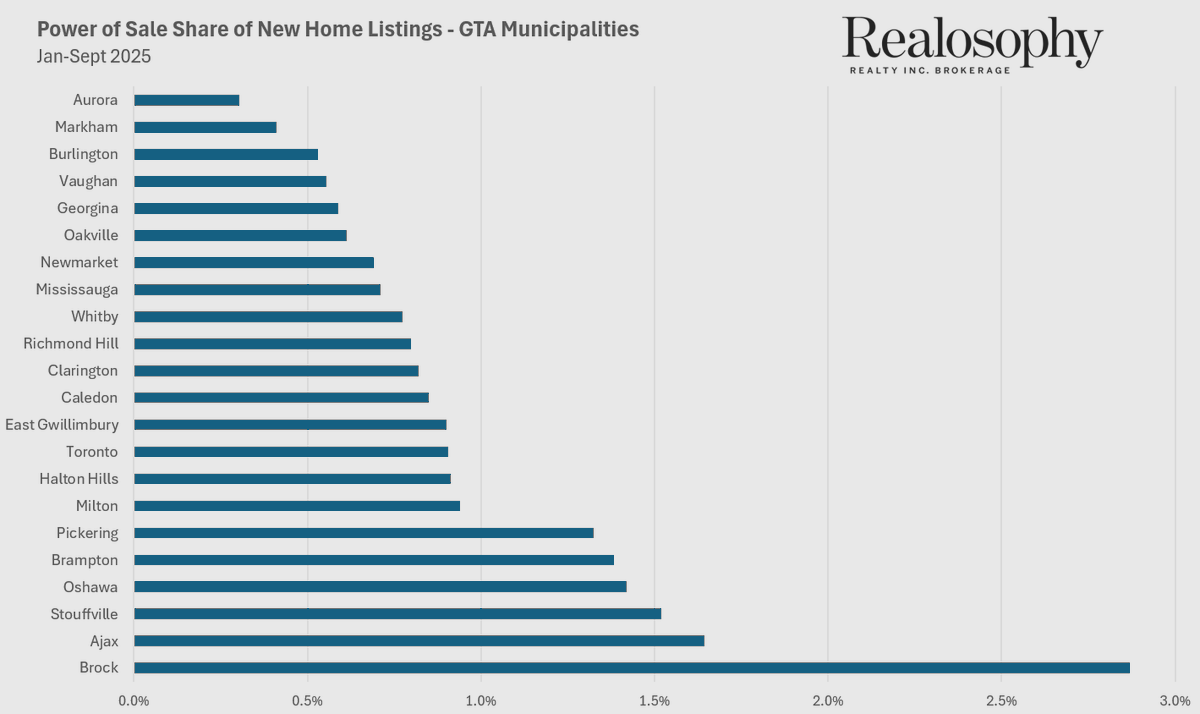

The sales data in the GTA last month represents a delayed spring market, and prices are skewed up by more low-rise home sales but it doesn't change the fact that this is the exact opposite trend that was predicted by most economists including CMHC ca.finance.yahoo.com/news/august-gr…

So far, the only forecast I'm aware of that is even remotely close to being accurate is from @TD_Economics . They were mocked for predicting at the height of the pandemic that GTA prices would end the year up 8%, they are currently up 13% torontostoreys.com/toronto-home-p…

And to be clear, I did not predict the market would be booming during a pandemic and have no idea how long this will last. My point is that overconfidence is a behavioural bias often associated with bulls - but bears are just as vulnerable to this bias.

In April, every housing bear was absolutely certain that prices would crash because of record unemployment and a surge in mortgage deferrals. It was "obvious" prices would crash and to suggest otherwise meant you were clearly "self-interested" and providing biased analysis.

It is interesting how the things that seemed obvious one month are not so obvious three months later. Will prices fall one day, of course. Will they fall by the end of this year? I wouldn't hold your breath!

• • •

Missing some Tweet in this thread? You can try to

force a refresh