All things Toronto real estate - President and Broker of Record at @RealosophyRE Ideas at @movesmartly

2 subscribers

How to get URL link on X (Twitter) App

Right now, tenants have what’s called security of tenure

Right now, tenants have what’s called security of tenure

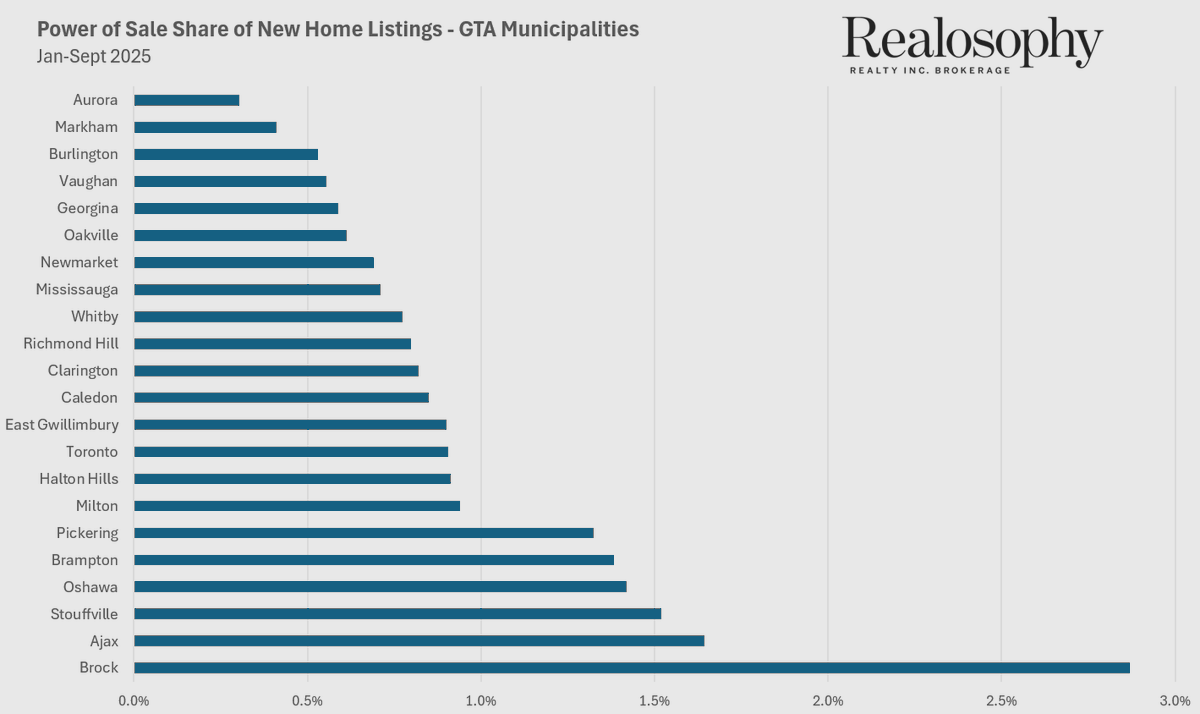

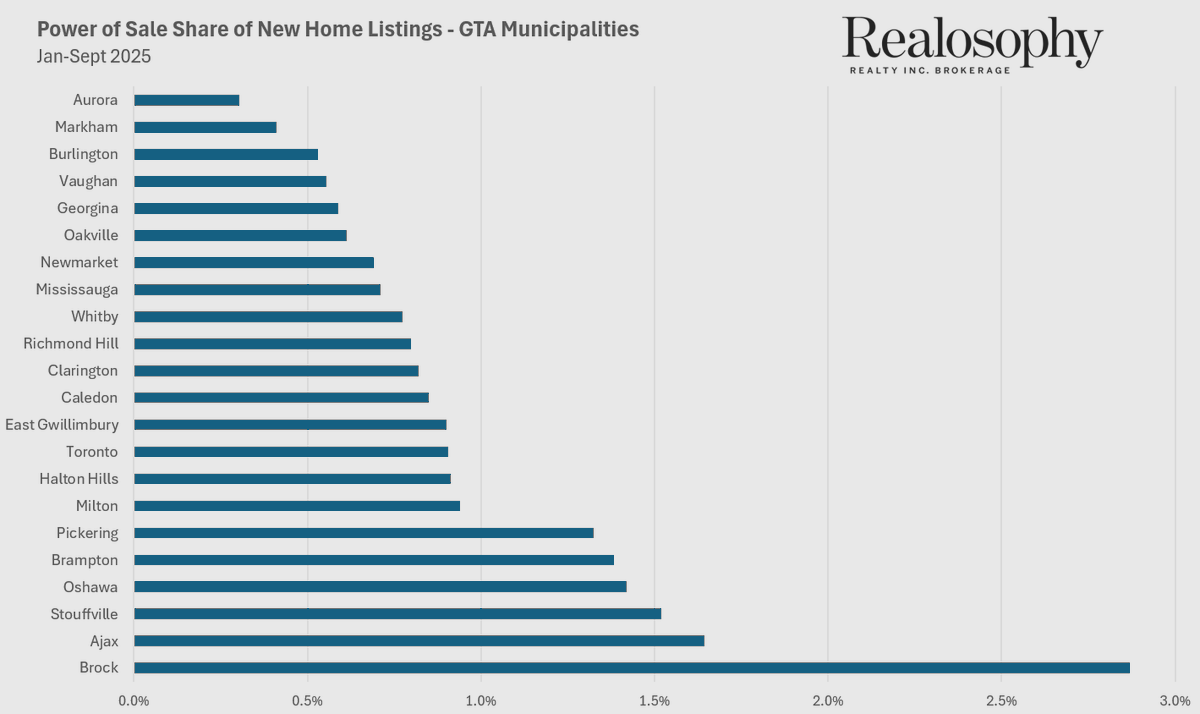

Mortgage arrears have been climbing, now above 0.4% at many major banks and as high as 6% at some private lenders.

Mortgage arrears have been climbing, now above 0.4% at many major banks and as high as 6% at some private lenders.https://twitter.com/CTVNews/status/1914670588838158367Do I agree with every idea that comes out of universities? Of course not

They have zeroed in on one thing

They have zeroed in on one thing

Here's the garden suite, which is listed for $1.3M 2/

Here's the garden suite, which is listed for $1.3M 2/

https://twitter.com/maxfawcett/status/1642178610344886274Here's a piece I wrote in 2021 showing how home prices changed under the Harper gov vs the current Trudeau government in Toronto

Pierre’s argument is quite bad because he’s trying to argue that “big city governments” ie. Toronto and Vancouver are causing our national housing crisis

Pierre’s argument is quite bad because he’s trying to argue that “big city governments” ie. Toronto and Vancouver are causing our national housing crisis

https://twitter.com/RE_MarketWatch/status/1585499914267774976What’s worse is that the landlord cannot just list their investment property for sale to unload their debt obligations and rental arrears

https://twitter.com/saretskysego/status/1584721646111272965Firstly, the people who I see in the press from the RE industry commenting on the housing market are always giving an honest look at what is happening on the ground