Many pointing to studies that $600/week did not increase disincentives. Those studies relevant in saying that policy was good in April, May and June. But they have limited relevance for how to set policy in Dec and Jan when economy will be very different than it was in lockdown.

Moreover, part of why the $600 didn’t cause disincentives is that many expected them to be temporary so would rather be in a job. If they had been smoothly extended through January as many originally wanted that would have undone some of that temporary expectation.

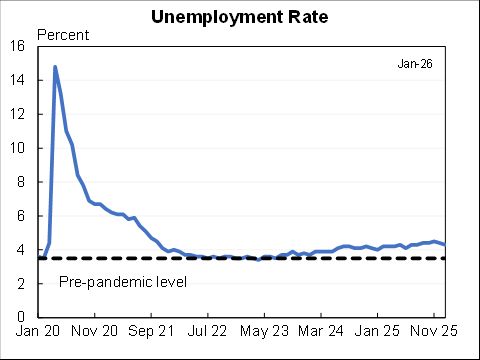

Supporters of triggers and enhanced automatic stabilizers should ask themselves what formula they would have for unemployment benefits. Would you pre-specify that at 8% UR it would be $600/week? And if so was it WAY too low with UR of 15% in the spring?

Even if the weekly boost came down to $400 that would be much higher than the $25 per week in the last recession and enough to ensure that about two thirds of workers were getting more from unemployment benefits than they had been paid on their jobs:

https://twitter.com/p_ganong/status/1289213392201240578?s=20

It is too late to shift to replacement rates instead of flat dollar amounts. But that should be a priority for the future. Until then, we should adjust the flat weekly amount based on economic circumstances to balance support for consumption with fairness/work incentives.

• • •

Missing some Tweet in this thread? You can try to

force a refresh