Professor at Harvard. Teaches Ec 10, some posts might be educational. Also Senior Fellow @PIIE & contributor @nytopinion. Was Chair of President Obama's CEA.

45 subscribers

How to get URL link on X (Twitter) App

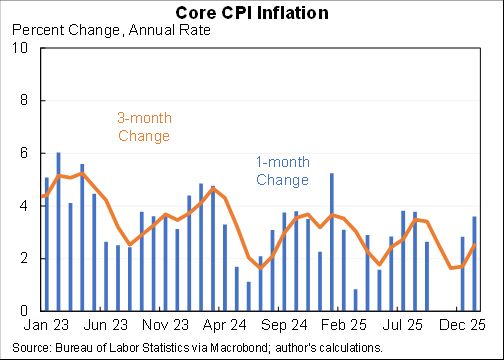

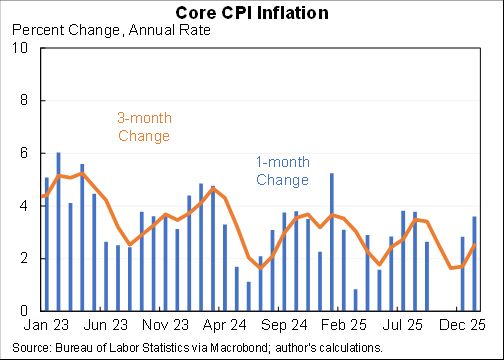

Here are the full numbers. Sadly no data for October because of shutdown so can't compute 3 month changes.

Here are the full numbers. Sadly no data for October because of shutdown so can't compute 3 month changes.

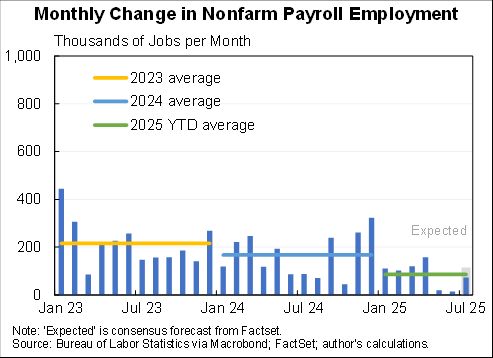

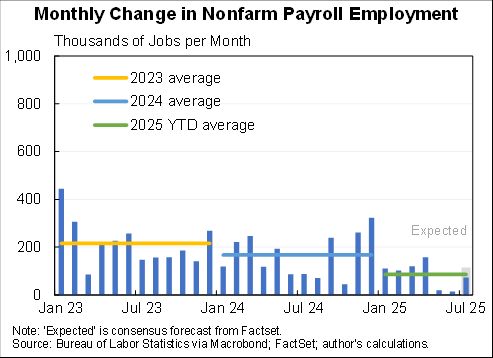

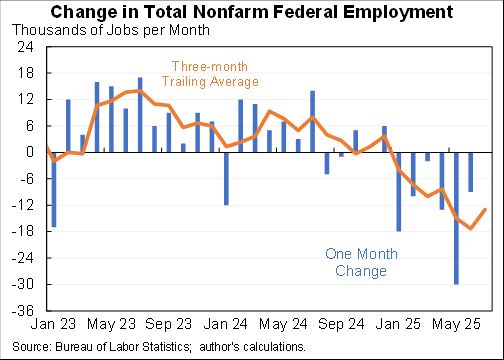

The job growth happened despite further cuts in federal jobs. Private employment was up an impressive 172K.

The job growth happened despite further cuts in federal jobs. Private employment was up an impressive 172K.

I've talked to numerous colleagues & students about grade inflation. Almost all of them see it as a a problem. I've also heard about as many different ideas for solutions as I've had conversations. I would tweak this proposal in various ways. But would support it over nothing.

I've talked to numerous colleagues & students about grade inflation. Almost all of them see it as a a problem. I've also heard about as many different ideas for solutions as I've had conversations. I would tweak this proposal in various ways. But would support it over nothing.

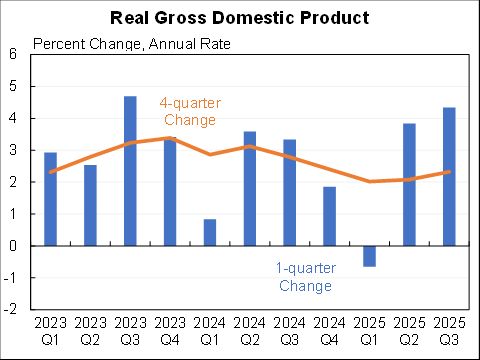

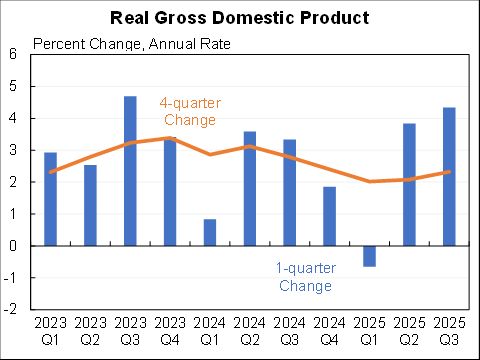

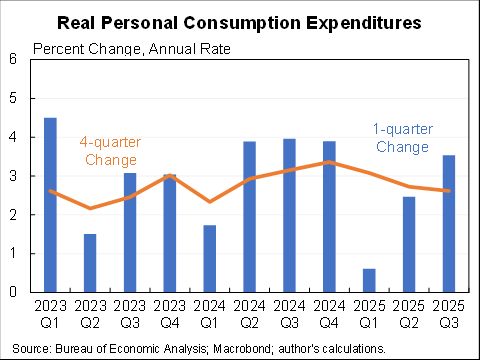

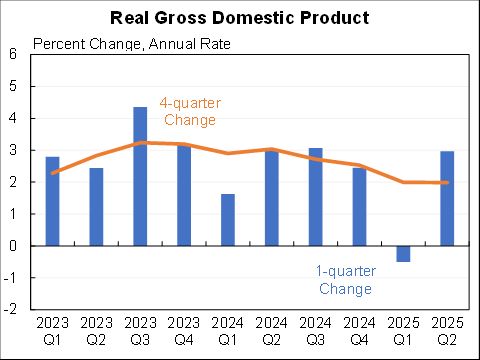

A big part of the story was consumer spending up at a 3.5% annual rate. Started the year looking weak but new data and revisions have made consumers very strong.

A big part of the story was consumer spending up at a 3.5% annual rate. Started the year looking weak but new data and revisions have made consumers very strong.

1. They claim price controls are good politically. I'm very open to this being true, I'm under no illusion that what I think is good policy is particularly well correlated with good politics. But I am genuinely interested in more evidence beyond the brief observations they make.

1. They claim price controls are good politically. I'm very open to this being true, I'm under no illusion that what I think is good policy is particularly well correlated with good politics. But I am genuinely interested in more evidence beyond the brief observations they make.

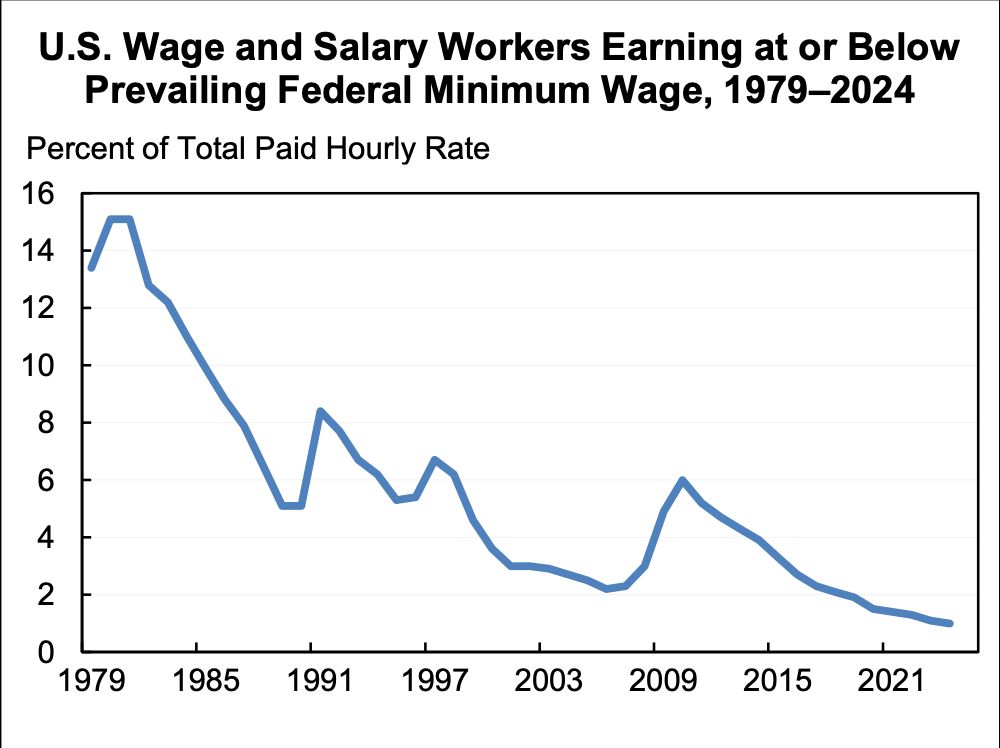

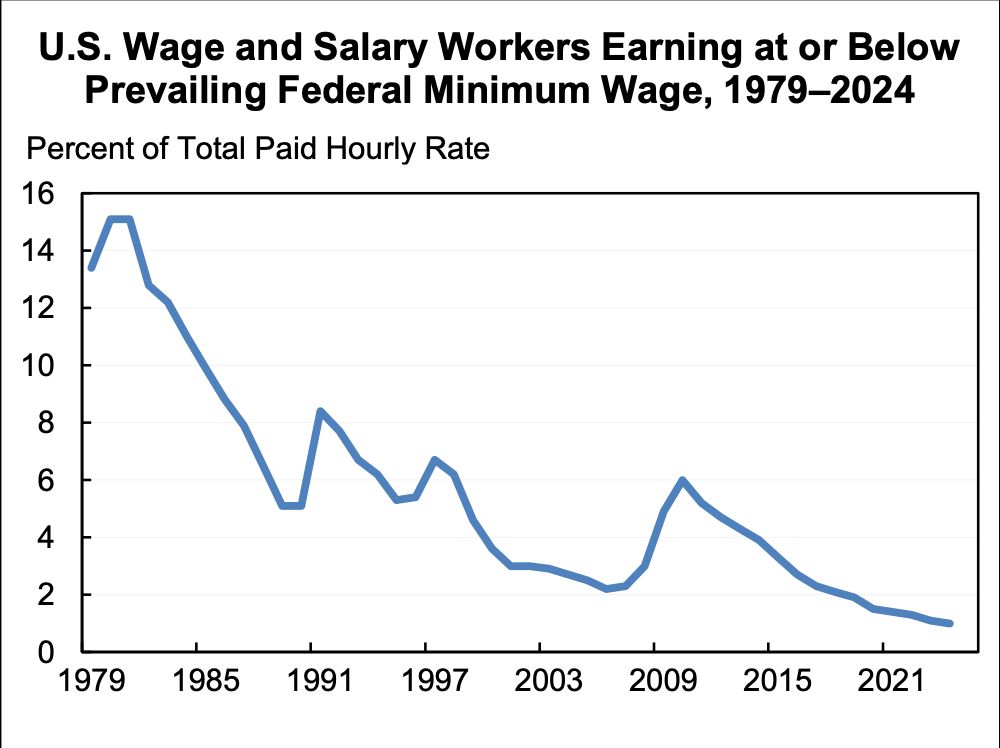

The last three legislated increases in the minimum wage were bipartisan:

The last three legislated increases in the minimum wage were bipartisan:

Here is quarterly consumer spending. It looked like it was really slowing but with this upward revision and the July and August indications it's looking much more healthy.

Here is quarterly consumer spending. It looked like it was really slowing but with this upward revision and the July and August indications it's looking much more healthy.

The unemployment rate rose from 4.2% to 4.3% (unrounded was a smaller increase).

The unemployment rate rose from 4.2% to 4.3% (unrounded was a smaller increase).

Here are the full set of numbers I'll talk about.

Here are the full set of numbers I'll talk about.

Here are all the numbers. All of them highly elevated except headline--which benefited from a 2.2% decline in gasoline prices (seasonally adjusted).

Here are all the numbers. All of them highly elevated except headline--which benefited from a 2.2% decline in gasoline prices (seasonally adjusted).

A small portion of the weaker jobs numbers in recent months are Federal cuts.

A small portion of the weaker jobs numbers in recent months are Federal cuts.

But there are two broader lessons here:

But there are two broader lessons here:

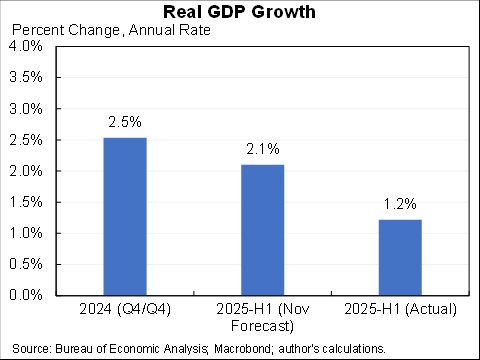

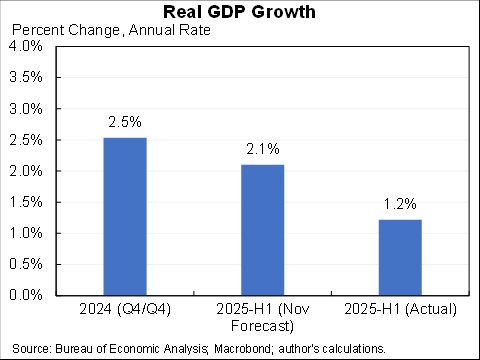

Here are the GDP numbers. In Q1 inventories added 2.6pp but imports subtracted 4.6pp. In Q2 it was the reverse, with inventories subtracting 3.2pp and imports adding 5.0pp. These are volatile categories and inventories, in particular, have large measurement error.

Here are the GDP numbers. In Q1 inventories added 2.6pp but imports subtracted 4.6pp. In Q2 it was the reverse, with inventories subtracting 3.2pp and imports adding 5.0pp. These are volatile categories and inventories, in particular, have large measurement error.

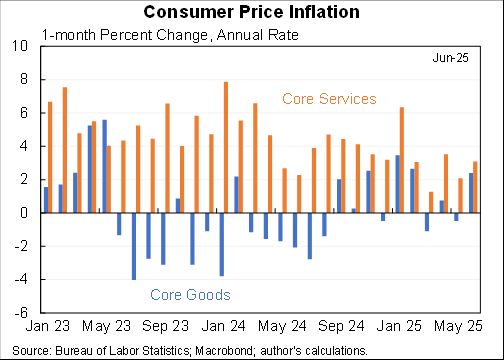

Here are core goods and core services. The service increase is relatively normal (even muted as shelter was low this month). Goods was unusually high including increases in tariffs sensitive items like appliances and apparel.

Here are core goods and core services. The service increase is relatively normal (even muted as shelter was low this month). Goods was unusually high including increases in tariffs sensitive items like appliances and apparel.

They propose the government borrowing $1.5 trillion to invest in stocks..

They propose the government borrowing $1.5 trillion to invest in stocks..