While political press occupies itself with heat & light of US-China decoupling, the financial press (FT, WSJ, Economist) has been telling story of "Chinese coronavirus success --> quick recovery -> increased attractiveness to Western firms & banks" 1/

https://twitter.com/S_Rabinovitch/status/1301668026094202880

2/ Since late '19 China's govt has pursued conscious coupling. It lifted foreign ownership caps on asset mgrs & let firms in:

Payments - MasterCard/Paypal got approval for JV

Invstmt banking - BlackRock/JPMorgan "" for mutual fund

Insurance - Allianz, HSBC

economist.com/finance-and-ec…

Payments - MasterCard/Paypal got approval for JV

Invstmt banking - BlackRock/JPMorgan "" for mutual fund

Insurance - Allianz, HSBC

economist.com/finance-and-ec…

3/ To Western firms, China offers 2 rare things: GDP growth & interest rates higher than zero.

~$200 billion has entered capital markets from abroad. Foreign holdings of Chinese stocks & bonds by June were 50% & 28% higher than a year earlier economist.com/finance-and-ec…

~$200 billion has entered capital markets from abroad. Foreign holdings of Chinese stocks & bonds by June were 50% & 28% higher than a year earlier economist.com/finance-and-ec…

4/ China's regulators sweeten the pot, but interests of foreign fin firms are core:

🇨🇳market is too big to ignore.

With soaring Chinese inequality, investable wealth of domestic clients is projected to grow from ~ $24 Trillion in 2018 to $41T by 2023!

oliverwyman.com/content/dam/ol…

🇨🇳market is too big to ignore.

With soaring Chinese inequality, investable wealth of domestic clients is projected to grow from ~ $24 Trillion in 2018 to $41T by 2023!

oliverwyman.com/content/dam/ol…

5/So, far from decoupling, the big 5 US investment banks chase fees from IPOs, shares and bonds issued by Chinese companies. Fees rose by 25% in 2020.

Financial firms judge politico-military tensions as low risk. ft.com/content/0069fc…

Financial firms judge politico-military tensions as low risk. ft.com/content/0069fc…

6/"Most Western companies are not leaving China because they are primarily for the China market, not because China is a cog in their global supply chains"

EU & US Chamber of Commerce surveys show fewer firms plan to relocate than in 2019 ht @KennedyCSIS

csis.org/blogs/trustee-…

EU & US Chamber of Commerce surveys show fewer firms plan to relocate than in 2019 ht @KennedyCSIS

csis.org/blogs/trustee-…

7/ Both Pentagon's sabre-rattling & hawkish rhetoric from Pompeo/Trump has received pushback from grand strategic apparatus. Former Director of National Intelligence calls for US to return to enlightened leadership & discard "strategic rivalry" washingtonpost.com/opinions/2020/…

8/ Some ppl don't believe the story of China's elimination of the virus with Hammer & Dance strategy.

Western firms don't just buy the story of the Wuhan Wave, they are right there in the pool party & the music doesn't stop if Trump/Pentagon say so.

Western firms don't just buy the story of the Wuhan Wave, they are right there in the pool party & the music doesn't stop if Trump/Pentagon say so.

https://twitter.com/AFP/status/1295345558270488577

9/ Foreign investors own far more of S Korea's, or Brazil's bonds than China's. There's a lot of room to run, & more that China can do to make its assets more attractive to investors (even if one is sceptical of RMB internationalization).

Thread.⬇️

Thread.⬇️

https://twitter.com/michaelxpettis/status/1314101788304445446

10/ "Why is Wall Street doubling down despite Washington's rhetoric to cut ties with China?

The short answer: China's financial sector has never been as open for business as it is now. And Wall St. has been waiting for this moment for nearly 20 years" wsj.com/video/wall-str…

The short answer: China's financial sector has never been as open for business as it is now. And Wall St. has been waiting for this moment for nearly 20 years" wsj.com/video/wall-str…

11/ Bridgewater’s Ray Dalio immersed into Arrighi long cycles of history, tells western investors to go long on China & not be blinded by racism when there is good money to be made in a competent state capitalist system. What decoupling? ft.com/content/8749b7…

12/ China Has One Powerful Friend Left in the U.S.: Wall Street. Trade deal left many US industries disappointed, but financial firms such as BlackRock see a potential windfall wsj.com/articles/china…

https://twitter.com/Lingling_Wei/status/1334169101602844675

13/ Stunning quotes & reporting on China sweetening the pot for Wall Street to counterbalance Trump trade war in 2018. Financial opening — what Wall St has hungered for decades — irresistible despite Pentagon fusillades. ht @Lingling_Wei @bobdavis187 wsj.com/articles/china…

14/ 'Cold War' rhetoric let loose by elite media in 2017 put planet towards our current climate, corona & nuclear confrontation. Vignettes from '18 agitprop blast from FT,FP. It mirrored Pentagon Natl Security Strategy analysed here adamtooze.com/2017/12/24/not…

https://twitter.com/70sBachchan/status/971474211989372928

15/"They came for the yield and stayed for the currency: why foreigners are buying Chinese bonds like never before"

Foreign investors own far more of S Korea's, or Brazil's bonds. There's a LOT of room to run esp w negative yields/low growth elsewhere. bloomberg.com/news/articles/…

Foreign investors own far more of S Korea's, or Brazil's bonds. There's a LOT of room to run esp w negative yields/low growth elsewhere. bloomberg.com/news/articles/…

16/ "Overall, China’s quick economic recovery and its dominance as a source for products [furniture, appliances, toys etc] that Americans have turned to during the pandemic have outweighed the dampening effect of Trump’s tariffs"- @melovely_max @AnaSwanson nytimes.com/2020/12/14/bus…

17/ Global investors can't get enough of China. Market value of Chinese stocks listed on exchanges from New York to Shanghai, gained ~40%, or $5 trillion versus a ~20% increase for US companies. Its corona success has boosted growth prospects for 2020s. wsj.com/articles/chine…

18/ "If a single word were chosen to define US-China in 2020, 'decoupling' would be a good candidate. Bandied about with abandon…what has been overlooked is just how little meaningful decoupling actually happened"

Some 90% of US/EU/Jap firms plan to stay macropolo.org/overlooked-ove…

Some 90% of US/EU/Jap firms plan to stay macropolo.org/overlooked-ove…

19/ After many decades in 2nd position, China overtakes the US as top destination for foreign investment. Acc. to UNCTAD FDI flows into the US nearly halved during the pandemic - more evidence that letting the virus rage uncontrolled hurts the economy wsj.com/articles/china…

20/ China's bonds stood out as a haven last week when investors fled from virtually everywhere including Treasuries...

"stable policy and growth make them less volatile compared to global peers, while yields are also more attractive” bloomberg.com/news/articles/…

"stable policy and growth make them less volatile compared to global peers, while yields are also more attractive” bloomberg.com/news/articles/…

21/ Louis Vuitton, Burberry and Gucci open more stores in all of China’s 25 biggest cities, as luxury consumption shifts. Western brands bet on (now richer) Chinese shoppers staying at home and not shopping in Europe after pandemic. ft.com/content/12c7b3…

22/ How do you decouple this? Western firms have poured FDI into China, not just to export to rest of world, but to sell into domestic China market as wages have tripled in last 10 years. Foreign holdings of Chinese stocks & bonds higher than ever before ft.com/content/4975eb…

23/ "In an era that is increasingly defined by geopolitical competition & a push towards economic “decoupling”, US finance has never been closer to Chinese wealth”

Nice FT story on WallSt+China wealth mgmt/Pensions w China sweetening the pot strategically ft.com/content/d5e09d…

Nice FT story on WallSt+China wealth mgmt/Pensions w China sweetening the pot strategically ft.com/content/d5e09d…

24/ That its impossible for US to contain China is dominant position in strategic community! Dan Coats (former director of natl intelligence):

"There's no Cold War with China - and if there were, we wouldn't win"

View from WallSt: washingtonpost.com/opinions/2020/…

ft.com/content/d5e09d…

"There's no Cold War with China - and if there were, we wouldn't win"

View from WallSt: washingtonpost.com/opinions/2020/…

ft.com/content/d5e09d…

25/ Wow. First Chinese regulators went after tech companies. Now SEC.

"The U.S. Securities & Exchange Commission (SEC) has stopped processing registrations of US initial public offerings (IPOs) & other sales of securities by Chinese companies" reuters.com/business/finan…

"The U.S. Securities & Exchange Commission (SEC) has stopped processing registrations of US initial public offerings (IPOs) & other sales of securities by Chinese companies" reuters.com/business/finan…

26/ With Xi going after China's tech billionaires, George Soros has finally seen enough. Calls Xi Jinping the 'Most Dangerous Enemy' of the Free World.

Is Soros the most significant Western financier to turn on China? wsj.com/articles/xi-ji…

Is Soros the most significant Western financier to turn on China? wsj.com/articles/xi-ji…

27/ BlackRock's chief investment strategist: “It has the 2nd-largest equity market, 2nd-largest bond market. It should be represented more in portfolios”

China was antifragile to Covid shock. Came out ahead of peer countries, just as it did after Crash. ft.com/content/f876fb…

China was antifragile to Covid shock. Came out ahead of peer countries, just as it did after Crash. ft.com/content/f876fb…

28/ Just how interlinked are West & China? Take a look at Western funds holding troubled real estate giant Evergrandes' bonds: Blackrock, UBS, HSBC, Royal Bank of Canada, Credit Agricole... bloomberg.com/news/articles/…

https://twitter.com/INArteCarloDoss/status/1438944431734919175

29/“Xi set out 3 tough battles for the Govt - Poverty, Pollution and financial risks. Significant progress has been made on the first two, but the battle against financial risks has lagged. Perhaps Evergrande will mark a turning point in that battle"@niubi adamtooze.substack.com/p/chartbook-on…

30/ "here’s the astonishing thing. Despite the fact that Chinese GDP has grown by a factor of 26 & US GDP has only grown by a factor 3 since 1994...US stock market has outperformed the 🇨🇳stock market over the same period"

@policytensor Stocks != Economy

policytensor.substack.com/p/are-us-inves…

@policytensor Stocks != Economy

policytensor.substack.com/p/are-us-inves…

31/ "As for global financial contagion, while the Evergrande crisis can (and will) have a substantial impact on domestic Chinese financial markets, the contagion mechanism abroad is likely to be pretty limited."

Thread

Thread

https://twitter.com/michaelxpettis/status/1442394524496584704

32/ In FT @RanaForoohar cites USCC on hypocrisy of American firms investing in Chinese military industrial firms: “One might be excused for thinking that a basic responsibility of American citizenship ought to be not to do anything to endanger US troops.”

ft.com/content/09efa1…

ft.com/content/09efa1…

33/ Drama in 3 acts--

JP Morgan: You got rich! Let us do banking in China

China: Only if u fight China hawks in US

JPM: Sure. Also we'll last longer than Communism

China: "The individual involved has sincerely reflected. I think this is the right attitude"

reuters.com/business/china…

JP Morgan: You got rich! Let us do banking in China

China: Only if u fight China hawks in US

JPM: Sure. Also we'll last longer than Communism

China: "The individual involved has sincerely reflected. I think this is the right attitude"

reuters.com/business/china…

34/ Biden is stuck.

Democrats want to protect workers in rustbelt from foreign competition before elections;

US allies want to export their goods to US Market to compensate for loss of China market;

Corporates don't want to decouple from China

@bobdavis187

politico.com/news/magazine/…

Democrats want to protect workers in rustbelt from foreign competition before elections;

US allies want to export their goods to US Market to compensate for loss of China market;

Corporates don't want to decouple from China

@bobdavis187

politico.com/news/magazine/…

35/ US-China Decoupling wont achieve aims. China's growth endogenous i.e not dependent on Western tech know-how.

Political fight:Restrictionists (China hawks in Congress & Pentagon) vs Cooperationists (Business lobby, progressives)

carnegieendowment.org/2022/04/25/u.s…

Political fight:Restrictionists (China hawks in Congress & Pentagon) vs Cooperationists (Business lobby, progressives)

carnegieendowment.org/2022/04/25/u.s…

https://twitter.com/JonKBateman/status/1518655885844881409

36/ Neither Western consumers nor companies are "decoupling" from China.

US, Europe and China’s neighbors in Asia have been buying *more* goods from China since the Pandemic began. Nice Pettis thread:

wsj.com/articles/pande…

US, Europe and China’s neighbors in Asia have been buying *more* goods from China since the Pandemic began. Nice Pettis thread:

wsj.com/articles/pande…

https://twitter.com/michaelxpettis/status/1561572040372396032

37/ Even as B-52 bombers overfly the Taiwan straits together with US Navy's 7th fleet warships, economic engagement by Western firms with China is at record levels.

Can US govt hawks change corporate strategy? ht @dskilling

davidskilling.substack.com/p/mind-the-gap…

Can US govt hawks change corporate strategy? ht @dskilling

davidskilling.substack.com/p/mind-the-gap…

https://twitter.com/70sBachchan/status/1554661960591020032

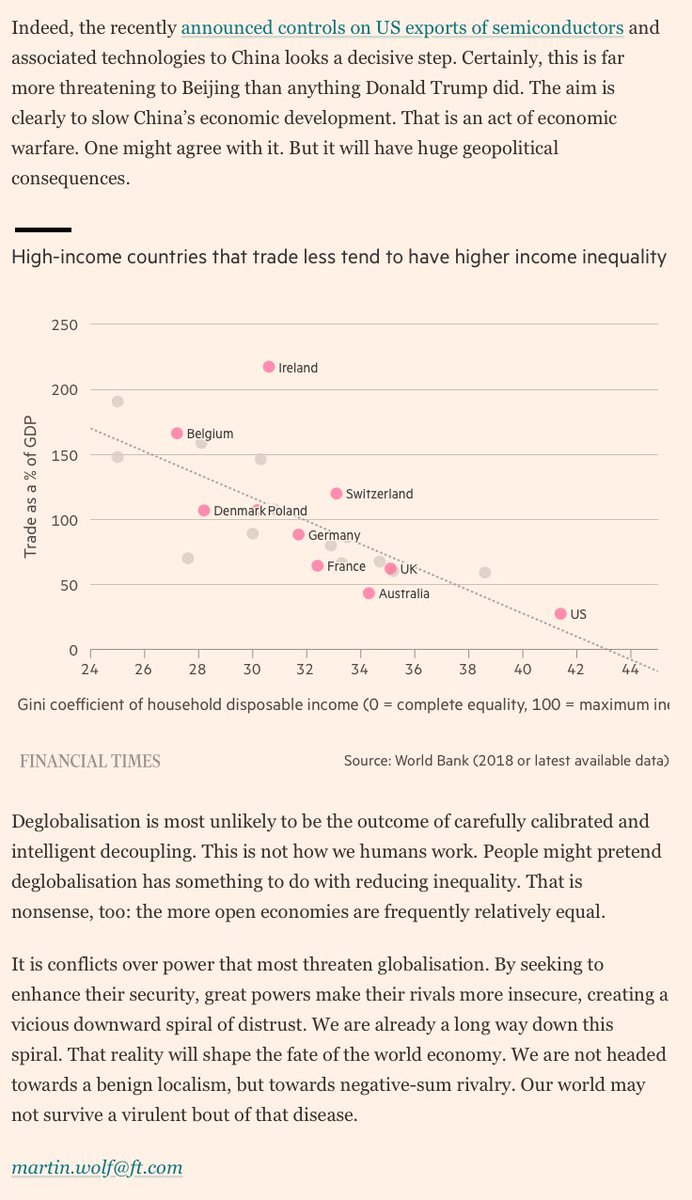

38/ Last 4 years, US has waged "low-grade economic warfare against China...firing volley after volley of tariffs, export controls, investment blocks, visa limits"

Hard Decoupling is here. But US power is limited by defiance of US allies and companies. foreignpolicy.com/2022/10/12/bid…

Hard Decoupling is here. But US power is limited by defiance of US allies and companies. foreignpolicy.com/2022/10/12/bid…

40/ I have been sceptical that hard decoupling

a. would arrest China's rise (leaving aside the morality of trying to kneecap a rival instead of running faster).

b. that US companies and allies like South Korea/Japan will comply with sanctions

a. would arrest China's rise (leaving aside the morality of trying to kneecap a rival instead of running faster).

b. that US companies and allies like South Korea/Japan will comply with sanctions

https://twitter.com/70sBachchan/status/1370436778797248512

32/ Last week the US ordered out engineers and firms working on semiconductors. But Decoupling is going to be long and painful. No sudden reversal of $5 trillion dollars of combined Western FDI in China. Read Kennedy's report:

csis.org/blogs/trustee-…

csis.org/blogs/trustee-…

https://twitter.com/matthew_pines/status/1583173717458239488

43/ "Global investors, who so often blow hot and cold on China, have again flipped — this time to embrace the new Xi."

Under pressure, Xi has reversed zero Covid, the tech crackdown & diluted bank leverage rules that led to property bust.

ft.com/content/f6c47c…

Under pressure, Xi has reversed zero Covid, the tech crackdown & diluted bank leverage rules that led to property bust.

ft.com/content/f6c47c…

44/ Chattering class: Decoupling is here! Where is the next China? Is it India? Vietnam? Bangladesh?

McKinsey: "If you are looking for growth, the answer is very Simple. The next China is China."

McKinsey: "If you are looking for growth, the answer is very Simple. The next China is China."

https://twitter.com/70sBachchan/status/1628132301119815680

• • •

Missing some Tweet in this thread? You can try to

force a refresh