Defiant, Dispirited, Despondent. Without illusions but not disillusioned. Focus on Climate, Inequality, Development. Twitter threads turn into Polycrisis essays

10 subscribers

How to get URL link on X (Twitter) App

2/"Japanese and South Korean firms built supply chains across SE Asia to lower production costs and reach Western markets. Samsung invested heavily in manufacturing plants in Vietnam. Japanese automakers like Toyota...set up auto plants across Thailand, Malaysia, Indonesia"

2/"Japanese and South Korean firms built supply chains across SE Asia to lower production costs and reach Western markets. Samsung invested heavily in manufacturing plants in Vietnam. Japanese automakers like Toyota...set up auto plants across Thailand, Malaysia, Indonesia"

This week we scan the latest frontiers of Trump’s trade war, from India to Brazil, amid the US pressure campaign against Russia. We end in Alaska, where Putin is slated to meet Trump on Friday. Is a new world order taking shape before our very eyes?

This week we scan the latest frontiers of Trump’s trade war, from India to Brazil, amid the US pressure campaign against Russia. We end in Alaska, where Putin is slated to meet Trump on Friday. Is a new world order taking shape before our very eyes?

“The projects — 22 of them — are being led by some of the nation’s leading pharmaceutical companies like Pfizer and Moderna to prevent flu, COVID-19 and H5N1 infections.”

“The projects — 22 of them — are being led by some of the nation’s leading pharmaceutical companies like Pfizer and Moderna to prevent flu, COVID-19 and H5N1 infections.”

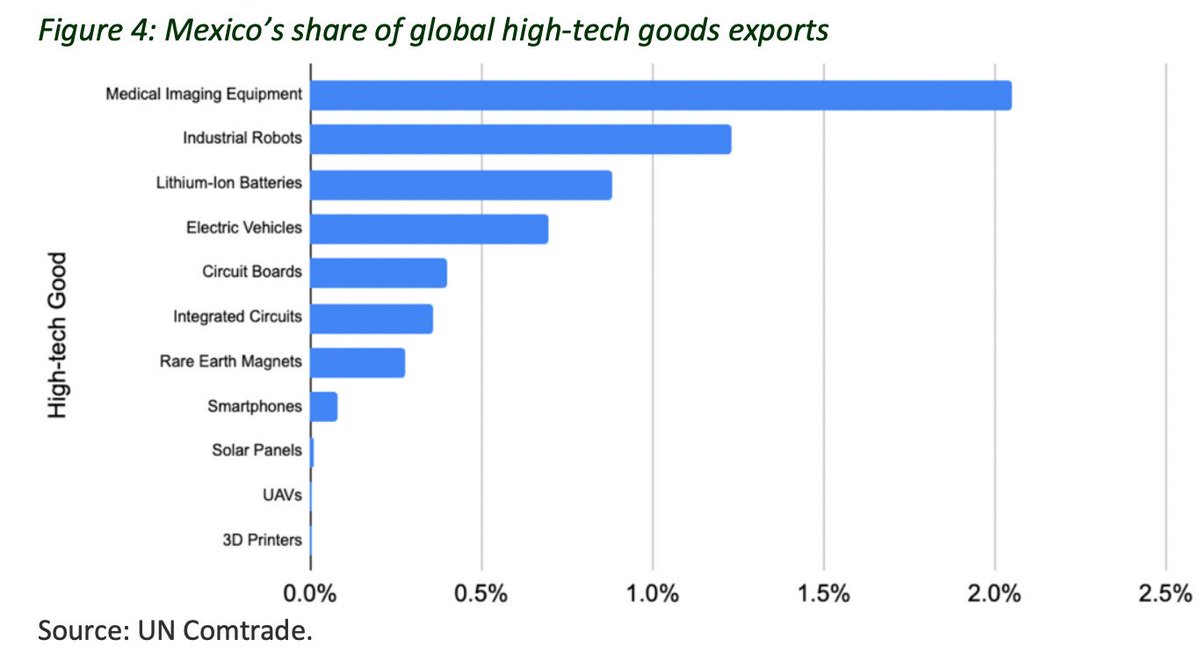

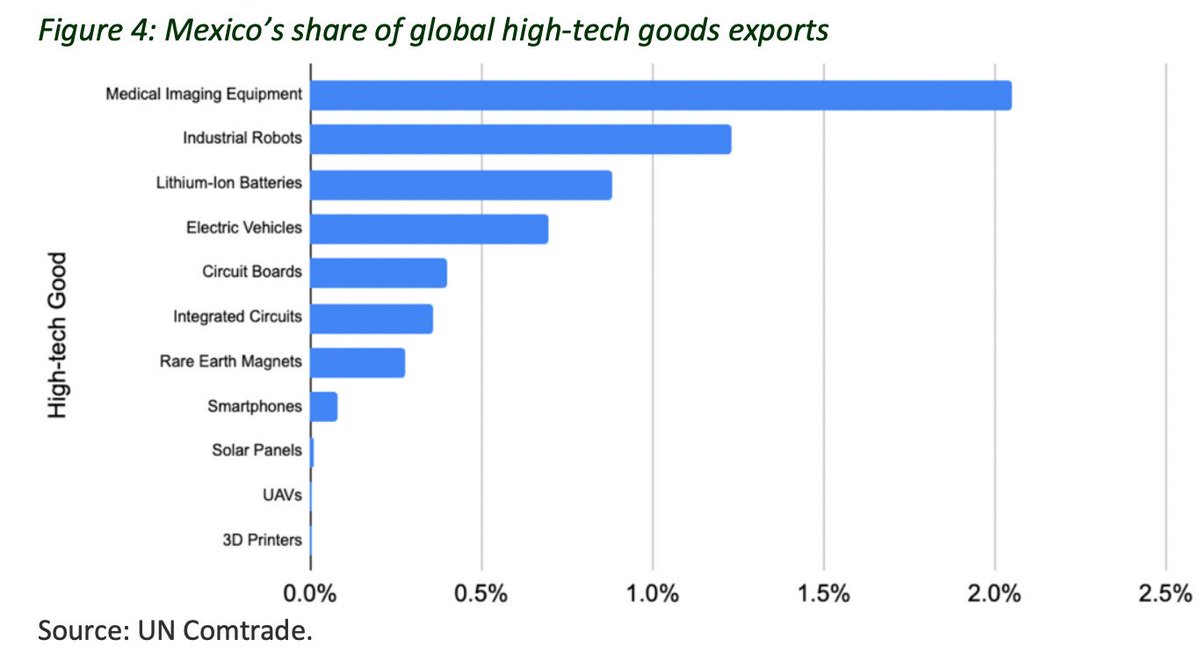

Claudia Sheinbaum:“Plan Mexico is the path that I am certain will lead us to a Mexico with more well-paid jobs, with less poverty & inequality...with a lower carbon footprint that respects the environment and increases our self-sufficiency and sovereignty"

Claudia Sheinbaum:“Plan Mexico is the path that I am certain will lead us to a Mexico with more well-paid jobs, with less poverty & inequality...with a lower carbon footprint that respects the environment and increases our self-sufficiency and sovereignty"

2/"The Getty Villa Museum has caught fire as the Palisades Fire pushes forward in Southern California, according to reporting from the LA Times. The museum’s collection contains more than 125,000 artifacts, many of them Greek and Roman antiquities"

2/"The Getty Villa Museum has caught fire as the Palisades Fire pushes forward in Southern California, according to reporting from the LA Times. The museum’s collection contains more than 125,000 artifacts, many of them Greek and Roman antiquities"

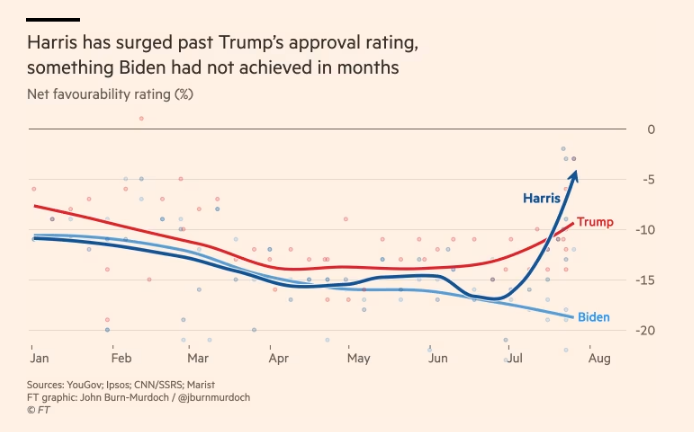

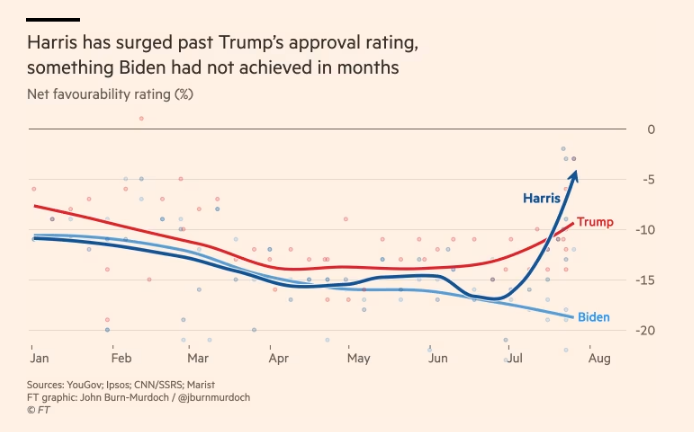

https://twitter.com/DailyLoud/status/1823760769688687044“The market will solve climate”

2/ In Israel's corner are US, UK, Egypt, Saudis, Jordan &Abraham Accord (informal milvalliance) with oil Kingdoms - UAE, Bahrain.

2/ In Israel's corner are US, UK, Egypt, Saudis, Jordan &Abraham Accord (informal milvalliance) with oil Kingdoms - UAE, Bahrain.

https://twitter.com/nycsouthpaw/status/1816493278717747295

The vibe shift, on the ground, in swing state Wisconsin

The vibe shift, on the ground, in swing state Wisconsin

https://x.com/CIRA_CSU/status/18118563740051499392/ Ecology: With super hot oceans, we are very worried about this Atlantic hurricane season. THIRTY storms are predicted plus minus 5, depending on el nino

2/ “The almost overnight surge in electricity demand from data centers is now outstripping the available power supply in many parts of the world”

2/ “The almost overnight surge in electricity demand from data centers is now outstripping the available power supply in many parts of the world”

https://twitter.com/natterjee/status/18016581149046375192/ Highly recommend @natterjee article

https://twitter.com/Kyunghoon_Kim_/status/1797997471412723966India's stock market slides. Their logic?

https://x.com/appadappajappa/status/1797950581694480577

https://twitter.com/RangaMberi/status/1773593707087831253

2/ This is not a a story of Guyana’s PM lecturing western liberals over hypocrisy climate, oil & Amazonian forests.

2/ This is not a a story of Guyana’s PM lecturing western liberals over hypocrisy climate, oil & Amazonian forests.

2/ UKRAINE: US so far has sent more than $75 billion to Ukraine. Of new $106B, Biden asks $61B for Ukraine.

2/ UKRAINE: US so far has sent more than $75 billion to Ukraine. Of new $106B, Biden asks $61B for Ukraine.

if 2 is true, then the future has no electrostates. None. Not Indonesia, Australia, certainly not Canada.

if 2 is true, then the future has no electrostates. None. Not Indonesia, Australia, certainly not Canada.

This July has been the hottest in our recorded history and, most likely, over the last 120,000 years

This July has been the hottest in our recorded history and, most likely, over the last 120,000 years