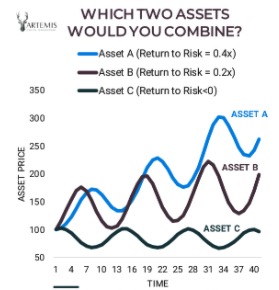

But, if you can buy two, what is the best overall portfolio?

Counterintuitively, the portfolio that combines the negatively correlated (Assets A+C) outperforms dramatically from a risk/reward perspective, even though Asset C has a negative yield.

In this example, by combining Assets A and C, which are negatively correlated to each other, when Asset C goes down, Asset A tends to go up, and vice versa.

They think purely in terms of expected value: "I like this stock and that stock"

But, diversification math shows that you can combine lower returning individual assets for a higher portfolio return.

If A&C become correlated, then you can get in trouble.

2. Using assets that are uncorrelated in "good times" but become correlated in a large drawdown =/= diversification.

This argument is made much better and more persuasively in @vol_christopher's latest paper "The Allegory of the Hawk and the Serpent - docsend.com/view/taygkbn

I summarized the paper here: mutinyfund.com/thedragon/

joshkaufman.net/permanent-port…

1. Investors should spend less time trying to "pick winners" and focus more on portfolio construction and diversification.

2. True diversification requires owning other assets than just stocks and bonds.