Why restructuring telecom infrastructure into a utility is great for shareholders and the unconnected - a thread

1. Most integrated telecom carriers trade at a discount to asset value. This means that value of cell towers, fiber, spectrum and other assets are generally greater than value of stock plus debt.

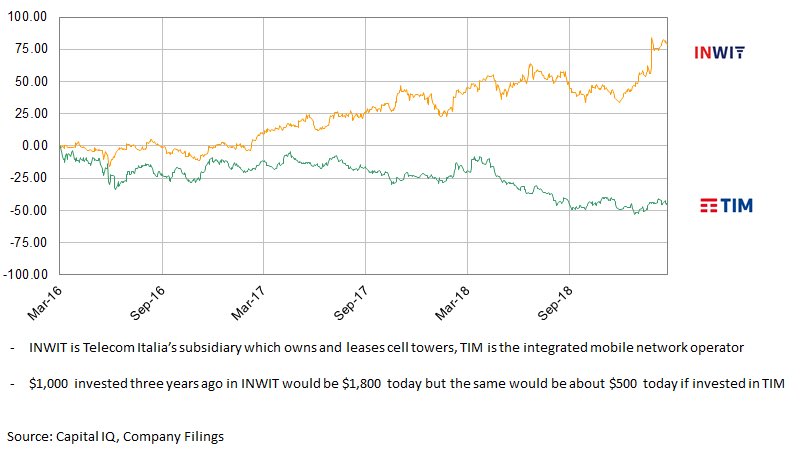

2. Tower sharing companies have outperformed integrated telecom carriers financially, even when the tower co is owned by the same set of shareholders. Investors like cash flow predictability.

3. Investors like cash flow predictability so much that for every unit of cash flow they are willing to pay 2-3x more in a situation where cash flow is more predictable. Best shown by valuation premium enjoyed by tower cos versus integrated carriers.

4. In a telecom infrastructure divestment most of the conversation revolves around tenancy growth (or demand risk). Tenancy growth assumptions determine the price paid to buy telecom infrastructure and lease rate paid by the seller.

5. Telecom operator is weary about doing a bad deal and so are the buyers. Both recognize high demand for such infrastructure but the need to be conservative with assumptions results in excessive padding. The negotiated end result creates a value based pricing scenario.

6. In contrast if the seller of infrastructure figured out a way to make cost based pricing feasible by transferring demand risk to a third party, the seller can enjoy declining leases, while the buyer gets what they want - predictable cash flows.

7. A structure like this is great for the unconnected because it would remove the disincentive against rural areas. For context, a telecom operator makes most of their money from dense urban areas and as a result ignores rural areas.

8. An Availability Payment scheme can make cost based pricing feasible. If this happens, the price paid to access this infrastructure can keep declining as usage increases because the marginal cost of handling additional Internet traffic is fairly low.

9. Structures like this aren’t fantasy and have already played out in small rural towns like Ammon Idaho and on a large scale in Indonesia with the Palapa Ring Project.

10. Everyone says Internet is a utility. Perhaps we should stop wondering about it’s demand and switch incentive structures already. Universal Service Funds are highly under utilized globally and can easily support an Availability Payment scheme.

11. And if not a USF then a city, state or provincial treasury ought to back such a scheme because this will allow the govt to mobilize $20+ of private capital for every $1 of Govt funding. There’s no shortage of capital but there is a shortage of bankable contracts.

12. People are hungry for services. Services are hungry for infrastructure. Infrastructure is hungry for capital. Capital is hungry for cash flow predictability. Cash flow predictability is hungry for bankable contracts.

• • •

Missing some Tweet in this thread? You can try to

force a refresh