How to get URL link on X (Twitter) App

https://twitter.com/virtualbacon1/status/1502723092723822596Distributes these beans to people who give money to this computer program.

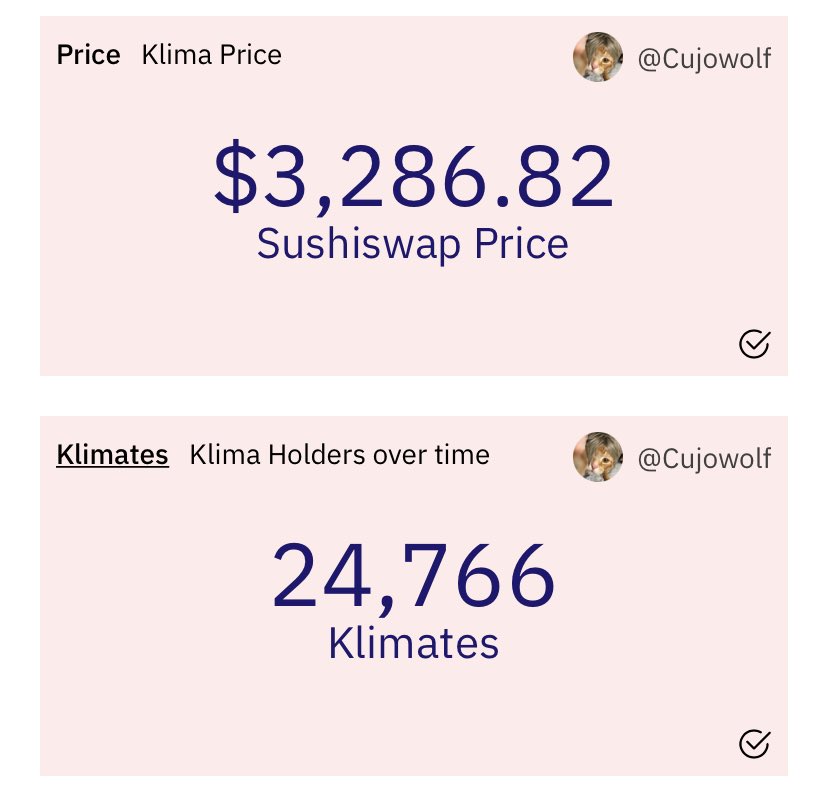

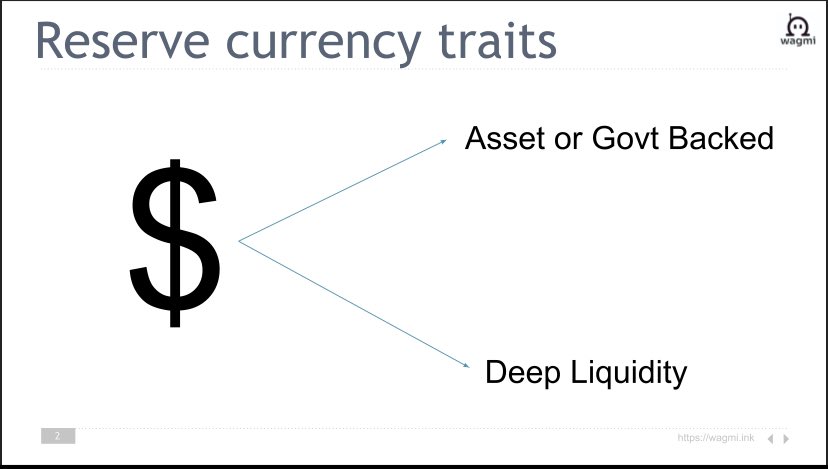

1. OlympusDAO is creating a decentralized reserve currency that is backed by a community governed treasury.

1. OlympusDAO is creating a decentralized reserve currency that is backed by a community governed treasury.

1. Olympus offers high cash flow predictability. As a result, it’s contracts are now bankable, meaning you can borrow against them.

1. Olympus offers high cash flow predictability. As a result, it’s contracts are now bankable, meaning you can borrow against them.

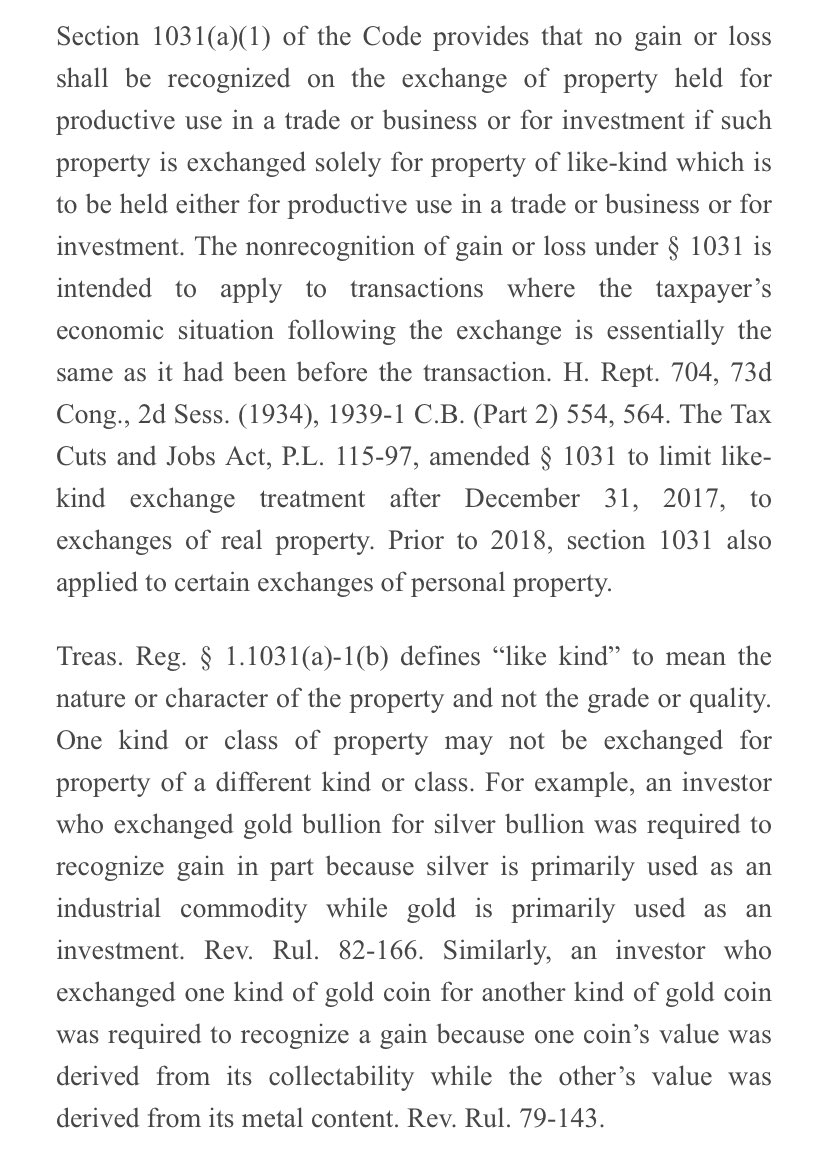

1. A reserve currency has two traits:

1. A reserve currency has two traits:

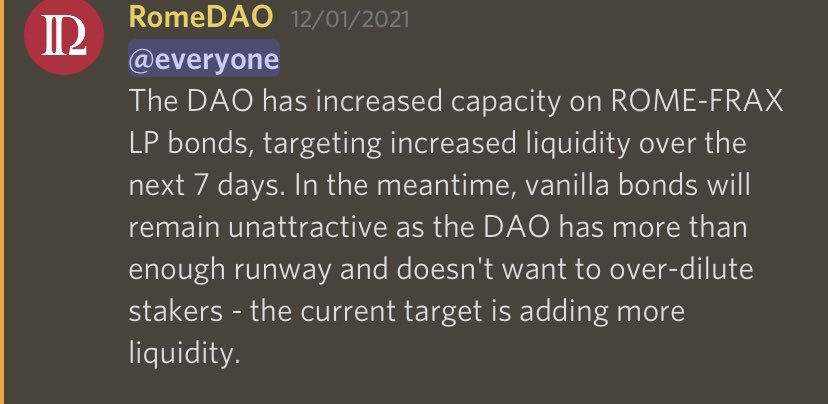

Within one week, $ROME has:

Within one week, $ROME has:https://twitter.com/wagmianon/status/1422431892029116416

Let's say you bought 250 $OHM for $500. If your OHM balance reaches 1,000 and $OHM price is $1,000 then:

Let's say you bought 250 $OHM for $500. If your OHM balance reaches 1,000 and $OHM price is $1,000 then: