I am long Nintendo.

It's fascinating setup because it's a great product, but it's an open question if it will be a good investment.

A thread on both sides here:

It's fascinating setup because it's a great product, but it's an open question if it will be a good investment.

A thread on both sides here:

First, the long side

@aaronvalue does a great job highlighting the bull thesis here. tl;DR: Nintendo has great IP and they could monetize it in various ways.

mindsetvalue.substack.com/p/mama-mia-nin…

@aaronvalue does a great job highlighting the bull thesis here. tl;DR: Nintendo has great IP and they could monetize it in various ways.

mindsetvalue.substack.com/p/mama-mia-nin…

Second, culture of Nintendo limits what path they're likely to take in the future.

@ballmatthew: "some are driven by perfecting their specific process. Not scaling it."

Nintendo is likely to continue to be themselves, not what investors expect

matthewball.vc/all/onnintendo

@ballmatthew: "some are driven by perfecting their specific process. Not scaling it."

Nintendo is likely to continue to be themselves, not what investors expect

matthewball.vc/all/onnintendo

my own experiences reinforce @ballmatthew's points:

I worked closely with a spinoff of Japanese tech conglomerate in the past. They still used laptops, feature phones made by that conglomerate even though products were all outdated. That's how strong the culture was

I worked closely with a spinoff of Japanese tech conglomerate in the past. They still used laptops, feature phones made by that conglomerate even though products were all outdated. That's how strong the culture was

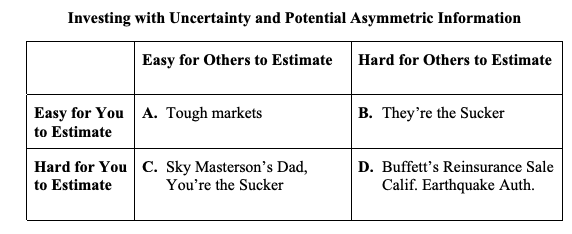

On the other hand, @aaronvalue's thesis highlights that Nintendo is creating surplus for consumers.

The million $ question is: how much of this surplus will they capture? (all monetization of IP is a way to do that)

Nintendo's culture is not focused on capturing this surplus.

The million $ question is: how much of this surplus will they capture? (all monetization of IP is a way to do that)

Nintendo's culture is not focused on capturing this surplus.

Think of IP as a valuable, magical mine -- you can keep mining and it never runs out.

Disney keeps mining it at fast cadence, Nintendo does it at a leisurely, slow pace.

Net result: Disney captures more of the surplus than Nintendo

Disney keeps mining it at fast cadence, Nintendo does it at a leisurely, slow pace.

Net result: Disney captures more of the surplus than Nintendo

Nintendo still captures "some" of the surplus.. I also believe they will create more surplus over time -- simply because the Switch platform and it's successors are more hardware processing capable than all previous platforms..

Going from Switch to Switch 2 is closer to going from Iphone 1 to Iphone 2.

Going from Wii U to Switch was a bigger jump (like a feature phone to a smartphone transition)

This should enable cadence of releasing games to be faster.. This is accelerating creation of surplus.

Going from Wii U to Switch was a bigger jump (like a feature phone to a smartphone transition)

This should enable cadence of releasing games to be faster.. This is accelerating creation of surplus.

Also the defocus on mobile with Switch being a hit isn't as bad as one might think.

Users still cary Iphones and kindle (different use cases). Shouldn't be different with carrying Iphone + Switch.

Users still cary Iphones and kindle (different use cases). Shouldn't be different with carrying Iphone + Switch.

Many bulls might be over-estimating Nintendo's desire for IP monetization (or surplus capture).

But they might also be under-estimating Nintendo's hardware + software vertical integration strengths. Of course, these strengths are hampered by lack of good online play

But they might also be under-estimating Nintendo's hardware + software vertical integration strengths. Of course, these strengths are hampered by lack of good online play

So Switch hardware updates (eg: gen 2) + unified platform to release games faster (from gen 1 to gen 2) + online play may be the type of excess consumer surplus that gets Nintendo excited.

I find it unlikely that Nintendo mgmt will suddenly find capturing surplus that appealing

I find it unlikely that Nintendo mgmt will suddenly find capturing surplus that appealing

A related point on creating consumer surplus is Nintendo's focus on appealing to demographics besides the hardcore games. That's why the hardware processing power being weak relative to PS, Xbox, even iphones may not be that big of a deal.

A specific example to highlight this appeal to wider set of players: Animal crossing calls making things as "Crafting". It's as if Pinterest inspired them.

In summary: Nintendo Hardware + games + online play (hopefully) will likely create amazing experiences for players and continue creating big consumer surplus.

Nintendo is unlikely to capture bigger % of that surplus. That's not who they are!

Nintendo is unlikely to capture bigger % of that surplus. That's not who they are!

PS: in terms of surplus for consumer, classic examples are Costco and Netflix. In fact, deliberately not monetizing too much can be the strategy.

Switch creates a lot of surplus for players. Eg: online Switch store gave me access to all nostalgic Super Nintendo games

Switch creates a lot of surplus for players. Eg: online Switch store gave me access to all nostalgic Super Nintendo games

• • •

Missing some Tweet in this thread? You can try to

force a refresh