How to get URL link on X (Twitter) App

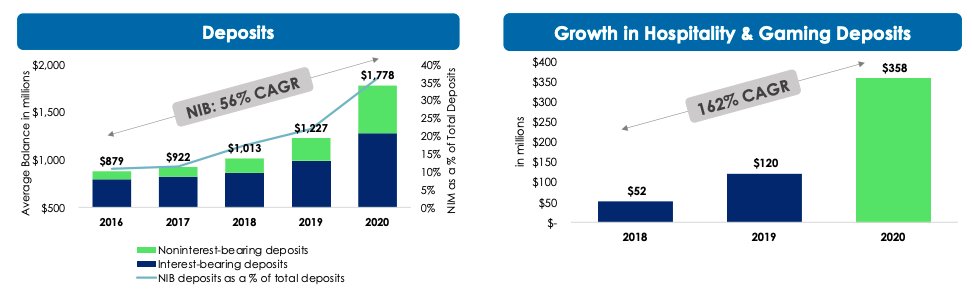

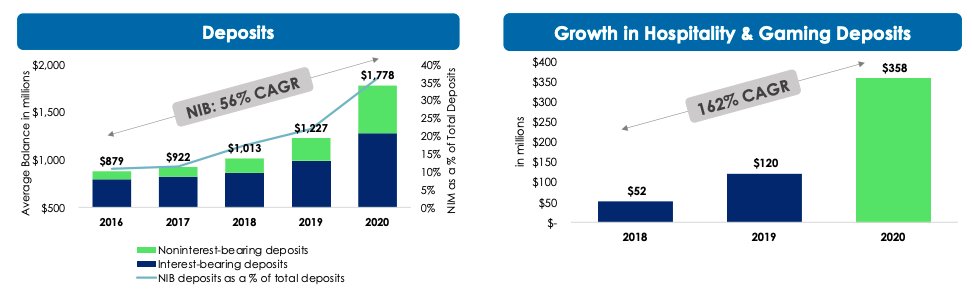

Around 2014-15, MVB was growing loan portfolio at 20% CAGR, but the deposits were not growing.

Around 2014-15, MVB was growing loan portfolio at 20% CAGR, but the deposits were not growing.

https://twitter.com/AnnieDuke/status/1243216731453050880" In the fog of pandemic, action must come before perfect information"

Why can they make these short term tradeoffs?

Why can they make these short term tradeoffs?

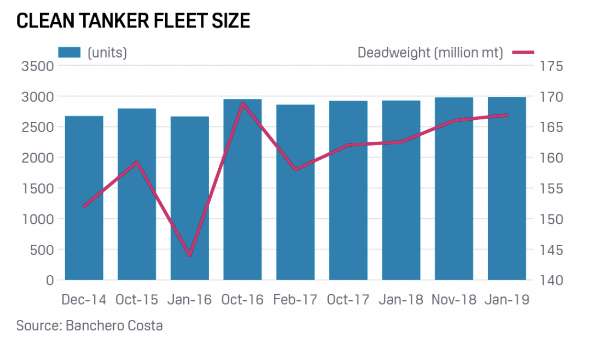

If we look at the sub-segment of tankers, and specifically clean tankers, in the last 5 years supply has gone up in terms of dead weight tons. In 2019, the deadweight tons went up by another 6 million, but the TCE rates have still gone up a lot.

If we look at the sub-segment of tankers, and specifically clean tankers, in the last 5 years supply has gone up in terms of dead weight tons. In 2019, the deadweight tons went up by another 6 million, but the TCE rates have still gone up a lot.

Next up: flashy salesguy Erik Bautista who lost 90%+ of his wealth in one year. His investors also lost it all because he lied about OGX offshore oil potential. Here's an article from 2013 that talks about it. /2

Next up: flashy salesguy Erik Bautista who lost 90%+ of his wealth in one year. His investors also lost it all because he lied about OGX offshore oil potential. Here's an article from 2013 that talks about it. /2