1. Preparation

2. Outreach

3. Navigating the process

4. Partner meetings + closing

Below you'll find a tweet-sized summary of @mccabe's incredible guest post from last week, with templates, references, and timelines.

👇 Read on 👇

Why raise: To accelerate your business – not because you are running out of money. VC’s don’t invest because you need money. They invest because they believe their equity stake will be worth a lot more in the future.

a16z.com/2017/02/18/12-…

1. A short blurb about your business, w/ headline numbers that indicate the business is doing well

2. A short teaser deck (3-7 slides)

3. A longer presentation deck (12-15 slides)

4. A 2-3 year forecast

rippling.com/blog/company-n…

sequoiacap.com/article/writin…

piktochart.com/blog/startup-p…

medium.com/@zebulgar/how-…

1. A Loom of your product flow explaining how you made key design decisions

2. An appendix of interesting information you yourself have read or viewed that inspired your approach

3. A compilation of customer testimonials

Planning your outreach is probably the most overlooked and tedious part of building a successful process. Your goal at this stage is to build a long list of funds who could lead your round – on that can fill the majority of your round.

docs.google.com/spreadsheets/d…

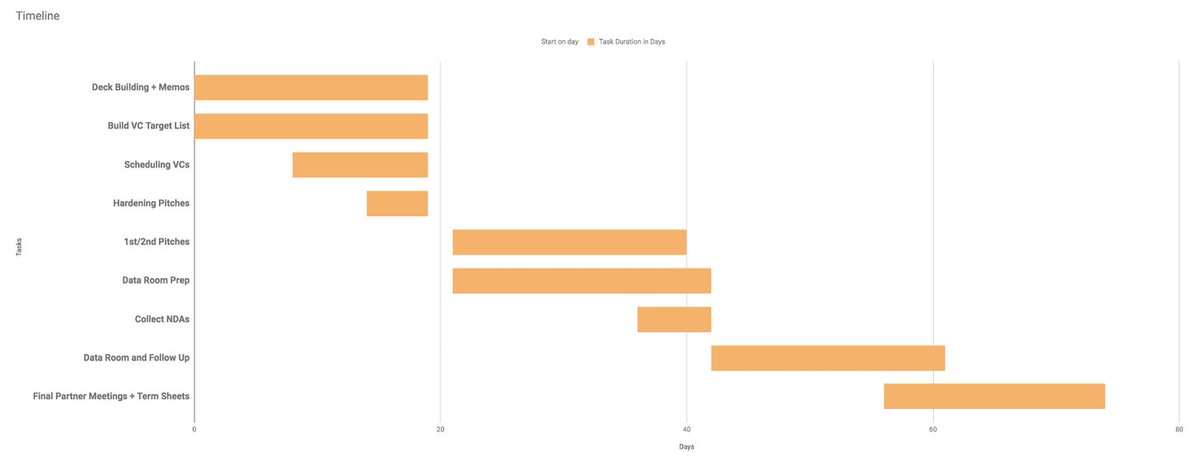

You now have your pitch materials and your investor list ready. Your ultimate goal is to end up with multiple interested funds who have completed their diligence and want to invest all at the same time.

docs.google.com/spreadsheets/d…

Having five VC partners interested in investing after the diligence phase is a success.

If you’ve made it this far, kudos, you’ll need that kind of perseverance to fundraise successfully.

If other funds are still interested, you can let them know you have a term sheet and that they’ll need to make a decision soon.

ycombinator.com/library/4P-a-s…

If you have any questions hit up @mccabe, the brains behind this post. And a big shoutout to @jpgg @eoghan @zebulgar and Riley Newman for their help with this post.

lennyrachitsky.com/p/a-playbook-f…