In ‘96 amid the dot com boom, he joined Citysearch.

A stark contrast to making candy in Waco, he loved working w/talented people on challenging, motivating projects.

After two years, he went on to Harvard Business School.

It was 2001. The recession and Napster crushed the music industry.

His role at BMG was eliminated before he started.

Jobless for months, Foley’s brother-in-law hired him at Ticketmaster.

Trying to compete with Amazon proved to be futile.

He’s 40 years old. Anxious. Wanting to prove himself.

Fortunately, he had an idea.

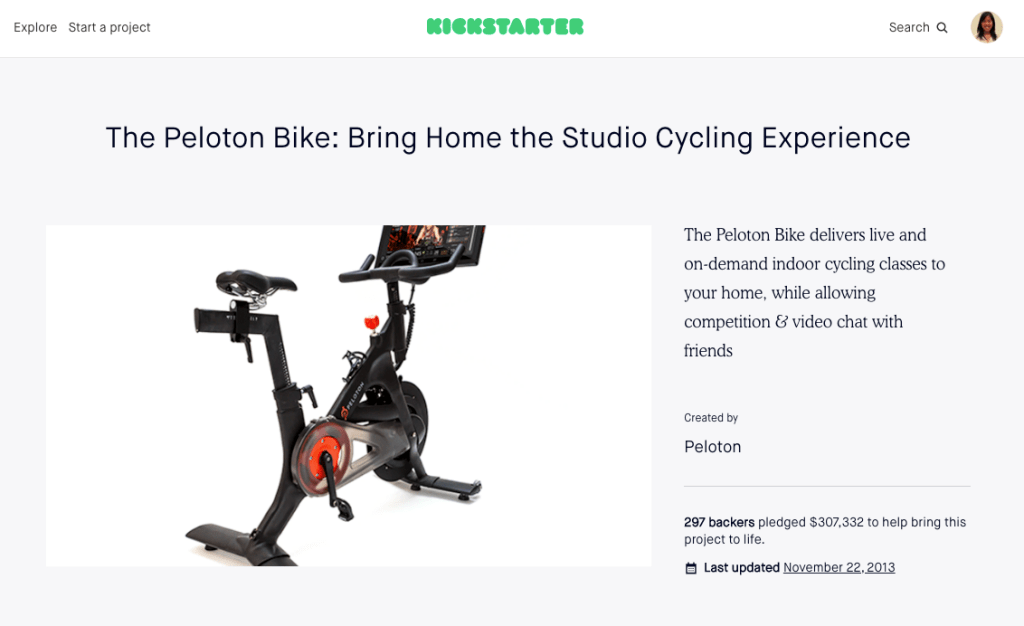

With his wife’s blessing, Foley recruited cofounders and raised Peloton’s seed round.

A friends and family round, Foley raised $400K @ $2M post from 8 angels.

The plan: combine an off-the-shelf tablet w/an exercise bike.

If only it were that simple...

Peloton’s bike would be scratch-built.

But that’s expensive. They needed more money.

Foley was in his mid-40s. Had two kids.

He hit the fundraising trail to keep his business afloat.

From 2011-14 Foley pitched 3,000 angels & 400 firms.

Almost everyone said no.

Eventually, he raised $10M from 100 angels.

Tiger Global was the first institutional investor earning $1.4B at IPO.

Post-Kickstarter, $PTON launched a website.

The bike was priced at $1200.

Now, the product looked cheap.

They increased the price and sales increased!

That year, Foley raised $100M+ in funding.

More classes led to more engagement and more sales.

More traction = more investment.

The company raised nearly $1B in all by 2018.

Join readers from companies like Peloton, Apple, Nike, and Goldman Sachs here:

insider.fitt.co

@kevinleeme @JoePompliano @tobydoyhowell @mariodgabriele @theSamParr @APompliano