Thread on "Investing Resources"

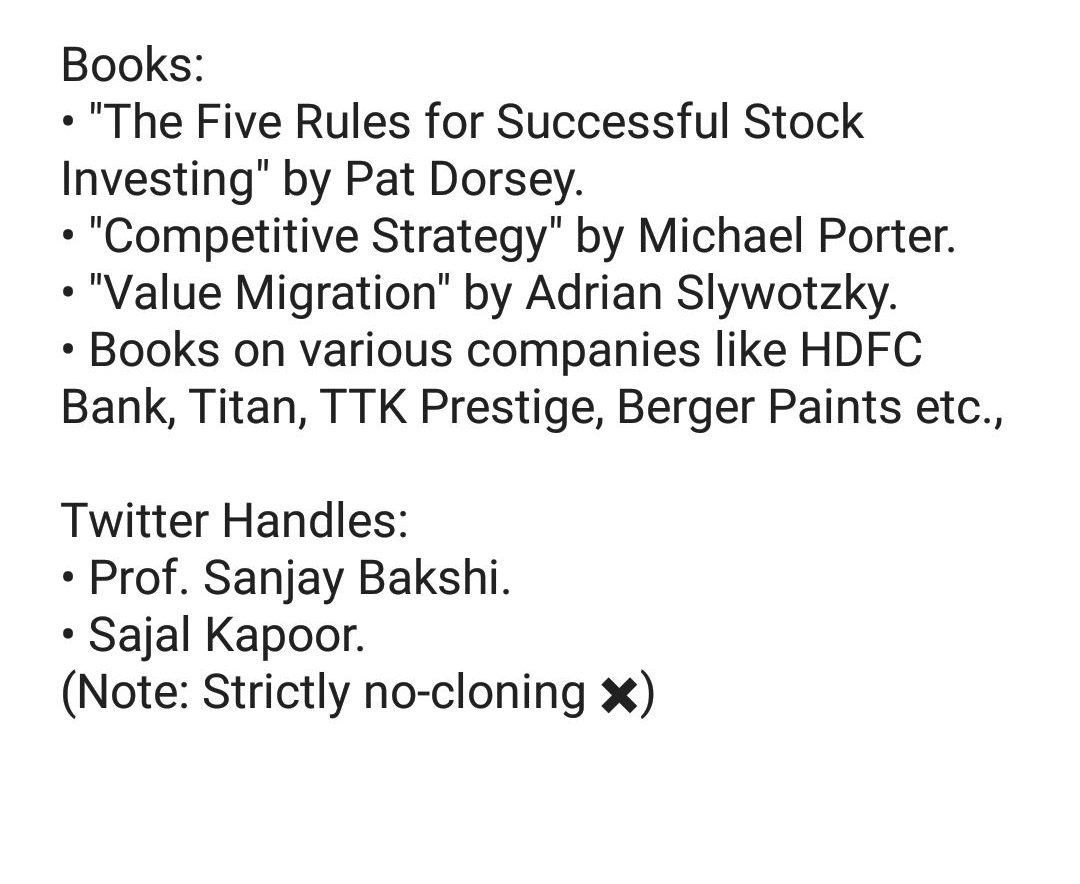

Day 1: Best sources which help us to understand the business models.

Day 1: Best sources which help us to understand the business models.

Day 4:

Life stories/ Biographies/ Autobiographies.

• The Snowball: Warren Buffett and the Business of Life.

• Poor Charlie's Almanack.

• Reminiscences of a Stock Operator.

Life stories/ Biographies/ Autobiographies.

• The Snowball: Warren Buffett and the Business of Life.

• Poor Charlie's Almanack.

• Reminiscences of a Stock Operator.

Day 6:

Websites/ Apps useful for stocks research:

• @screener_in

• @ValueResearch

• @in_morningstar

• @mystockedge

• @Tijori1

• @MoneyWorks4ME

• @moneycontrolcom

Websites/ Apps useful for stocks research:

• @screener_in

• @ValueResearch

• @in_morningstar

• @mystockedge

• @Tijori1

• @MoneyWorks4ME

• @moneycontrolcom

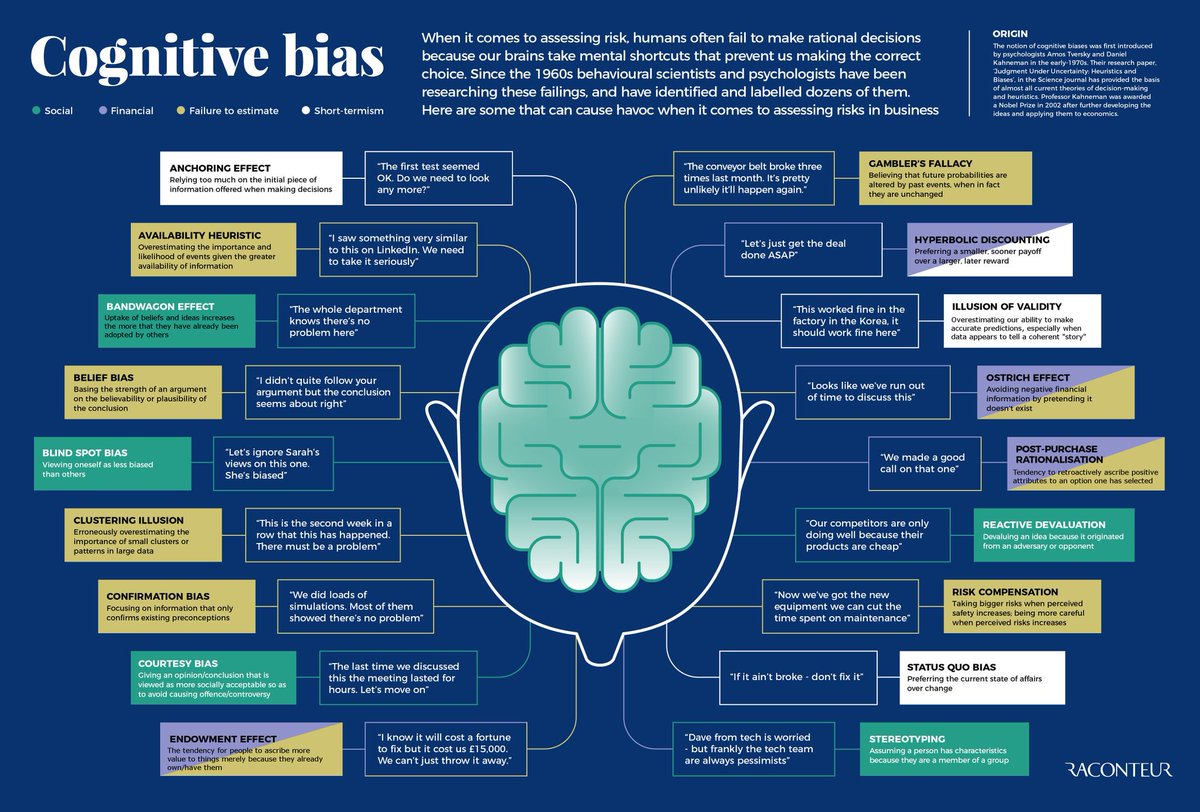

Image courtesy: Visual Capitalist.

Day 13:

Behavioural aspects of investing:

Books 📚:

• The Little Book of Behavioral Investing.

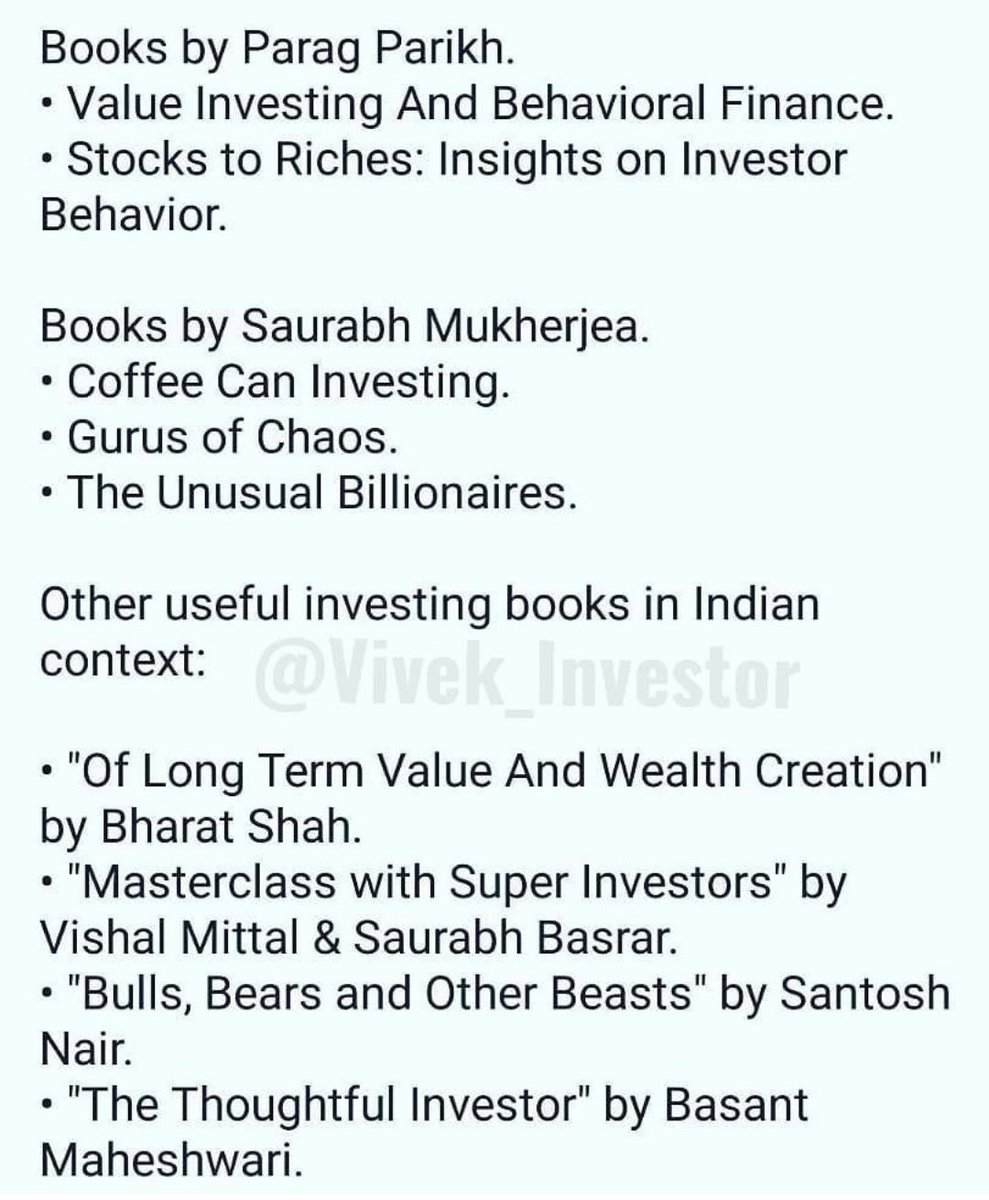

• Value Investing And Behavioral Finance.

• The Behavioral Investor.

Behavioural aspects of investing:

Books 📚:

• The Little Book of Behavioral Investing.

• Value Investing And Behavioral Finance.

• The Behavioral Investor.

• • •

Missing some Tweet in this thread? You can try to

force a refresh