Stock Visualisation🔗: Bal Krishna Industries🚜

Video Link🎥:

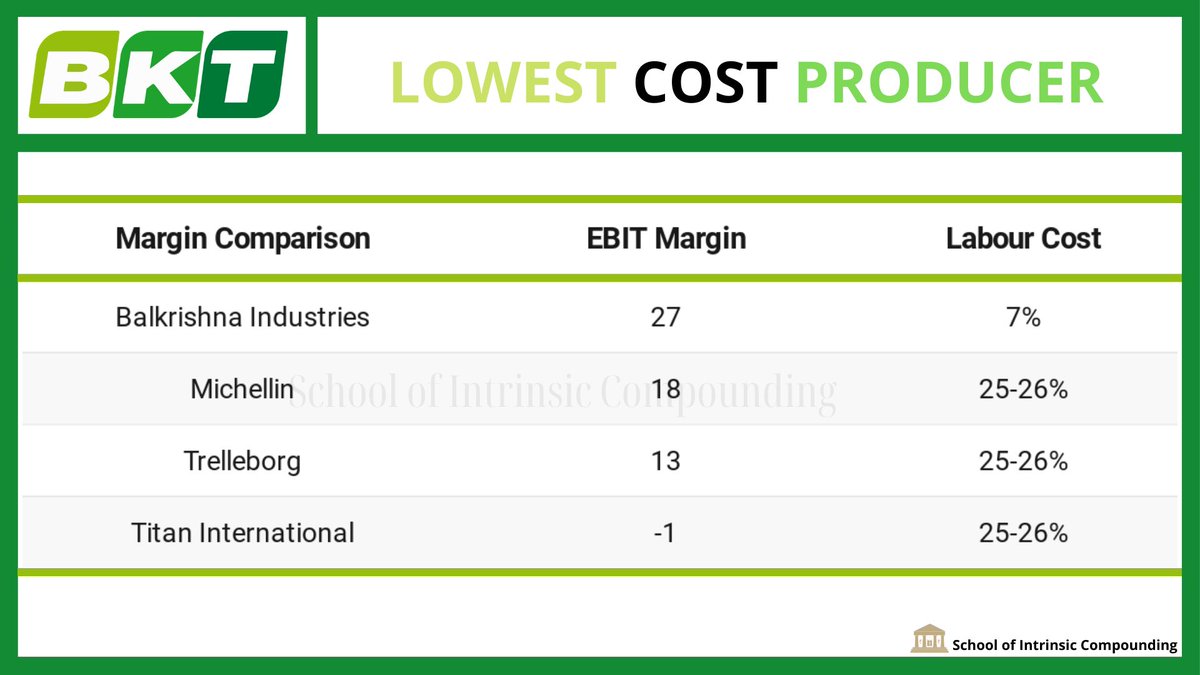

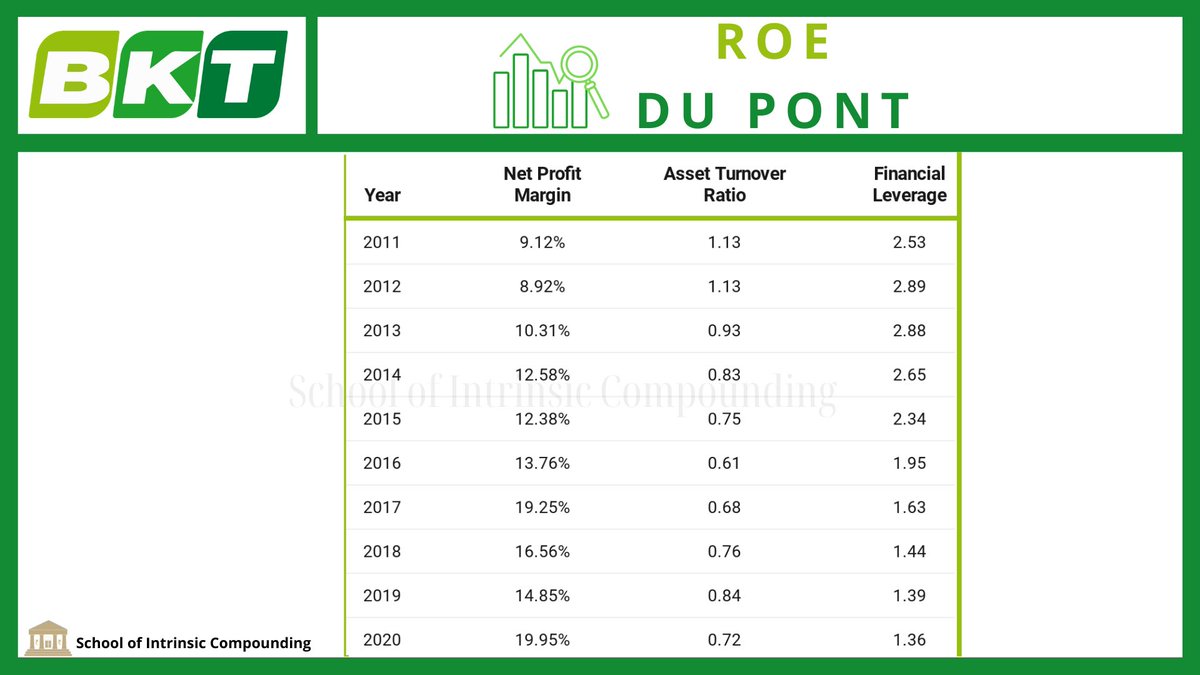

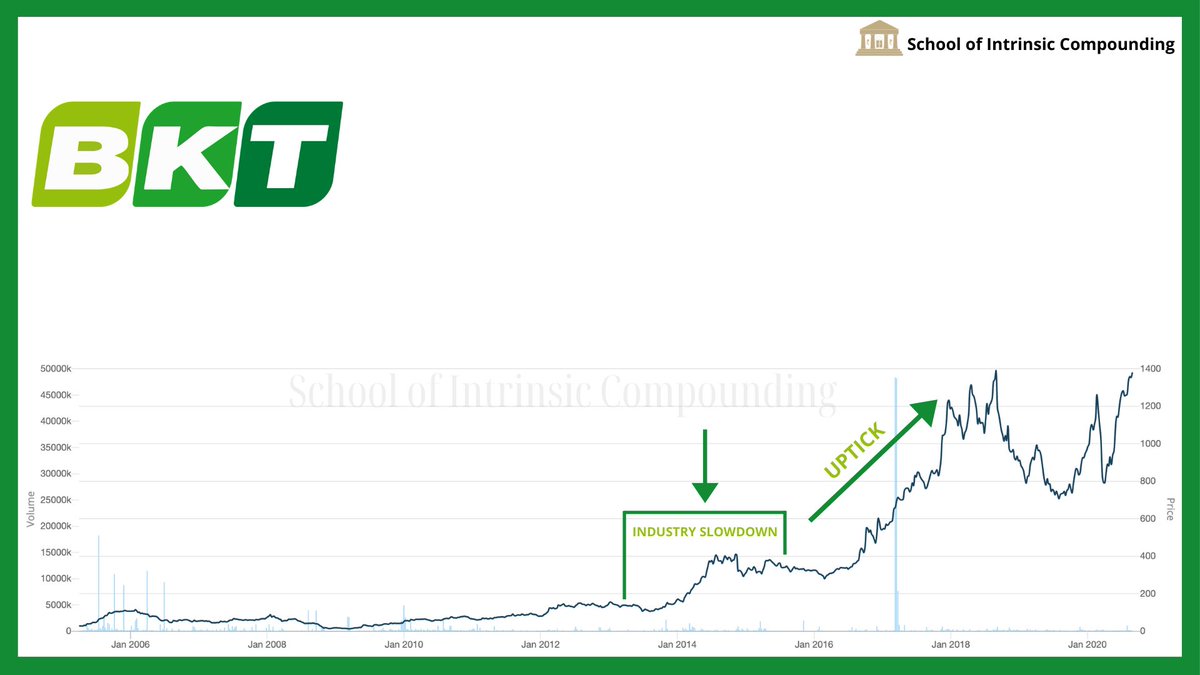

Look for a low cost producer with expanding margins. #BKT

Video Link🎥:

Look for a low cost producer with expanding margins. #BKT

• • •

Missing some Tweet in this thread? You can try to

force a refresh