🏛Seeking Wisdom in the Indian Stock Markets|Disclaimer:Nothing should be considered as investment advice to buy or sell| Education|Fundamental Analysis

77 subscribers

How to get URL link on X (Twitter) App

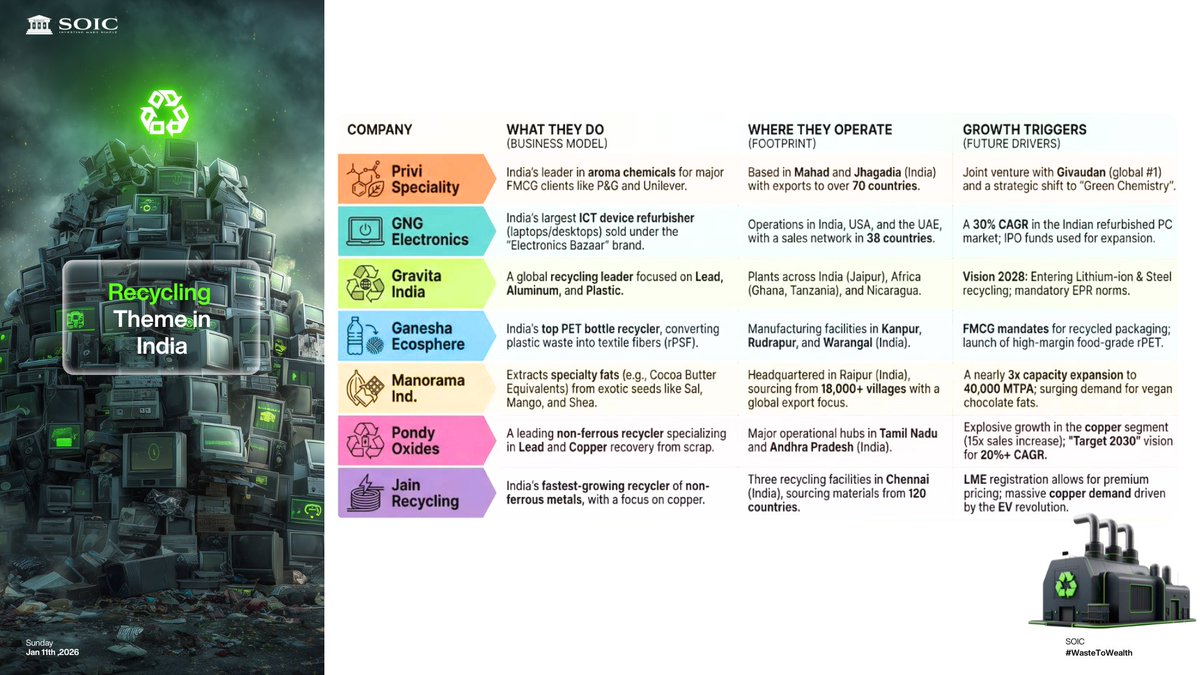

Waste to wealth isn’t only “recycling”.

Waste to wealth isn’t only “recycling”.

An aircraft isn't just one machine; it’s a "global integration" of millions of parts sourced from dozens of countries.

An aircraft isn't just one machine; it’s a "global integration" of millions of parts sourced from dozens of countries.

To understand the value chain, we dissect the 2-wheeler into these functional groups:

To understand the value chain, we dissect the 2-wheeler into these functional groups:

The common thread across these 5 companies is De-risking. Whether it is acquiring downstream steel assets, entering battery storage, or building global ports, these players are moving up the value chain to protect margins and grow their topline.

The common thread across these 5 companies is De-risking. Whether it is acquiring downstream steel assets, entering battery storage, or building global ports, these players are moving up the value chain to protect margins and grow their topline.

There are multiple players in the value chain starting from big airframe and engine parts (Tata Advanced Systems, Dynamatic, Azad, Aequs, Unimech, Raymond/Maini, Bharat Forge, Godrej). Global giants ~ Airbus, Boeing, Safran, GE, Rolls-Royce are buying more from India as our airlines place record orders, and maintenance hubs at home (AIESL, Air Works–Adani, GMR, Tata–Air India) are replacing expensive trips abroad.

There are multiple players in the value chain starting from big airframe and engine parts (Tata Advanced Systems, Dynamatic, Azad, Aequs, Unimech, Raymond/Maini, Bharat Forge, Godrej). Global giants ~ Airbus, Boeing, Safran, GE, Rolls-Royce are buying more from India as our airlines place record orders, and maintenance hubs at home (AIESL, Air Works–Adani, GMR, Tata–Air India) are replacing expensive trips abroad.

Born from Sarabhai’s humble experiments, India’s space programme is now wide open to private ambition.

Born from Sarabhai’s humble experiments, India’s space programme is now wide open to private ambition.

First let’s clear up the difference between Robots and Humanoids

First let’s clear up the difference between Robots and Humanoids

1/n

1/n

1/n

1/n

1/n

1/n

1/n

1/n

Before exploring the widespread effects, let's clarify the distinction between fiscal and monetary policy (Economics 101).

Before exploring the widespread effects, let's clarify the distinction between fiscal and monetary policy (Economics 101).

1/ Indian Airlines Eye 50% International Market Share by 2025

1/ Indian Airlines Eye 50% International Market Share by 2025

1) Massive Oversupply

1) Massive Oversupply

https://x.com/soicfinance/status/1748619046608843155?s=20

Let's dive into the performance of SGB (Sovereign Gold Bonds) over the years! 📈 The inaugural SGB came into existence in 2015, reaching maturity in 2023, completing a 8-year cycle. 🎉

Let's dive into the performance of SGB (Sovereign Gold Bonds) over the years! 📈 The inaugural SGB came into existence in 2015, reaching maturity in 2023, completing a 8-year cycle. 🎉