#FINEORGANICS -VERY FINE CHEM. CO.

FOIL is in d oleo chem based additives buss with majority of additives sales coming from food (30%) & plastic(40%) segm. together contributing 70% to d overall revenues & rest being contri. by additives like paints, rubber, cosmetics etc.

FOIL is in d oleo chem based additives buss with majority of additives sales coming from food (30%) & plastic(40%) segm. together contributing 70% to d overall revenues & rest being contri. by additives like paints, rubber, cosmetics etc.

Founded in 1970, by Mr. Ramesh Shah, a Mumbai-based businessman wid experience in chem. trading and Mr. Prakash Kamat, a skilled technocrat from Institution of Chemical Technology.

Promoter hold 75% stake & only 3.48% (10.65 lacs shares) r available for Retail shareholders.

Promoter hold 75% stake & only 3.48% (10.65 lacs shares) r available for Retail shareholders.

Co. claims to be d largest organised player of Oleo-chem based green additives in India.

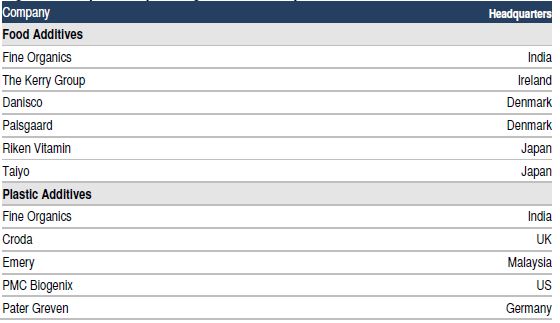

-Amng top 6 global players in the specialty food emulsifiers

-1 of d 5 global players in d polymer additives industry

-dey also claim to develop proprietary tech. to mfg green additives.

-Amng top 6 global players in the specialty food emulsifiers

-1 of d 5 global players in d polymer additives industry

-dey also claim to develop proprietary tech. to mfg green additives.

PRODUCTS

Dey mfg additives whch are naturally derived from oleochemicals other than synthetically derived from petrochemicals. They have around 400+ product profile which has doubled in last few years.

So, what these additives are & why they are important?

Dey mfg additives whch are naturally derived from oleochemicals other than synthetically derived from petrochemicals. They have around 400+ product profile which has doubled in last few years.

So, what these additives are & why they are important?

Since plastic & food Additives are major contributor to the revenue let talk about Plastic Additives first.

PLASTIC ADDITIVES - Plastics prod r made frm polymers & these polymers are mixed wid a complex blend materials called plastic additives.

PLASTIC ADDITIVES - Plastics prod r made frm polymers & these polymers are mixed wid a complex blend materials called plastic additives.

They mfg wide range of additives for polyolefins, polyolefin compounds masterbatches, styrenics compounds, engineering plastics, rigid PVC products.

So basically they r req. in mostly all d plastic products that we use n see in our daily life’s.

Uses of these additives are 👇

So basically they r req. in mostly all d plastic products that we use n see in our daily life’s.

Uses of these additives are 👇

D packaging sector is d major user of plastic additive (26%) followed by consumer goods (21%) & construction & auto industry, with 20% each.

Global mkt size of plastic is around $30bn (2021E)whereas Indian mkt size is around 9000crs growing with a CAGR of 8-10%.

Global mkt size of plastic is around $30bn (2021E)whereas Indian mkt size is around 9000crs growing with a CAGR of 8-10%.

FOOD ADDITIVES

R substances added to food whch affect its characteristics. They are used to preserve,flavour, blend, thicken etc.

Food additives are strictly regulated and monitored by governments to ensure the health of people therefore there is🚫entry barrier into this segment.

R substances added to food whch affect its characteristics. They are used to preserve,flavour, blend, thicken etc.

Food additives are strictly regulated and monitored by governments to ensure the health of people therefore there is🚫entry barrier into this segment.

GLOBAL MKT SIZE – $2.4bn(2023E) INDIAN MARKET SIZE – 1100 crs (2023).

Acc. To mgt they were having 90% mkt share in food additives segment. Inc shift of consumer to packaged food due to covid might lead to increased demand for their products too.

Acc. To mgt they were having 90% mkt share in food additives segment. Inc shift of consumer to packaged food due to covid might lead to increased demand for their products too.

CLIENTS

700+ direct customers

160+ distributors frm 70 countries.

CLIENTS-Reliance Industries Limited, GAIL, Haldia Petrochemicals Limited, Exxon Mobil, Dow Chemicals etc.

FOOD SEG. HUL, Mondelez, Coca Cola, Britannia, Parle, etc

No customer accounts for more than 5% of SALES.👍

700+ direct customers

160+ distributors frm 70 countries.

CLIENTS-Reliance Industries Limited, GAIL, Haldia Petrochemicals Limited, Exxon Mobil, Dow Chemicals etc.

FOOD SEG. HUL, Mondelez, Coca Cola, Britannia, Parle, etc

No customer accounts for more than 5% of SALES.👍

RAW MAT.

Since their products are derived from oleochemicals which are mfg by processing vegetable oil,Palm oil etc these oils act as a raw material for them. Other raw mats are fatty acids, fatty amines, fatty alcohols etc.

Since their products are derived from oleochemicals which are mfg by processing vegetable oil,Palm oil etc these oils act as a raw material for them. Other raw mats are fatty acids, fatty amines, fatty alcohols etc.

co. procures raw materials from domestic and international markets & uses a mix of spot contracts and fixed-price agreements of up to six months.

- 45% of purchases are through the top two suppliers only.

-28% of raw materials are imported.

- 45% of purchases are through the top two suppliers only.

-28% of raw materials are imported.

ENTRY BARRIERS

There is a high entry barrier as customers don’t easily shift to other players offering at lower prices, Quality is the main parameter & it takes months or years to get approval from the customers.

New players don't come in due to complex tech. & resources req.

There is a high entry barrier as customers don’t easily shift to other players offering at lower prices, Quality is the main parameter & it takes months or years to get approval from the customers.

New players don't come in due to complex tech. & resources req.

CAPACITY- it has total capacity of 101,300 MTPA at Ambernath1(49500 MTPA)

Ambernath 2 (5000 MTPA)

Ambernath3( 32000 MTPA)

Badlapur (6400 MTPA) and

Dombivali (8400 MTPA).

Ambernath 2 (5000 MTPA)

Ambernath3( 32000 MTPA)

Badlapur (6400 MTPA) and

Dombivali (8400 MTPA).

EXPANSION – By FY22 they will reach around 131300 MTPA which is nearly double of FY19 CAP-69300 MTPA. Mgt expects to reach optimum utilization in next 4yrs.

REVENUE CONTRIBUTION – EXPORTS- 55% DOMESTIC-45%

Major Countries of export are

i)North &South America -20-25%

REVENUE CONTRIBUTION – EXPORTS- 55% DOMESTIC-45%

Major Countries of export are

i)North &South America -20-25%

ii)EUROPE - 20-22%

iii) Middle East & Africa 30-40%

iv) Asia 20-25% (INCLUDING CHINA)

They derives 50% of rev through annual contract, while rest 50% comes from short-term contracts (about 3months) through distributors.

iii) Middle East & Africa 30-40%

iv) Asia 20-25% (INCLUDING CHINA)

They derives 50% of rev through annual contract, while rest 50% comes from short-term contracts (about 3months) through distributors.

BAL SHEET

they hv got quite strong balance sheet with NET DEBT FREE.

Cash+ INV - 243crs

Debt- 125crs (4.8% int. cost)

Net asset - 217crs vs 78crs (+178%)⬆️

WC DAYS - 75

they hv got quite strong balance sheet with NET DEBT FREE.

Cash+ INV - 243crs

Debt- 125crs (4.8% int. cost)

Net asset - 217crs vs 78crs (+178%)⬆️

WC DAYS - 75

P&L

GP margins are stable around 40% wid some fluctuations due to raw mat price volatility

In 2017 all oleochem co's faced margin pressure to inc in palm oil prices.

Over the years margins hv steadily improved due to op lev benifits.

GP margins are stable around 40% wid some fluctuations due to raw mat price volatility

In 2017 all oleochem co's faced margin pressure to inc in palm oil prices.

Over the years margins hv steadily improved due to op lev benifits.

Ratios

One thing wch stands out is d return ratios

ROCE - 32%(FY19) Fy20 ROCE WIL BE LOW DUE RECENT EXP.

ROE- 26%

Wats amazing is its NET FIXED ASSET TURN.

NEARLY 10X at peak capacity.

Don't think it being high due to high realization as prod doesn't seem to be commodity at all.

One thing wch stands out is d return ratios

ROCE - 32%(FY19) Fy20 ROCE WIL BE LOW DUE RECENT EXP.

ROE- 26%

Wats amazing is its NET FIXED ASSET TURN.

NEARLY 10X at peak capacity.

Don't think it being high due to high realization as prod doesn't seem to be commodity at all.

Valuations - Doesn't look cheap from any angle.

But given the Buss. model of co.

High Entry Barriers

Good Return Ratios

Healthy cash Generations.

Low float.

Mgt pedigree

It can be a good buy if mkt provides opport.

NOT A RECOMMENDATION.

But given the Buss. model of co.

High Entry Barriers

Good Return Ratios

Healthy cash Generations.

Low float.

Mgt pedigree

It can be a good buy if mkt provides opport.

NOT A RECOMMENDATION.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh