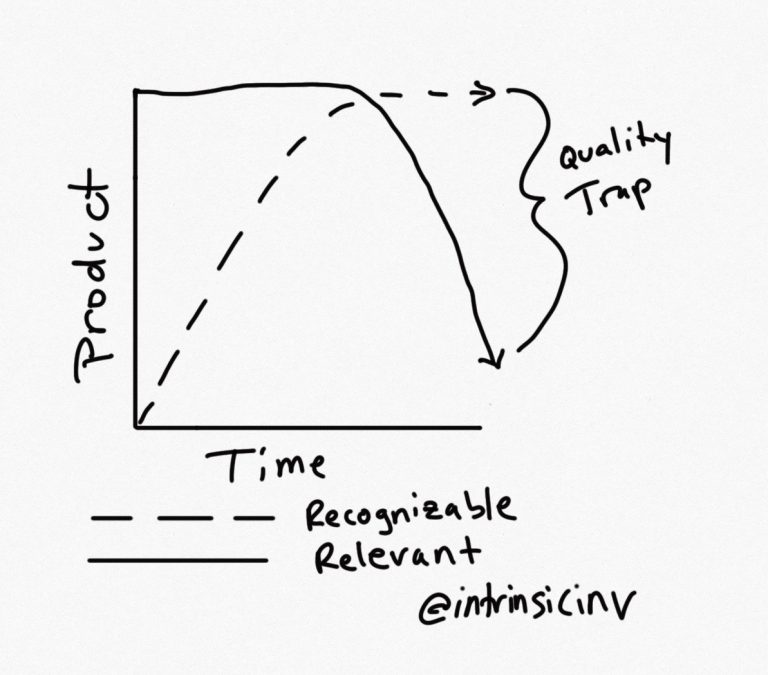

Investors often confuse relevance & recognizability. Just because a customer *recognizes* a brand/service, does not mean it is *relevant* to their lives. Relevance drives attention, attention drives demand, demand drives pricing power. 1/11

This is the path that most successful products/services take. It starts with a relevant product that quickly becomes recognizable. Without good stewardship, its relevance fades even though people still remember it. 2/11

Relevance fade can happen quickly (e.g. a fad) or slowly. Once we’ve determined a product/service/brand relevance is in secular decline, we either won’t invest or will exit an existing position. 3/11

Exceptional companies find ways of maintaining a high level of relevance for a decade or longer. This requires innovation and brand stewardship (and luck!) to remain connected with customer interests. 4/11

intrinsicinvesting.com/2019/10/16/why…

intrinsicinvesting.com/2019/10/16/why…

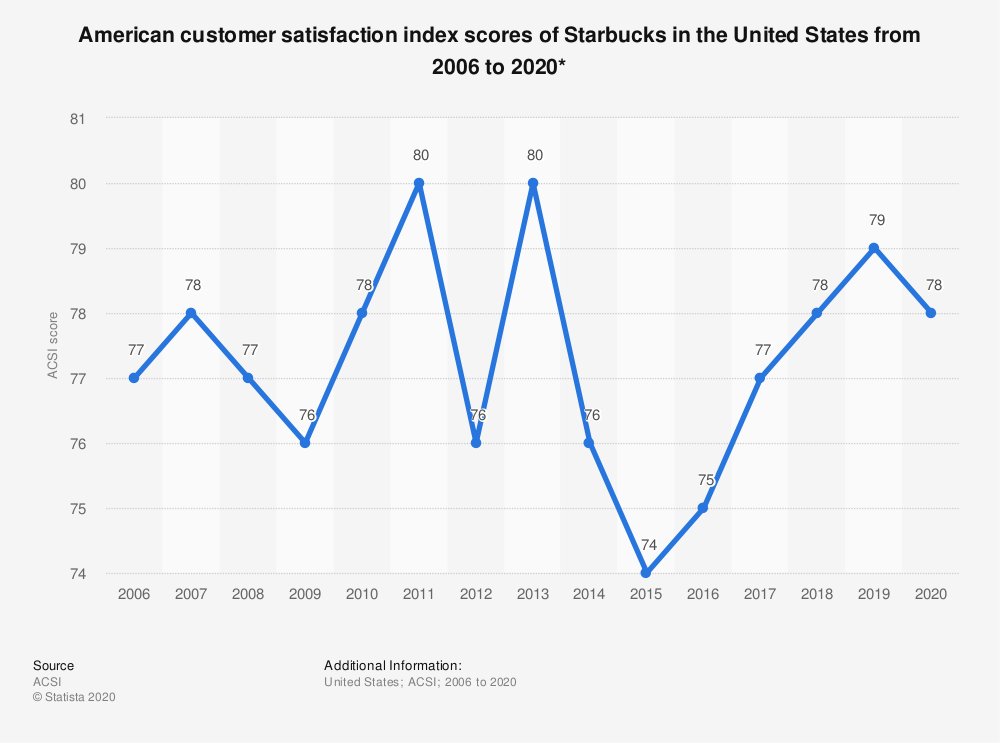

$SBUX has maintained relevance through creative beverage offerings (Frappuccino, Cold Brew) and reducing transaction frictions (digital payments, rewards, drive through stores). 5/11

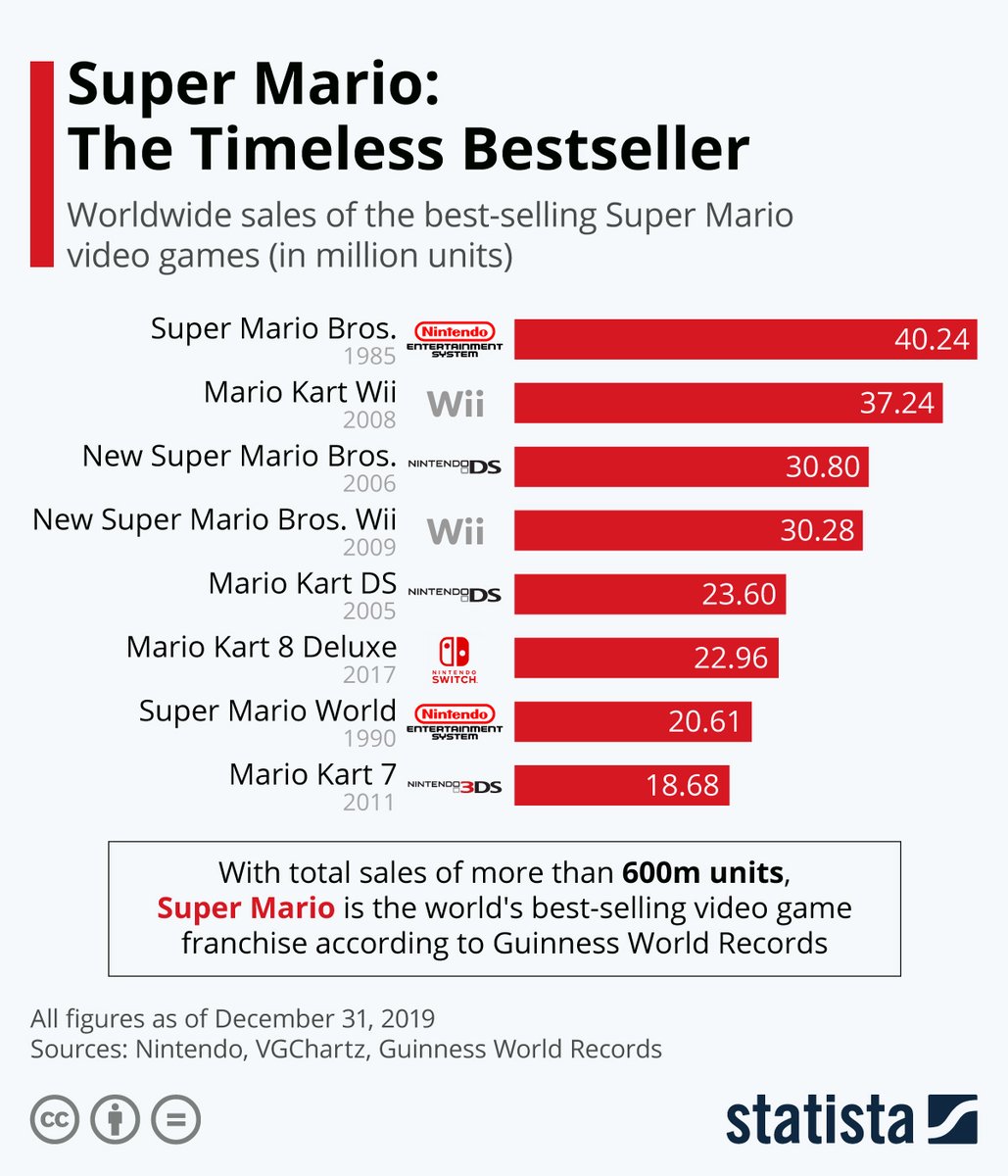

Pac-Man and Mario are two of the most recognizable video game characters of all-time, but Mario remained recognizable *and* relevant while Pac-Man remained just recognizable. 6/11

Relevance risk begins when a product/service begins to lose wallet share. This can be due to better substitute products (BlackBerry), poor execution (Kodak), or a secular shift in customer needs/wants (Coke). 7/11

intrinsicinvesting.com/2019/06/17/moa…

intrinsicinvesting.com/2019/06/17/moa…

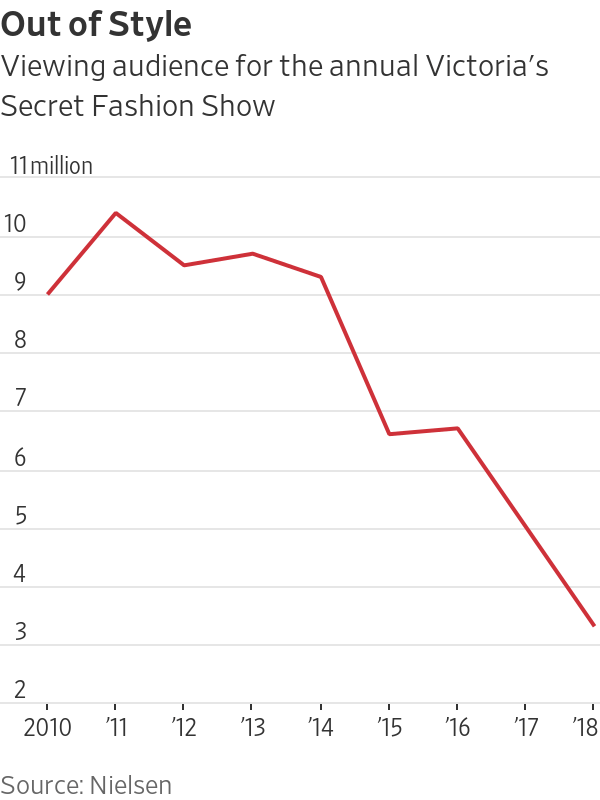

We experienced the last one with our former investment in L Brands, owner of Victoria’s Secret. VS is globally recognizable, but a secular shift in customer preference led to a sharp drop in relevance. 8/11

Quality traps like this can be particularly painful because you pay a high price for what you thought was a great business, only to have the rug pulled out. 9/

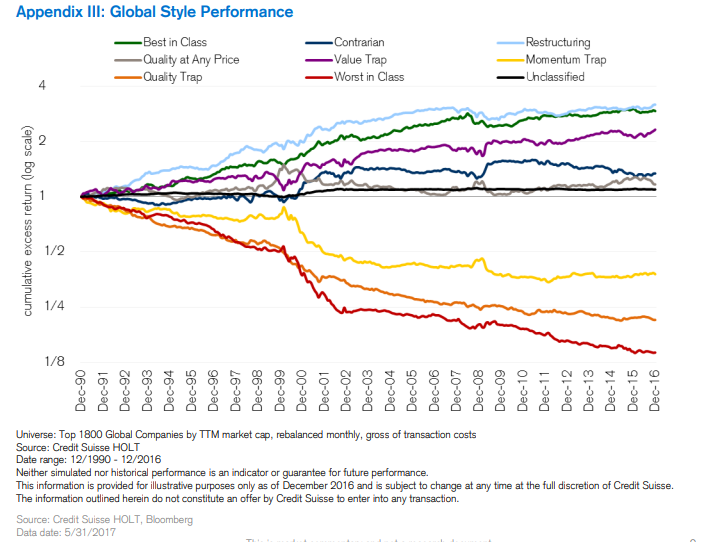

In fact, Credit Suisse found that “Quality Traps” (high quality, poor momentum, expensive) were the second worst-performing group of stocks from 1990-2016. 10/11

So before investing in any company for the long-term, it’s critical to ask how confident you are the company’s products/services will remain at least as *relevant* in 5-10 years as they are today. /end

intrinsicinvesting.com/2020/02/21/rel…

intrinsicinvesting.com/2020/02/21/rel…

• • •

Missing some Tweet in this thread? You can try to

force a refresh