Focused, fundamental-driven portfolios for private & institutional clients. Blog: https://t.co/tCIo9w1BfO. Disclosures: https://t.co/fjmCVIq6D1

8 subscribers

How to get URL link on X (Twitter) App

2/8 4Q22 S&P 500 earnings were -5% and 1Q23 is tracking towards -7%. But inflation in those quarters was +7% and +6%. To make these earnings declines comparable to those in the past, we can adjust them for 2% inflation rate.

2/8 4Q22 S&P 500 earnings were -5% and 1Q23 is tracking towards -7%. But inflation in those quarters was +7% and +6%. To make these earnings declines comparable to those in the past, we can adjust them for 2% inflation rate.

https://twitter.com/intrinsicinv/status/1507801087440351233

2/20 Pick up in a parking lot went smoothly with the car stopping in a safe area and waiting for me to get in.

2/20 Pick up in a parking lot went smoothly with the car stopping in a safe area and waiting for me to get in.

https://twitter.com/conorsen/status/1505136426417070080This debate isn’t actually new. Whether the New Normal, low growth of the 2010s was a permanent secular trend or a decade long hangover from the Financial Crisis was a live debate prior to COVID. 2/4 intrinsicinvesting.com/2018/08/23/ret…

https://twitter.com/typesfast/status/1453753924960219145You want management teams to optimize returns on a cross cycle basis, including preparing for unusually negative down cycles, not optimizing for a pro forma world in which disasters never strike.

If an analyst is looking for a job, an investment firm that views remote work as a “perk,” requires permission, or has an arbitrary limit, will likely be seen as a firm that is out of touch, doesn’t trust their staff, or is at minimum a slow to adapt organization. Major red flag.

If an analyst is looking for a job, an investment firm that views remote work as a “perk,” requires permission, or has an arbitrary limit, will likely be seen as a firm that is out of touch, doesn’t trust their staff, or is at minimum a slow to adapt organization. Major red flag.

https://twitter.com/IntrinsicInv/status/13385341765223219202/x Prior to COVID, we wrote about how forecasts are a necessary part of investing. Your only choice is whether to make explicit forecasts or implicit ones. intrinsicinvesting.com/2020/01/10/pic…

https://twitter.com/IntrinsicInv/status/13359948071859036182/x We started the year talking about "hyperbolic discounting", a "$5 phrase" that explains a lot about investor behavior. intrinsicinvesting.com/2019/01/02/tak…

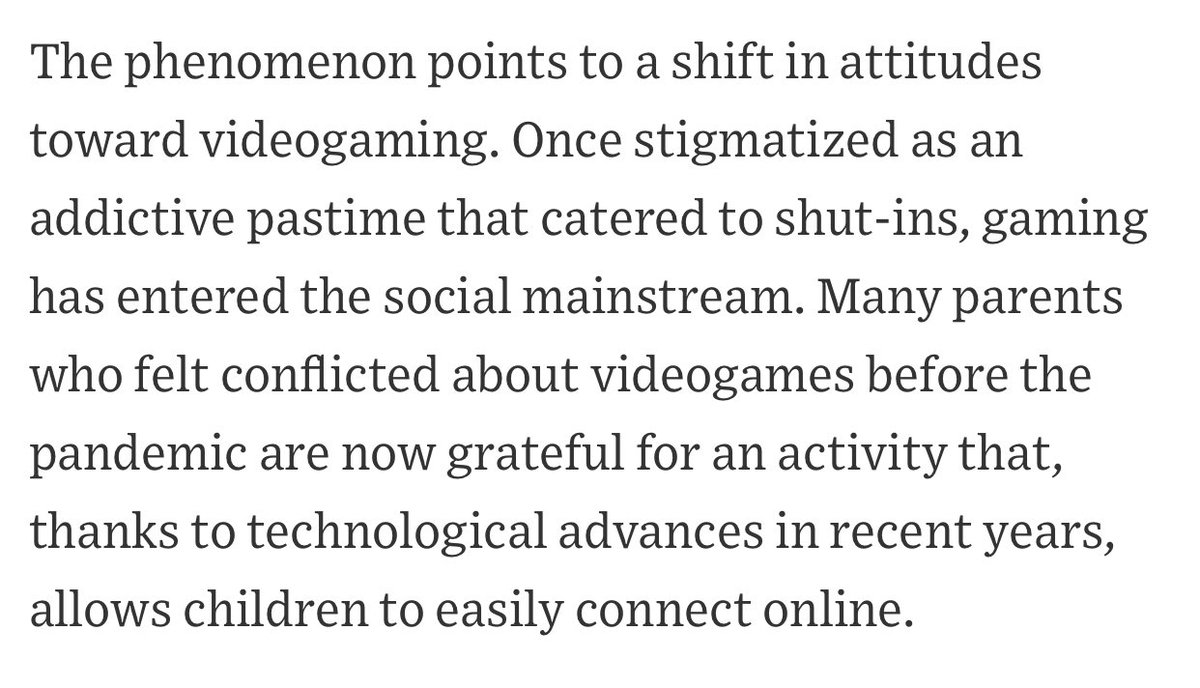

wsj.com/articles/from-…

wsj.com/articles/from-…