@trylolli is arguably in the best position to take advantage in a post coronavirus world amid a looming cloud of an economic downturn.

here's why 👇

here's why 👇

Lolli’s mission is to make bitcoin more accessible to all, by simplifying the way people earn, share & save bitcoin.

It does this by way of a browser extension that allows users to earn a percentage of bitcoin back when they buy online products from select brands.

It does this by way of a browser extension that allows users to earn a percentage of bitcoin back when they buy online products from select brands.

By removing the process of logging onto an exchange and aligning their business model with something everyone is familiar with (ecommerce), Lolli has effectively lowered the barrier to entry.

Users benefit through bitcoin exposure w/o changing any previous shopping habits.

Users benefit through bitcoin exposure w/o changing any previous shopping habits.

Not surprisingly, while the world is in quarantine, there was a sharp increase in online sales and an influx of new customers.

In the Q1 2020, consumers spent $146.47 billion online with US retailers, up 14.5% from $127.89 billion for the previous year.

census.gov/retail/index.h…

In the Q1 2020, consumers spent $146.47 billion online with US retailers, up 14.5% from $127.89 billion for the previous year.

census.gov/retail/index.h…

Lolli separates itself from its competitors by offering a novel rewards system.

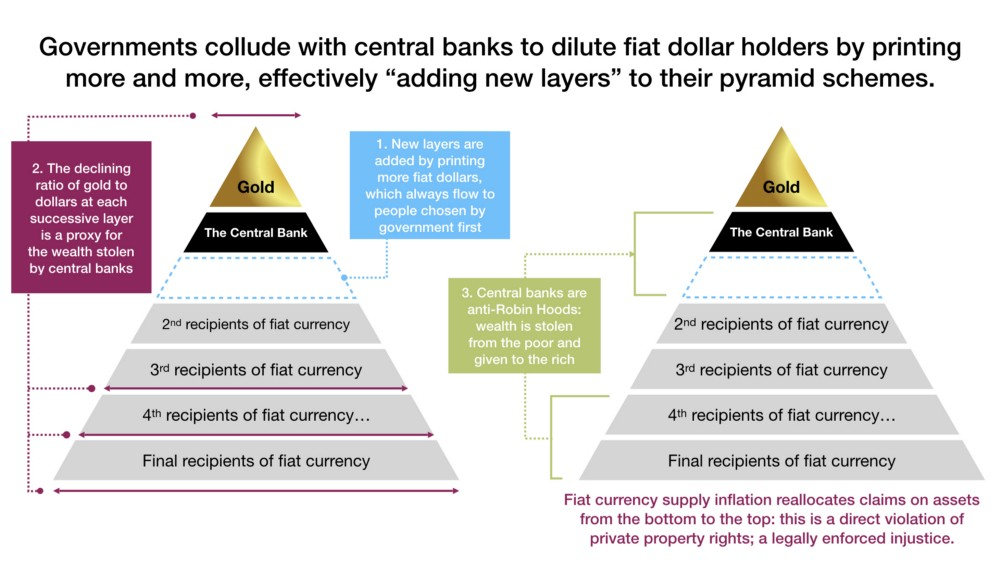

@Rakuten, @Honey, @IbottaApp & more all handle their business in terms of fiat. Once a purchase is made you get a set amount of dollars back. That's it.

@Rakuten, @Honey, @IbottaApp & more all handle their business in terms of fiat. Once a purchase is made you get a set amount of dollars back. That's it.

In 2020, brick&mortar sales are projected to fall more than 14% to $4.184T.

As a result, small biz is turning to online sales to stay afloat. Per Shopify, merchant growth in Q2 was 56%. It very well may become favorable to partner with Lolli to establish an online presence.

As a result, small biz is turning to online sales to stay afloat. Per Shopify, merchant growth in Q2 was 56%. It very well may become favorable to partner with Lolli to establish an online presence.

Lolli is a financial services company that has built a brand around fun, lightheartedness and the importance of sound money.

They separate themselves from the exchanges of the world for they only make money when you purchase something that you want.

lolli.com/about

They separate themselves from the exchanges of the world for they only make money when you purchase something that you want.

lolli.com/about

The company launched in August of 2018 with over 500 brand partnerships.

Since then co-founders @alexadelman & @MattSenter have seen the company more than doubled in team size, brand partnerships and a rocking social media presence.

lolli.com/stores

Since then co-founders @alexadelman & @MattSenter have seen the company more than doubled in team size, brand partnerships and a rocking social media presence.

lolli.com/stores

Onto their blog which has posts like:

- Stay Cool & Stack Sats

- Lolli's Ultimate Mother's Day Gift Guide

- Top 10 Lolli Brands Helping with COVID 19 Relief Efforts

These & many more highlight their partners diverse product offerings.

blog.lolli.com

cc @aubreystrobel

- Stay Cool & Stack Sats

- Lolli's Ultimate Mother's Day Gift Guide

- Top 10 Lolli Brands Helping with COVID 19 Relief Efforts

These & many more highlight their partners diverse product offerings.

blog.lolli.com

cc @aubreystrobel

As it stands, the ecommerce industry in the U.S. alone is expected to surpass $1 trillion by 2025.

This in addition to funding from the likes of @aplusk, @MichellePhan & @jmj has afforded the team some breathing room.

theblockcrypto.com/linked/64710/b…

This in addition to funding from the likes of @aplusk, @MichellePhan & @jmj has afforded the team some breathing room.

theblockcrypto.com/linked/64710/b…

Comparable reward programs Honey & Ebates have both been acquired for $4 and $1 billion respectfully.

In 2019, They saw over $200 million in revenue. If Lolli were to continue doubling partnerships and capture 10% of the budding market, it will surpass $20 million in revenue.

In 2019, They saw over $200 million in revenue. If Lolli were to continue doubling partnerships and capture 10% of the budding market, it will surpass $20 million in revenue.

Keep in mind that this is just through its browser extension.

The team has floated around channels such as a mobile application. Which 35% of US consumers only use to buy online. Therefore, expanding to mobile to capture a piece of this market could prove rewarding.

The team has floated around channels such as a mobile application. Which 35% of US consumers only use to buy online. Therefore, expanding to mobile to capture a piece of this market could prove rewarding.

As a financial services company, Lolli has the capabilities to upsell a suite of financial products to its existing userbase.

ex) the company could partner with a lending provider such as @TheRealBlockFi to offer users a % boost on interest payouts or discounts on loans.

ex) the company could partner with a lending provider such as @TheRealBlockFi to offer users a % boost on interest payouts or discounts on loans.

Perhaps an agreement with BlockFi could see users receive trading fees discounts to promote their nascent exchange.

As a third-party provider, Lolli can process bitcoin payments at a higher scale due to being off chain. Therefore it is not limited by technical challenges

As a third-party provider, Lolli can process bitcoin payments at a higher scale due to being off chain. Therefore it is not limited by technical challenges

Despite the intention to run Lolli for 30+ years, a biz that is responsible for onboarding millions of people to the hardest money on earth might garner some interest.

To speculate a few:

- BlockFi

- @square

- @coinbase

- @krakenfx

- Rakuten

To speculate a few:

- BlockFi

- @square

- @coinbase

- @krakenfx

- Rakuten

https://twitter.com/alexadelman/status/1291200881183141889?s=20

Ultimately Lolli offers users a way to gain exposure to bitcoin without changing any habits.

For the complete thesis and more check out this week's issue of The ₿it Economy!

robsarrow.substack.com/p/a-new-way-to…

For the complete thesis and more check out this week's issue of The ₿it Economy!

robsarrow.substack.com/p/a-new-way-to…

• • •

Missing some Tweet in this thread? You can try to

force a refresh