How to get URL link on X (Twitter) App

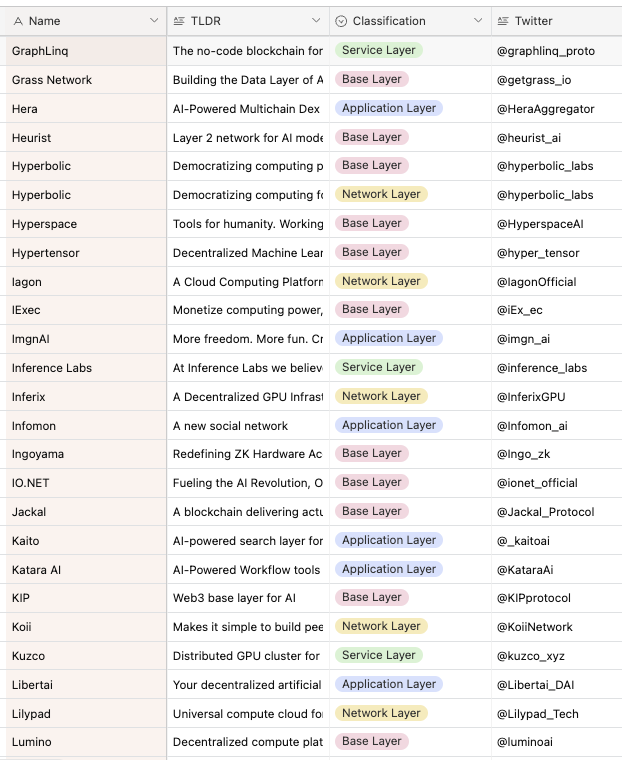

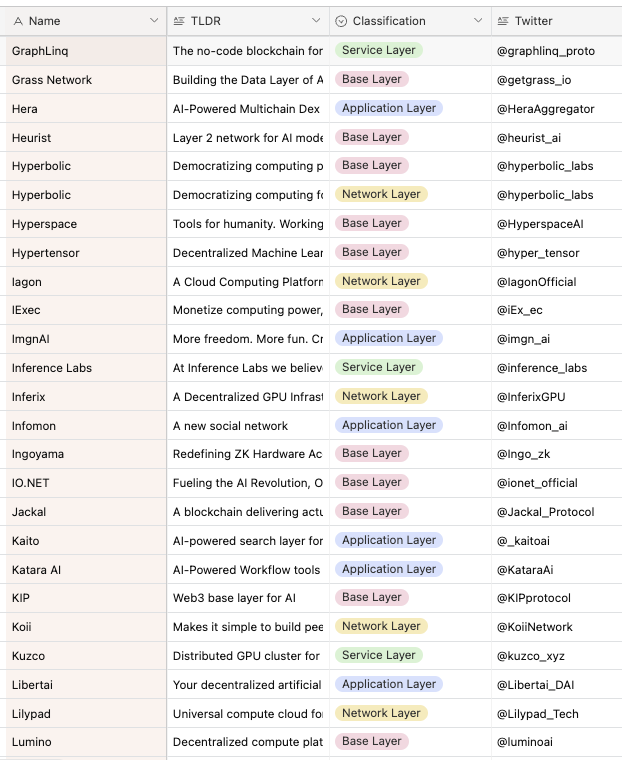

The intersection of AI and crypto introduces a new approach to handling data, training models, and applying inference in ways that enhance both cryptographic networks and AI's capabilities.

The intersection of AI and crypto introduces a new approach to handling data, training models, and applying inference in ways that enhance both cryptographic networks and AI's capabilities.

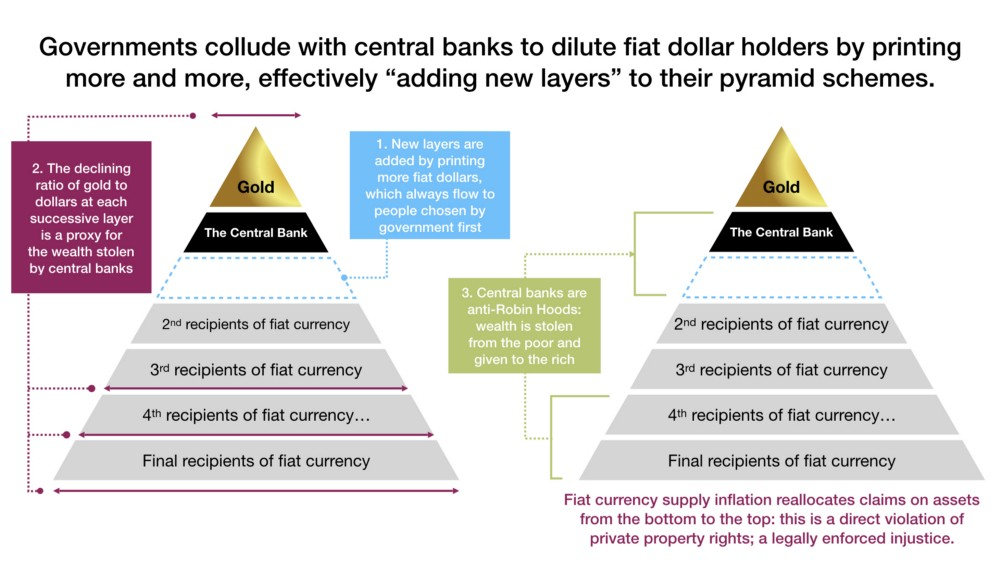

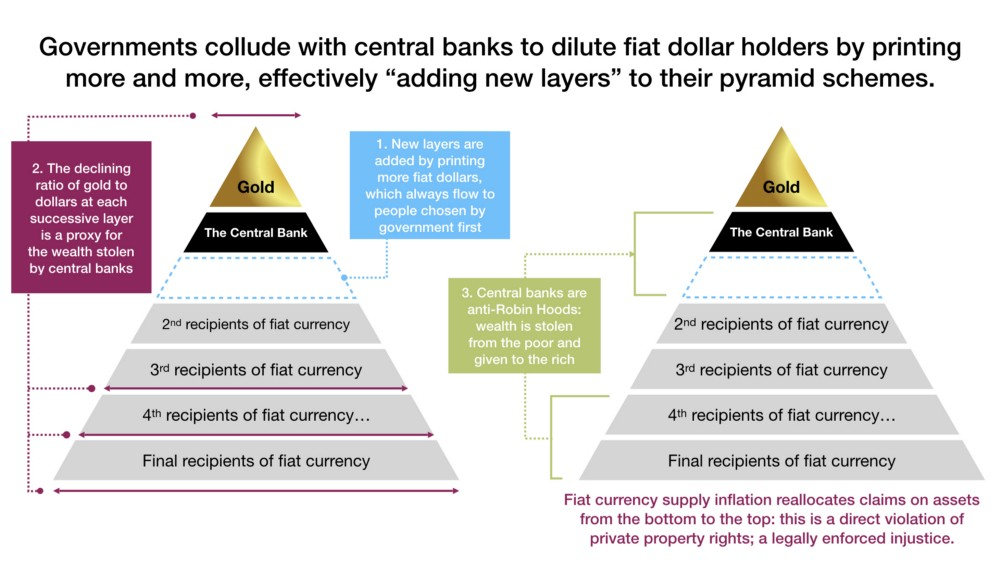

1/ Bitcoin is not a hedge against your typical recession. Rather Bitcoin is a hedge against monetary inflation and the loss of confidence in fiat currency.

1/ Bitcoin is not a hedge against your typical recession. Rather Bitcoin is a hedge against monetary inflation and the loss of confidence in fiat currency.https://twitter.com/unchainedcap/status/1240004869374779393?s=20