They had me right up to the end. The last paragraph should have been omitted. The fiscal trajectory is not unsustainable. Planting those seeds just undermines the broader argument. washingtonpost.com/opinions/2020/…

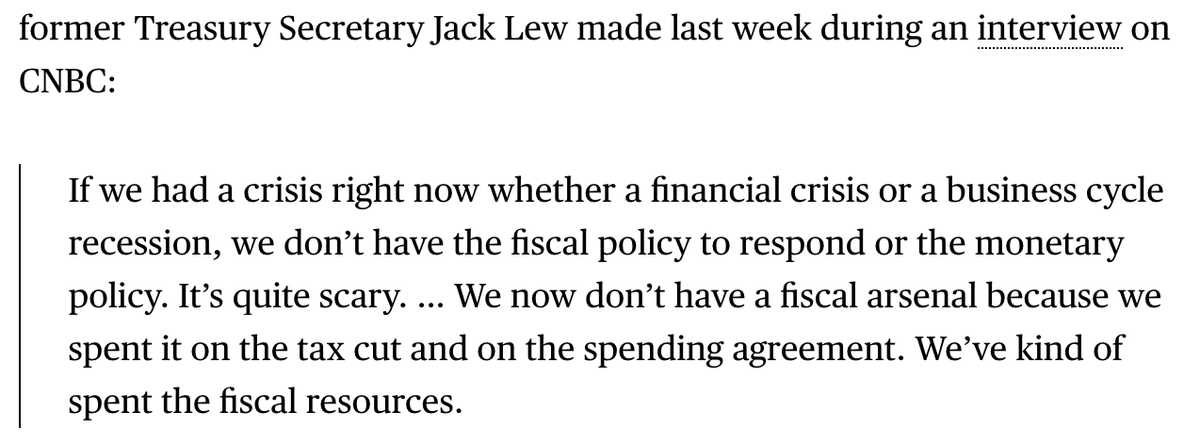

Worth noting that Lew got this very wrong. 2017 tax cuts in no way constrained fiscal capacity in the face of COVID-19. Similarly, today's deficits don't pose any inherent risk looking ahead. If you're worried about inflation, say so. Otherwise, last para above just a throwaway.

Full interview cnbc.com/video/2018/03/…

FWIW, this was my view at the time. bloomberg.com/opinion/articl…

• • •

Missing some Tweet in this thread? You can try to

force a refresh