Author of NYT Bestseller https://t.co/DVWlRrB2YD 📖 Professor @stonybrooku 👩🏼🏫

30 subscribers

How to get URL link on X (Twitter) App

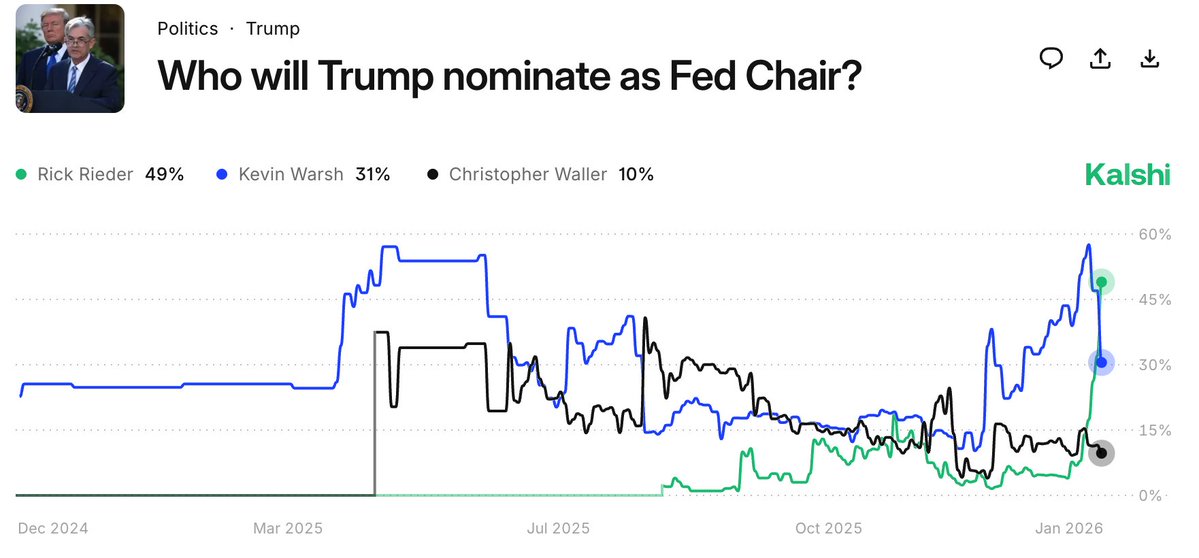

"The 14-year BlackRock veteran, who oversees $2.4 trillion in assets at the world’s largest asset manager and is known as one of the leading voices in the bond market, argued that the Fed may need to change its strategy and opt for rate cuts in order to fight the last remnants of inflation." 2/

"The 14-year BlackRock veteran, who oversees $2.4 trillion in assets at the world’s largest asset manager and is known as one of the leading voices in the bond market, argued that the Fed may need to change its strategy and opt for rate cuts in order to fight the last remnants of inflation." 2/

Without the bond sale, the $10 would stay in bank reserve accounts at the Fed, where it would earn whatever the Fed chooses to pay on overnight reserve balances (IOR). 2/

Without the bond sale, the $10 would stay in bank reserve accounts at the Fed, where it would earn whatever the Fed chooses to pay on overnight reserve balances (IOR). 2/

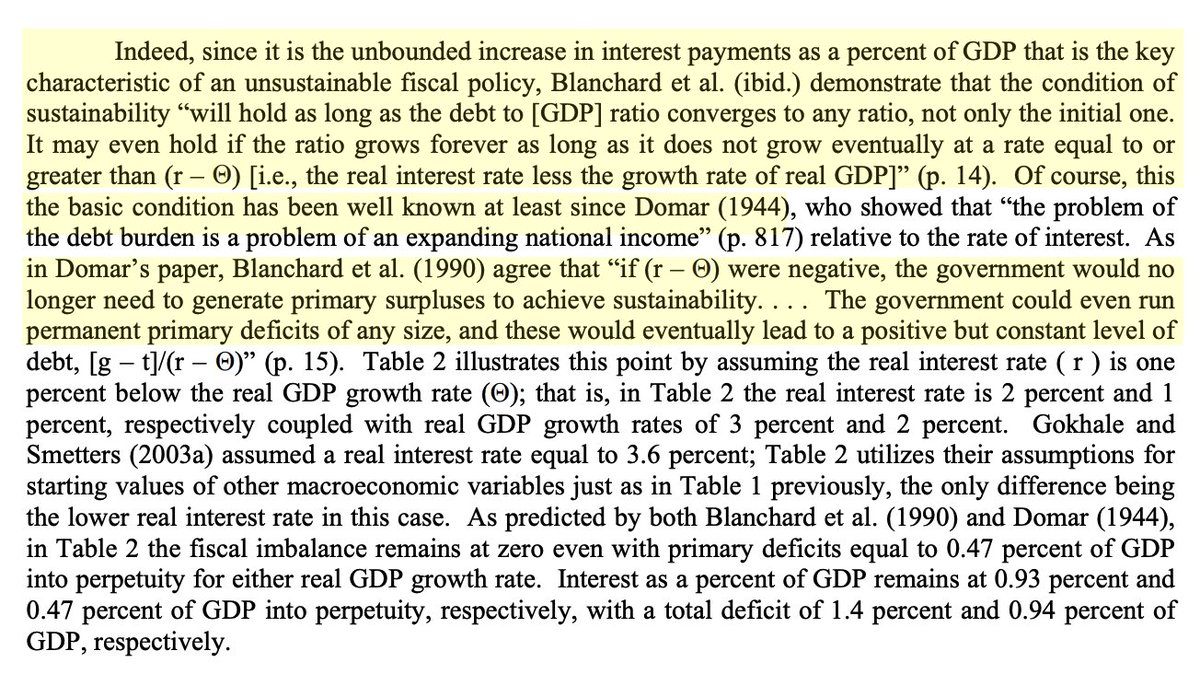

That Bill Clinton was the last POTUS to preside over a fiscal surplus. It is also worth remembering why those surpluses weren't sustainable. Pay close attention to the dates as you look at each slide. The fiscal surplus appears in 1998. 2/

That Bill Clinton was the last POTUS to preside over a fiscal surplus. It is also worth remembering why those surpluses weren't sustainable. Pay close attention to the dates as you look at each slide. The fiscal surplus appears in 1998. 2/

https://twitter.com/talmonsmith/status/1661419574116466688LINK

https://twitter.com/StephanieKelton/status/1658865924664082434"We will pay our debts in the end. It's not like if we don't pay we can't pay. We've got the right to print our own money. That's the key." ~Warren Buffet