In 1872, an American inventor named John Keely raised money on the promise of a new motor with a power source that would revolutionize the world.

The only problem? It was an elaborate fraud. One with eerie similarities to certain modern day events.

Who's up for a story?

👇👇👇

The only problem? It was an elaborate fraud. One with eerie similarities to certain modern day events.

Who's up for a story?

👇👇👇

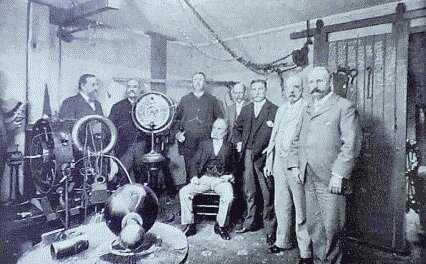

1/ John Ernst Worrell Keely was born in Chester, Pennsylvania in 1837.

Orphaned at a young age, his grandparents raised him on the outskirts of Philadelphia.

Keely was bright and energetic, taking on jobs like orchestra leader and carnival barker before becoming a mechanic.

Orphaned at a young age, his grandparents raised him on the outskirts of Philadelphia.

Keely was bright and energetic, taking on jobs like orchestra leader and carnival barker before becoming a mechanic.

2/ But while his means remained modest, his dreams were anything but.

Keely was determined to make it big.

He had an ability to create what future generations would refer to as a "reality distortion field" with his charisma.

So in 1872, he set about distorting reality...

Keely was determined to make it big.

He had an ability to create what future generations would refer to as a "reality distortion field" with his charisma.

So in 1872, he set about distorting reality...

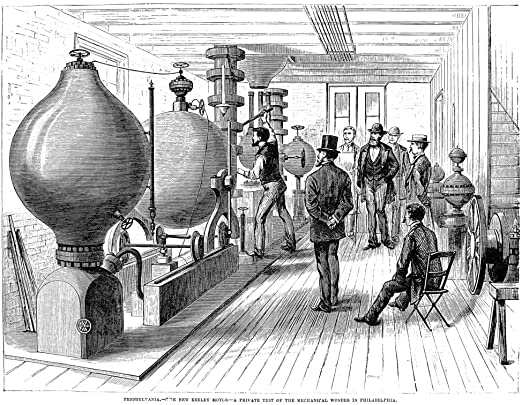

3/ Keely invited scientists and investors to his Philadelphia laboratory for a demonstration of a revolutionary new technology.

He claimed that he had discovered a new source of power, capable of previously unheard of efficiency and output.

He claimed that he had discovered a new source of power, capable of previously unheard of efficiency and output.

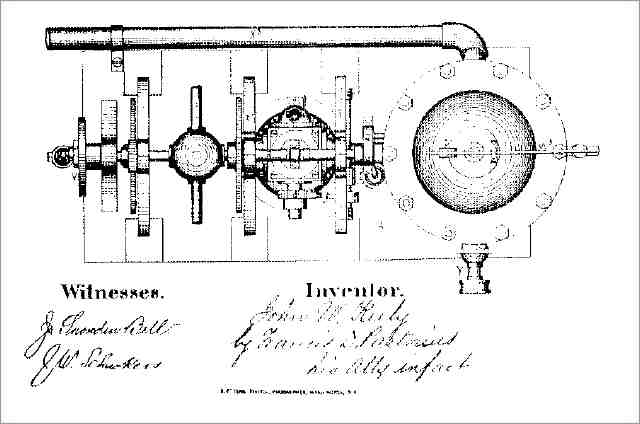

4/ Keely explained to those gathered that the new source of power was from an "etheric force."

He claimed he had found a way to harness the vibrations of atoms in water as fuel for machines.

This force would allow one quart of water to power a train round trip from SF to NYC!

He claimed he had found a way to harness the vibrations of atoms in water as fuel for machines.

This force would allow one quart of water to power a train round trip from SF to NYC!

5/ With his hook now planted, Keely formed the Keely Motor Company, persuading a dozen or so scientists and capitalists to invest in his business.

He went on a grand speaking tour around the Northeast, using his easy charisma to persuade new investors to join the revolution.

He went on a grand speaking tour around the Northeast, using his easy charisma to persuade new investors to join the revolution.

6/ With his reality distortion field in full effect, Keely raised $5 million (>$100 million today) from a long list of investors and the general public.

He had placed his own name alongside Thomas Edison and Alexander Graham Bell on the list of great American inventors.

He had placed his own name alongside Thomas Edison and Alexander Graham Bell on the list of great American inventors.

7/ But with this money came great expectations. Keely would actually have to deliver on his promises!

Or so you would think...

In 1874, he gave the first demonstration of his "working" prototype engine, making a show of guarding the secrets from the audience of onlookers.

Or so you would think...

In 1874, he gave the first demonstration of his "working" prototype engine, making a show of guarding the secrets from the audience of onlookers.

8/ At the demonstration, he used phrases like "hydro-pneumatic-pulsating-vacu-engine" to wow his audience.

A spectator noted, "Great ropes were torn apart, iron bars broken in two or twisted out of shape...by a force which could not be determined."

The bravado worked, at first.

A spectator noted, "Great ropes were torn apart, iron bars broken in two or twisted out of shape...by a force which could not be determined."

The bravado worked, at first.

9/ But as time passed and no products were brought to market, his investors grew increasingly wary of what was happening.

Each time his investors, scientists, or the public would question the legitimacy of his operations, Keely would unveil some new technology designed to amaze.

Each time his investors, scientists, or the public would question the legitimacy of his operations, Keely would unveil some new technology designed to amaze.

10/ Keely avoided filing for any patents, telling investors he didn't want to reveal his secrets to anyone, especially the patent office.

Despite the red flags, investors continued with their support.

Even John Jacob Astor, one of the wealthiest men of the era, became a backer.

Despite the red flags, investors continued with their support.

Even John Jacob Astor, one of the wealthiest men of the era, became a backer.

11/ Amazingly, John Keely was able to keep his elaborate fraud afloat for 26 years. For each ounce of skepticism that came his way, he piled on a pound of confidence.

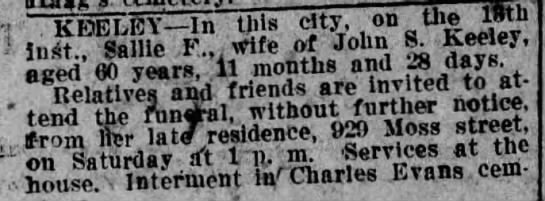

When he died in 1898, he left an estate of $10,000 to his widow, having burned through all the investments.

When he died in 1898, he left an estate of $10,000 to his widow, having burned through all the investments.

12/ The Keely Motor Company never produced a product, never made a profit, and never paid a dividend.

Only after his death did newspapers uncover the rouse.

To this day, the question remains: was John Keely a brazen fraudster, or simply an ambitious man who got over his skis?

Only after his death did newspapers uncover the rouse.

To this day, the question remains: was John Keely a brazen fraudster, or simply an ambitious man who got over his skis?

13/ As you may have realized, the story of John Keely has eerie similarities to certain modern day events...

My friend @InvestorAmnesia wrote an incredible piece looking at these in his most recent newsletter. If you aren't subscribed, do it now! investoramnesia.com/2020/09/13/the…

My friend @InvestorAmnesia wrote an incredible piece looking at these in his most recent newsletter. If you aren't subscribed, do it now! investoramnesia.com/2020/09/13/the…

14/ So what do you think? Does history rhyme, or are the similarities imagined? I'd love to hear your thoughts!

Tag any bulls or bears here to hear both sides! I'll start...

@HindenburgRes @muddywatersre @CitronResearch @ttmygh @TESLAcharts

Tag any bulls or bears here to hear both sides! I'll start...

@HindenburgRes @muddywatersre @CitronResearch @ttmygh @TESLAcharts

15/ And for more educational stories and threads, check out my meta thread below!

https://twitter.com/SahilBloom/status/1284583099775324161?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh