Reading a @TechCabal’s article and intrigued with some figures, which confirm massive role Fintech & digital payments will play in Nigeria’s economic future. Let me share some:

1. Between Jan - June 2020, GTBank processed $356.4m USSD payment & added 600,000 new USSD customers.

1. Between Jan - June 2020, GTBank processed $356.4m USSD payment & added 600,000 new USSD customers.

2. Mobile & Internet Banking: Jan - June 2020, GTbank processed 95 million mobile banking transactions worth ₦5.7 trillion, and internet banking transactions grew 14% to ₦1.2 trillion.

3. Nigeria’s fintech revenues is predicted to grow to as much as $543.3 million by 2022.

3. Nigeria’s fintech revenues is predicted to grow to as much as $543.3 million by 2022.

4. Nigeria’s payment market is estimated to grow between $20 billion to $40 billion over the next few years.

5. In August 2020 alone, NIBSS Instant payment (NIP) transaction volume was nearly 200 million with total transaction value of almost ₦15 trillion ($38.9 billion).

5. In August 2020 alone, NIBSS Instant payment (NIP) transaction volume was nearly 200 million with total transaction value of almost ₦15 trillion ($38.9 billion).

Makes sense why more banks are aggressively venturing into fintech & digital products (GTbank even wants to set up a standalone payment entity), but my guess is that most players are still contending for the same market (banked, economically active and providing more convenience)

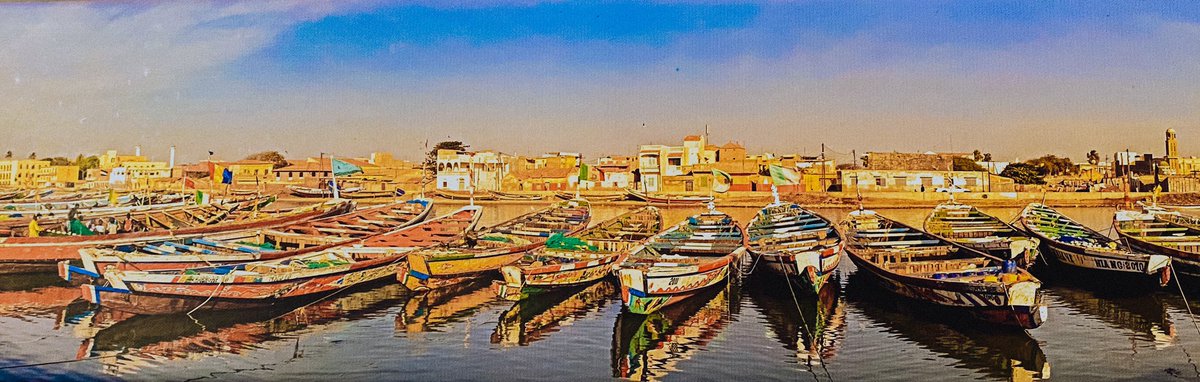

The real winner in all of these will be the product that succeeds at achieving in-roads with underbanked or unbanked

My theory is not to focus on banking them but rather on enabling and facilitating the transactions (economic activities) of underbanked or unbanked.

My theory is not to focus on banking them but rather on enabling and facilitating the transactions (economic activities) of underbanked or unbanked.

Given present economy, makes no sense to try to provide banking services to a person so poor they won’t want to pay any banking charges.

However, there is value in facilitating their economic activities & collecting a convenience charge (which they would have paid for transport)

However, there is value in facilitating their economic activities & collecting a convenience charge (which they would have paid for transport)

So maybe we simply need to rethink how we approach/communicate financial inclusion.

Rather than penalizing cash transactions, what if we incentivized digital inclusion by communicating the economic value of digital transactions to the unbanked/underbanked. Mpesa did it in Kenya

Rather than penalizing cash transactions, what if we incentivized digital inclusion by communicating the economic value of digital transactions to the unbanked/underbanked. Mpesa did it in Kenya

Most important part will be designing financial products that digitize the present economic activities that underbanked/unbanked engage it, but at increased convenience & marginally lower cost.

This will involve moving from present banking activities to actually designing value

This will involve moving from present banking activities to actually designing value

This is not an assumption that it will be easy, but simply an acknowledgment that we need to rethink our financial inclusion approach.

For those interested, this is the referenced @TechCabal article written by @IAtalkspace

techcabal.com/2020/09/14/gt-…

techcabal.com/2020/09/14/gt-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh