Regulation on crypto-asset in Nigeria

Nigeria’s SEC in a recent regulatory statement stated it classifies virtual crypto asset as securities (under s.13 of Investment securities act).

Meaning SEC has powers to regulate crypto asset investments (e.g crypto-token or crypto-coins)

Nigeria’s SEC in a recent regulatory statement stated it classifies virtual crypto asset as securities (under s.13 of Investment securities act).

Meaning SEC has powers to regulate crypto asset investments (e.g crypto-token or crypto-coins)

The statement defines issuing crypto assets as a regulated activity & specifically lists:

⁃Initial coin offering

⁃Digital asset token offering

⁃Security token offering

Gives existing digital offering 3 months to submit documents for initial assessment or registration

⁃Initial coin offering

⁃Digital asset token offering

⁃Security token offering

Gives existing digital offering 3 months to submit documents for initial assessment or registration

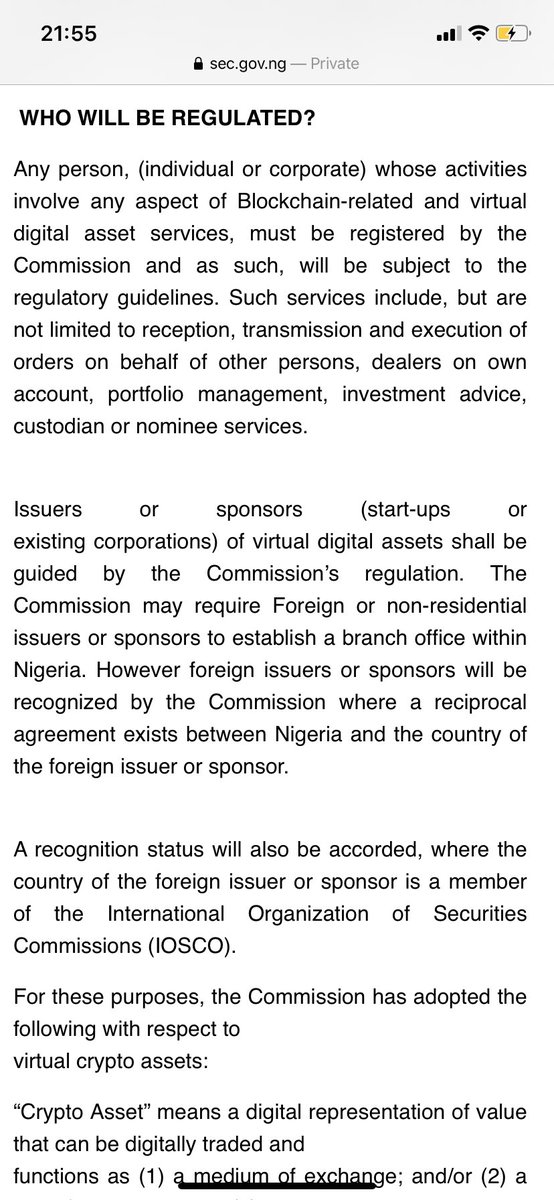

Who is regulated?

1. Any person, (individual or corporate) whose activities involve any aspect of Blockchain-related and virtual digital asset services (They must register with SEC)

2. Issuers or sponsors (start-ups or existing corporations) of virtual digital assets

1. Any person, (individual or corporate) whose activities involve any aspect of Blockchain-related and virtual digital asset services (They must register with SEC)

2. Issuers or sponsors (start-ups or existing corporations) of virtual digital assets

Also, Foreign or non-residential issuers of crypto-assets may be required to establish a branch office within Nigeria

Where the foreign issuer or sponsor is a member of the International Organization of Securities Commissions (IOSCO), SEC will accord similar recognition status.

Where the foreign issuer or sponsor is a member of the International Organization of Securities Commissions (IOSCO), SEC will accord similar recognition status.

SEC’s categorization of virtual assets/instruments are:

- Crypto assets (e.g non-fiat virtual currency);

- Utility Token or Non-security Token;

- Security Token;

- Derivatives and Collective Investment Funds of Crypto Assets, Security Tokens and Utility Tokens.

- Crypto assets (e.g non-fiat virtual currency);

- Utility Token or Non-security Token;

- Security Token;

- Derivatives and Collective Investment Funds of Crypto Assets, Security Tokens and Utility Tokens.

US SEC has always insisted oversight over Initial Coin Offerings (sec.gov/ICO) and SEC v telegram case emphasized SEC’s regulatory powers. Asides KYC and information requirements, no other impact of the designation has reflected in US crypto-assets investment space.

Still, Nigeria’s SEC crypto-assets announcement is the clearest position on crypto-assets by any financial regulator in Africa & deviation from previous vague positions.

One can probably interpret this as a good development as it welcomes the regulated use of crypto assets

One can probably interpret this as a good development as it welcomes the regulated use of crypto assets

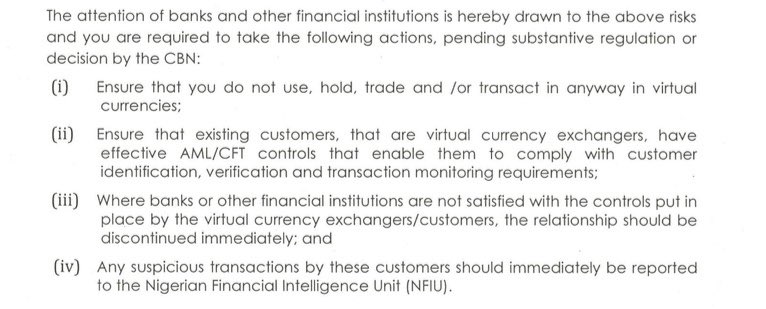

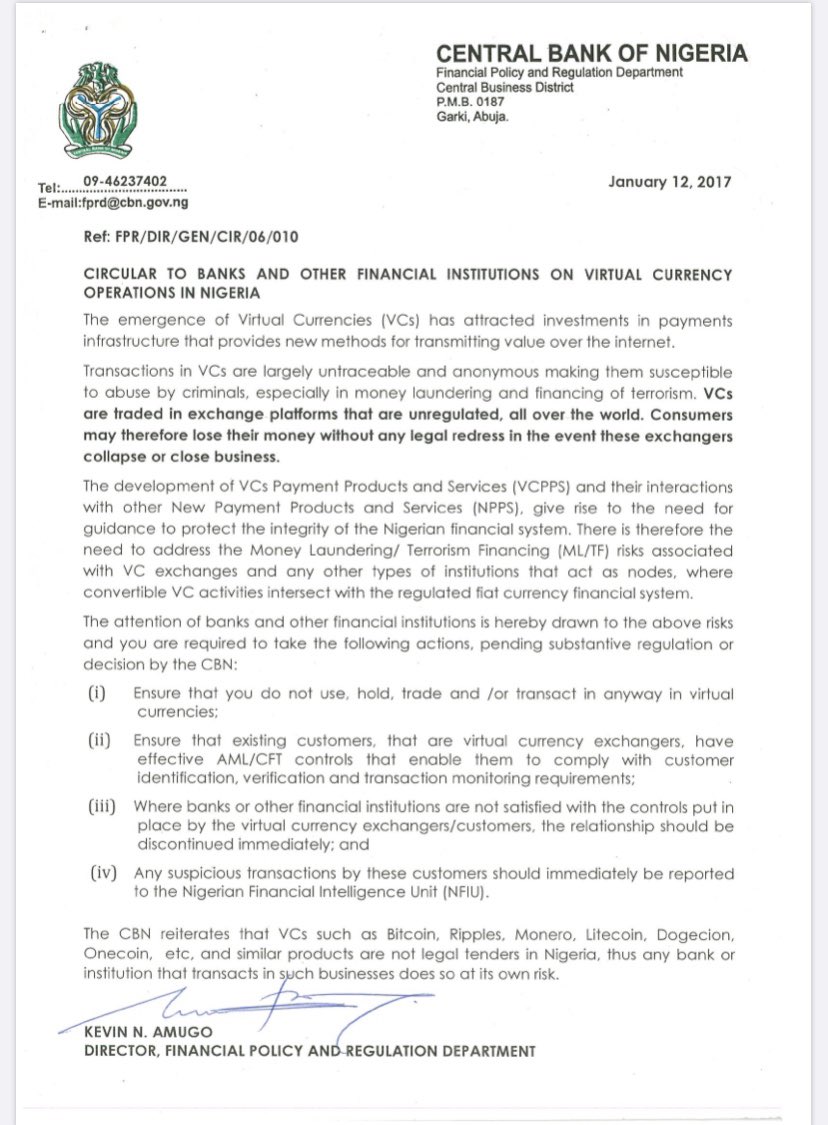

Asides Feb 2018 announcement by Nigeria’s central bank that virtual currencies are not legal tenders in Nigeria (cbn.gov.ng/Out/2018/CCD/P…), there is also the stern Jan 2017 circular by the CBN to all Nigerian banks.

The Jan 2017 CBN regulation ( cbn.gov.ng/out/2017/fprd/… )states that till a substantive regulation or decision by the CBN, no banks/financial institutions should hold, transact, trade in virtual currencies & put effective anti-money laundering controls for virtual currency exchange

The question becomes does a substantive regulation by the SEC qualify as a “substantive regulation” to satisfy the CBN’s Jan 2017 circular or does the substantive regulation have to be one issued by the CBN?

Is a financial institution’s registration with SEC satisfactory?

Is a financial institution’s registration with SEC satisfactory?

Regardless, Jan 2017 CBN circular places customer identification, verification and transaction monitoring requirements (KYC) on any financial institution whose customers deal with any virtual currency operations.

One expects these KYC requirements will extend to crypto-assets.

One expects these KYC requirements will extend to crypto-assets.

You can find Nigeria’s SEC regulatory statement on digital & crypto assets here: sec.gov.ng/statement-on-d…

• • •

Missing some Tweet in this thread? You can try to

force a refresh