1/n

Yesterday BP released its 2020 World Energy Outlook, which got a lot of press for saying that global oil demand has already peaked.

In this thread, I want to unpick a little bit what the BP 2020 WEO says about India.

Lots of interesting stuff here.

Yesterday BP released its 2020 World Energy Outlook, which got a lot of press for saying that global oil demand has already peaked.

In this thread, I want to unpick a little bit what the BP 2020 WEO says about India.

Lots of interesting stuff here.

2/n

The fig below shows primary consumption by fuel in the outlook's three scenarios.

You may be struck by high huge growth of coal in the BAU scenario (1.8 x between 2018 and 2050). I'll come back to this.

But more striking to me is the modest oil demand growth in the BAU.

The fig below shows primary consumption by fuel in the outlook's three scenarios.

You may be struck by high huge growth of coal in the BAU scenario (1.8 x between 2018 and 2050). I'll come back to this.

But more striking to me is the modest oil demand growth in the BAU.

3/n

Oil product demand grows less than 2x between 2018 and 2050. This is far lower than other comparable energy scenarios.

For example, the apparently transformative Shell Sky Scenario has India's oil product demand growing >3x between 2015-2050.

Oil product demand grows less than 2x between 2018 and 2050. This is far lower than other comparable energy scenarios.

For example, the apparently transformative Shell Sky Scenario has India's oil product demand growing >3x between 2015-2050.

4/n

I think the BP scenario is a better reflection of BAU. Given India's population density, congested cities, and emergence of shared and electric mobility, even a BAU oil product demand scenario should envisage modest growth by 2050, in my view.

I think the BP scenario is a better reflection of BAU. Given India's population density, congested cities, and emergence of shared and electric mobility, even a BAU oil product demand scenario should envisage modest growth by 2050, in my view.

5/n

Coming now to coal, I think the secret to what BP assumes in the BAU scenario lies in their assumptions of sectoral final energy consumption.

In 2050, they assume 1000 Mtoe of industrial energy demand. This seems far too high to me.

Coming now to coal, I think the secret to what BP assumes in the BAU scenario lies in their assumptions of sectoral final energy consumption.

In 2050, they assume 1000 Mtoe of industrial energy demand. This seems far too high to me.

6/n

For comparison, in 2018, China consumed 997 Mtoe of industrial final energy.

China is one of the most over-industrialized countries in economic history, and its huge industrial energy consumption is driven by an industry and investment share in GDP both > 40%.

For comparison, in 2018, China consumed 997 Mtoe of industrial final energy.

China is one of the most over-industrialized countries in economic history, and its huge industrial energy consumption is driven by an industry and investment share in GDP both > 40%.

7/n

Implying that India will be a kind of second China in 2050 seems to contradict everything that we have seen of India's rather unique, services-driven, low-urbanization, investment-lite development model.

So I think we should discount the industry demand number by 30%-40%

Implying that India will be a kind of second China in 2050 seems to contradict everything that we have seen of India's rather unique, services-driven, low-urbanization, investment-lite development model.

So I think we should discount the industry demand number by 30%-40%

8/n

Given that industry final energy is dominated by coal, this would shave a substantial share of the apparently high level of primary coal consumption in the BAU scenario.

Moving on to assumptions on growth of wind and solar, see below

Given that industry final energy is dominated by coal, this would shave a substantial share of the apparently high level of primary coal consumption in the BAU scenario.

Moving on to assumptions on growth of wind and solar, see below

9/10

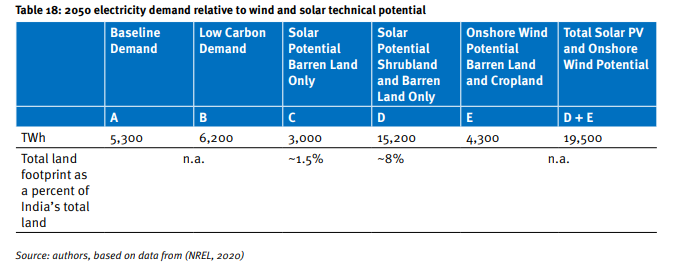

The BAU sees wind and solar supplying ~2000 TWh by 2050, which if we guess an electricity demand of about 5000 TWh, would imply a 40% share for VRE. This seems a little low for a BAU scenario, given what we know about the economic competitiveness of wind and solar in India.

The BAU sees wind and solar supplying ~2000 TWh by 2050, which if we guess an electricity demand of about 5000 TWh, would imply a 40% share for VRE. This seems a little low for a BAU scenario, given what we know about the economic competitiveness of wind and solar in India.

10/10

So in sum, BP:

1. gets it about right with a low oil product demand growth future, even in BAU.

2. gets it wrong in suggesting a high industry demand future.

3. somewhat under-projects wind and solar in BAU

4. correctly projects high VRE in strong transition scenarios.

So in sum, BP:

1. gets it about right with a low oil product demand growth future, even in BAU.

2. gets it wrong in suggesting a high industry demand future.

3. somewhat under-projects wind and solar in BAU

4. correctly projects high VRE in strong transition scenarios.

• • •

Missing some Tweet in this thread? You can try to

force a refresh