🧵:

Yesterday we talked a bit about why stable nominal GDP growth is desirable. While my new paper speaks well of NGDP targeting, it is not the only content.

In fact, much of the analysis of 2007-2019 would remain the same with or without NGDP targeting.

jec.senate.gov/public/index.c…

Yesterday we talked a bit about why stable nominal GDP growth is desirable. While my new paper speaks well of NGDP targeting, it is not the only content.

In fact, much of the analysis of 2007-2019 would remain the same with or without NGDP targeting.

jec.senate.gov/public/index.c…

The unfortunate conclusion I reach about the 2007-2019 era is that we screwed it up. We screwed it up very badly.

A generation of Americans--my generation--will have scars from those mistakes forever, and I hope we are the last such generation.

A generation of Americans--my generation--will have scars from those mistakes forever, and I hope we are the last such generation.

The first part of that era begins in 2007 and ends in maybe the December 2008 Fed meeting, or early 2009 when the stock market finally calmed.

I believe we made about four mistakes in that period, all interlocking, all ultimately running the same way.

I believe we made about four mistakes in that period, all interlocking, all ultimately running the same way.

The four mistakes of 2007-2008:

1. Underreaction to labor market indicators

2. Overemphasis on oil prices

3. Scope creep into attempts to manage housing prices

4. Constricted credit for the general public even as financial institutions got emergency lending

1. Underreaction to labor market indicators

2. Overemphasis on oil prices

3. Scope creep into attempts to manage housing prices

4. Constricted credit for the general public even as financial institutions got emergency lending

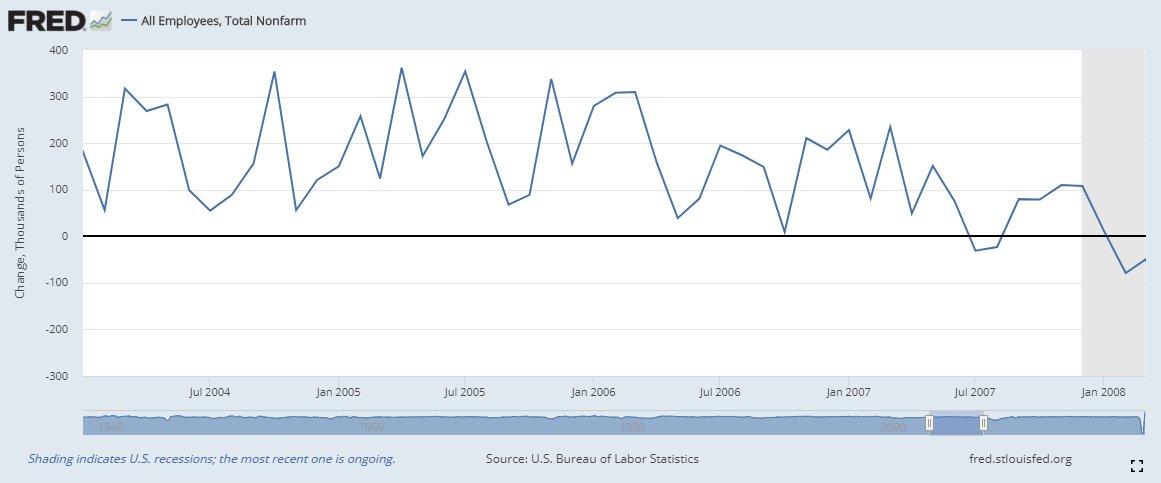

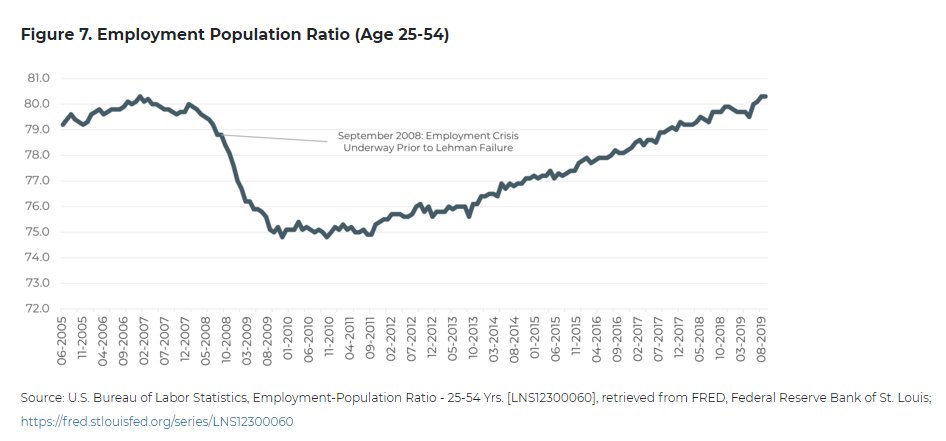

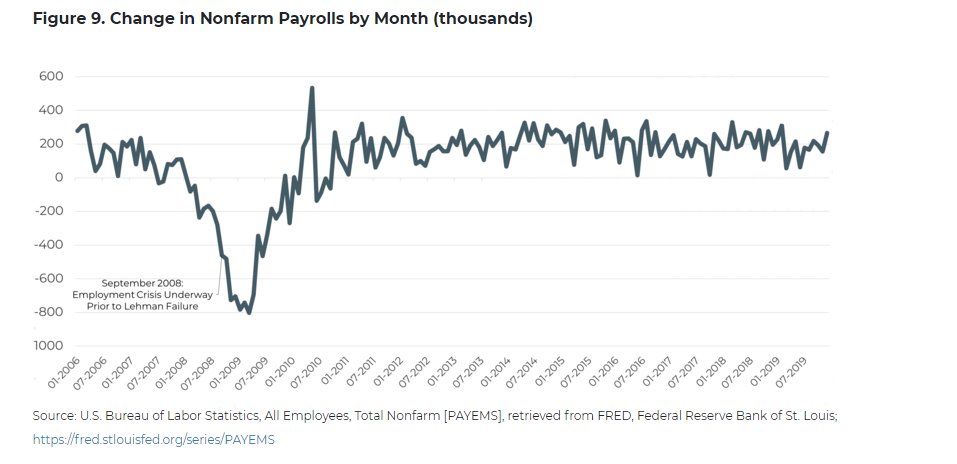

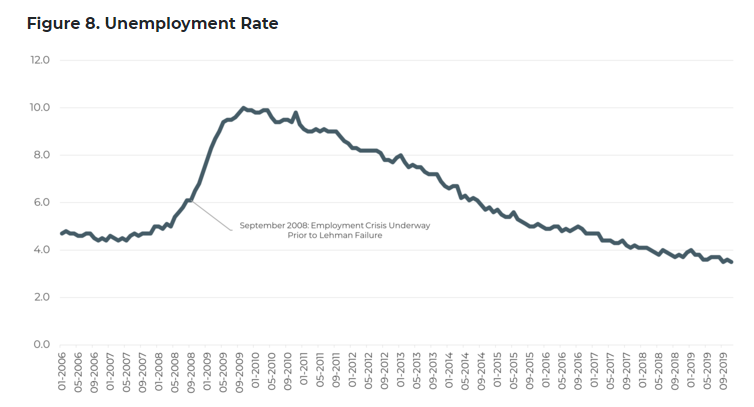

The first thing you should know about 2008 is that there was an employment crisis before banks started failing. You can see signs of distress as far back as the middle of 2007, and they are blindingly obvious warning lights by early 2008.

Here's a pop quiz for economic history buffs. When was the first negative-payroll-growth month of the financial crisis era?

When was the second?

The answer is actually July 2007 to the first question, and August 2007 to the second.

When was the second?

The answer is actually July 2007 to the first question, and August 2007 to the second.

The folk history we get about 2008 (and actually, about the Great Depression also) is that there was a panic in New York, and then it spread outward to cause distress in the rest of the country.

In both cases, actually, the precise opposite is true.

In both cases, actually, the precise opposite is true.

This isn't a deeply contrarian view among economic historians, they've written plenty on problems with farm failures prior to the 1929 crash.

The problems with the 2008 economy prior to Bear Stearns/Lehman are also well-documented.

The problems with the 2008 economy prior to Bear Stearns/Lehman are also well-documented.

Anyway, you'd think that two straight months of negative job growth would be, by itself, a problem for a country with a growing population, and indicate a need for a powerful course correction.

But it gets way, way worse.

But it gets way, way worse.

Here's how some key labor market indicators looked going into the Bear Stearns failure. Graph cut off at that point:

Two more consecutive months of negative payroll growth, now bigger than before.

Two more consecutive months of negative payroll growth, now bigger than before.

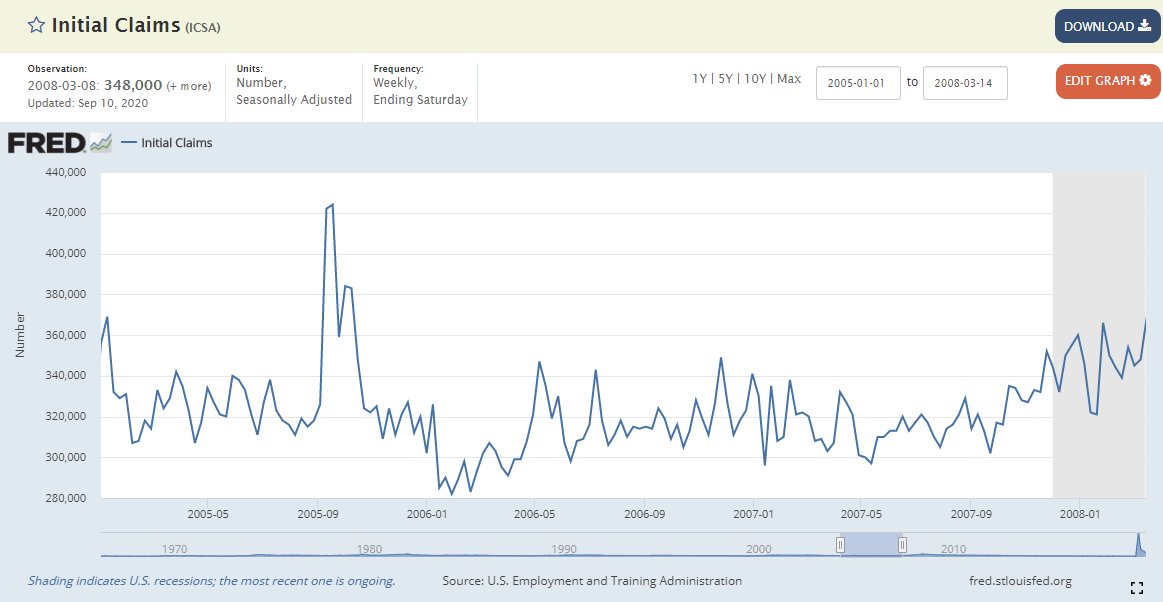

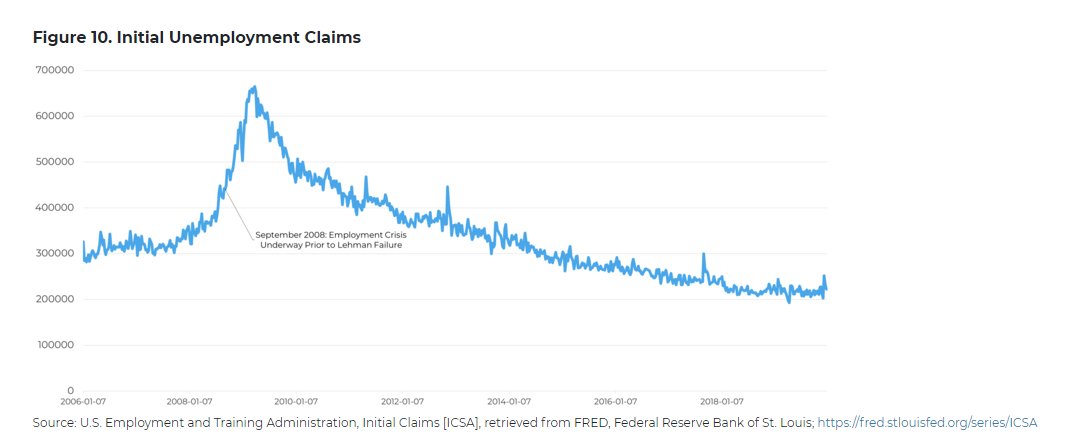

Or for an alternative view, look at the weekly unemployment claims numbers going into the Bear Stearns failure.

The big spike in August 2005 is Hurricane Katrina. In March 2008, though, we were heading up into Hurricane Katrina Aftermath numbers for, well, no good reason at all.

The big spike in August 2005 is Hurricane Katrina. In March 2008, though, we were heading up into Hurricane Katrina Aftermath numbers for, well, no good reason at all.

As we all know, of course, these indicators continue to get way worse.

Here's a remarkable time capsule from that era: "Bernanke Unshaken by Jobless Rise/Fed's Outlook Intact As Other Indicators Ease the Worst Fears."

WSJ, June 10, 2008.

wsj.com/articles/SB121…

Here's a remarkable time capsule from that era: "Bernanke Unshaken by Jobless Rise/Fed's Outlook Intact As Other Indicators Ease the Worst Fears."

WSJ, June 10, 2008.

wsj.com/articles/SB121…

This already sounds like it belongs on one of those "Freezing Cold Takes" accounts that highlights terrible sports predictions, but it's actually far worse than the headline makes it sound.

How big do you think the one-month rise in unemployment that prompted that headline was?

How big do you think the one-month rise in unemployment that prompted that headline was?

The answer, if you check out the article, is 0.5%. The unemployment rate rose half a percent in a single month.

Yes, they have a bevy of evidence that's an outlier number, that we were on a slower pace of contraction at the time overall, and so on. But, not comforting.

Yes, they have a bevy of evidence that's an outlier number, that we were on a slower pace of contraction at the time overall, and so on. But, not comforting.

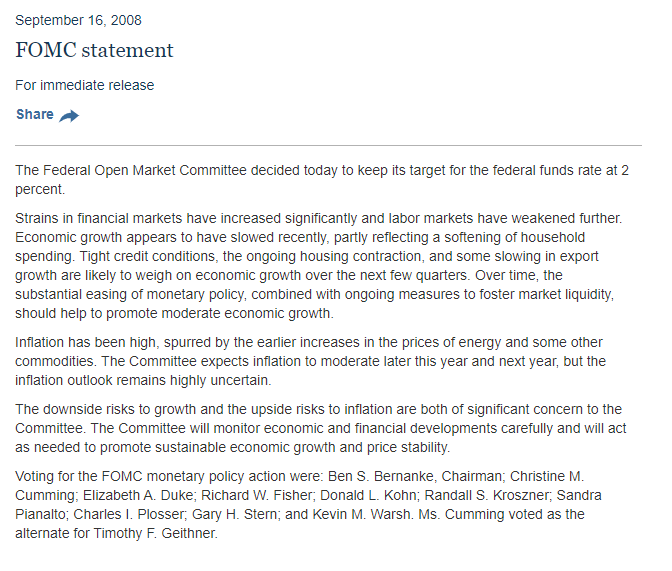

In the paper I highlight where we were by September 2008 (Lehman failure) on four big indicators. Not a single one of them looks remotely acceptable. Most of them were in several consecutive weeks or months of "worst-of-all-time-to-date" numbers.

With that backdrop in mind, check out the September statement from the Fed, from a day after the Lehman Chapter 11:

Stay the course, risks to growth have to be balanced against risks to the inflation upside. Unanimous vote.

federalreserve.gov/newsevents/pre…

Stay the course, risks to growth have to be balanced against risks to the inflation upside. Unanimous vote.

federalreserve.gov/newsevents/pre…

So where did this mistake come from? One thing weighing on their minds was--as they said--the other half of the dual mandate, inflation.

For an article rundown of how heavily inflation weighed on their minds, read here: theatlantic.com/business/archi…

For an article rundown of how heavily inflation weighed on their minds, read here: theatlantic.com/business/archi…

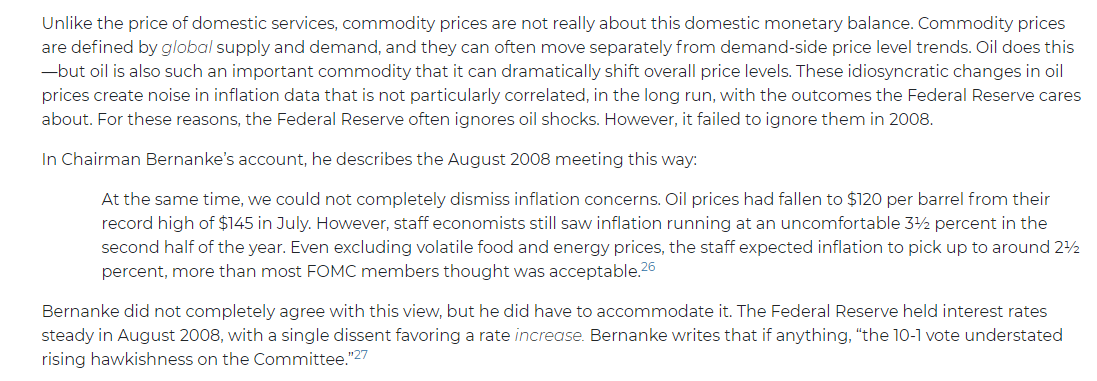

Here's the problem with the assessment of inflation from the committee, though: they paid a *lot* of attention to oil. Bernanke says so in his book, it says so in the minutes, and so on.

Why is paying attention to oil a problem?

Why is paying attention to oil a problem?

Well, because inflation in oil prices is not really the kind of inflation the Fed is responsible for. It's a global price responding to real trends in global supply and demand.

High gas prices alone don't really imply a general problem of too much money in the US economy.

High gas prices alone don't really imply a general problem of too much money in the US economy.

The reason we have an inflation component of the mandate is more to stop the Fed from growing our currency circulation much faster than the U.S. productive capacity.

It's not to entirely insulate commodity prices from reflecting real supply and demand.

It's not to entirely insulate commodity prices from reflecting real supply and demand.

We knew all of this back in the 2000s, we just kind of... forgot it. Here's an educational primer on this from the Fed that pre-dates the crisis. frbsf.org/education/publ…

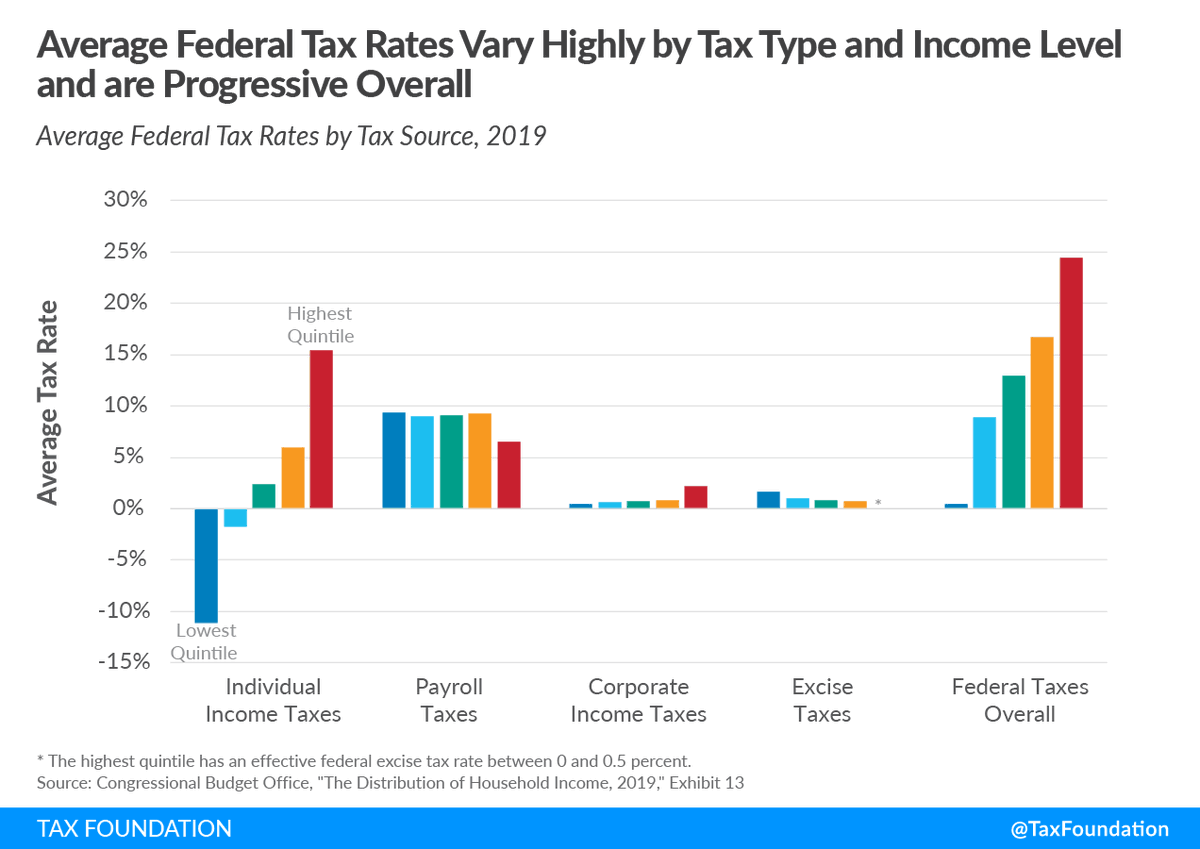

There's good evidence that the 2008 Fed was much more concerned with the components of the green lines, which are volatile and encompass some international supply and demand mechanics that the Fed isn't really responsible for--not the blue line, which was more stable.

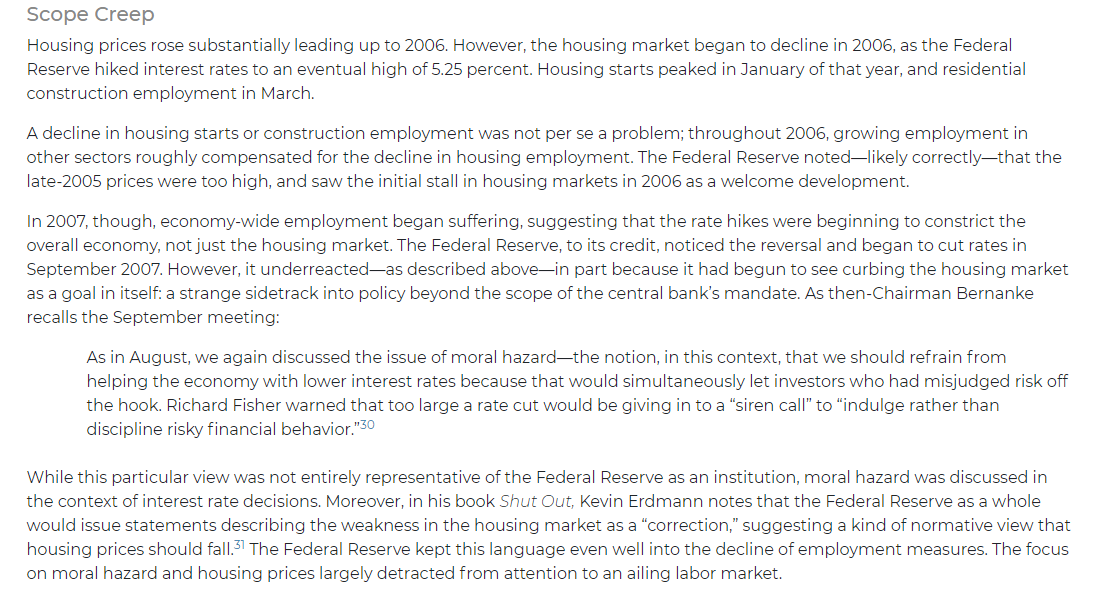

The other thing the Fed was doing in 2008 was managing some things that fall pretty far outside the scope of the dual mandate. They had an idea about what the correct housing prices would be, and they had some ideas about moral hazard.

They were wrong on both counts.

They were wrong on both counts.

On housing: turns out house prices were rising for a variety of boring, secular reasons: people getting richer, population growing, more saving in the economy pushing the natural rate of interest down, and zoning restrictions making some coastal cities expensive.

There was, to be sure, some irrational exuberance and over-lending, too, but absent a Fed-generated recession, the overall trend for housing prices is to go up.

Was the 2006 price exactly right? Probably not, probably a bit ahead of the trend.

Was the 2006 price exactly right? Probably not, probably a bit ahead of the trend.

But was "correcting" the 2006 price by taking away 9 million jobs so that people would be poor and bid less on houses a helpful solution to a mispricing of assets?

Also no.

Also no.

Finally, the "moral hazard" claim is arguably the worst one. The argument goes like this:

(a) some people made investments that will do poorly under a bad economy

(b) we could fix the economy by loosening monetary policy

(c) but we shouldn't do that, to teach them a lesson

(a) some people made investments that will do poorly under a bad economy

(b) we could fix the economy by loosening monetary policy

(c) but we shouldn't do that, to teach them a lesson

This George Bluth Senior-level logic really has no place in government, but even if it did, it should fall under the scope of Congress's work, not the Fed's.

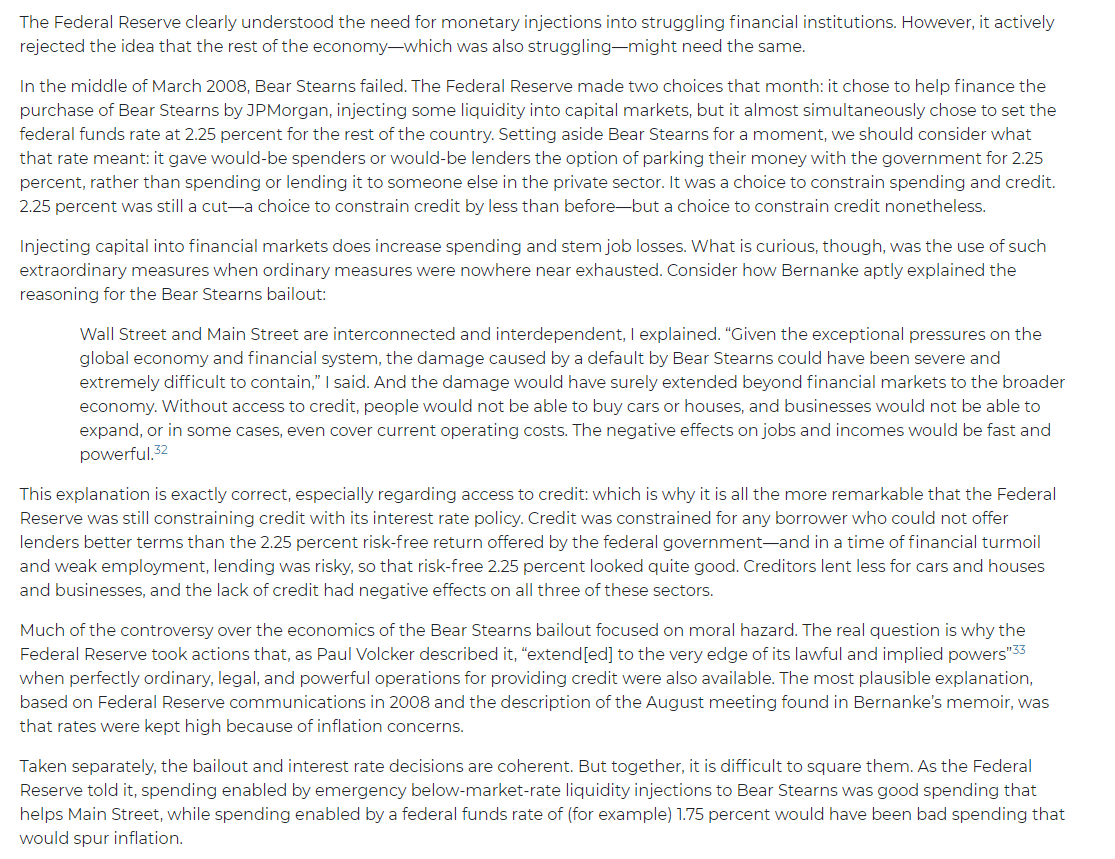

The final area to address about 2007-2008 is that bespoke rescue packages for banks, with looser credit for them, were matched with tighter credit for the public at large, presumably to contain inflation.

I am not a populist, in tone, in policy preferences, really in anything. But the facts are what they are here.

The public should get the benefit of the Fed's ordinary policy tools long, long before extraordinary measures are employed.

The public should get the benefit of the Fed's ordinary policy tools long, long before extraordinary measures are employed.

That's all for now, on the 2007-2008 era. That's how we got into this mess.

But we can also do a better job of getting out of messes. Later we'll talk 2009-2019, which also has some implications for how we get out of the COVID economy troubles. jec.senate.gov/public/index.c…

But we can also do a better job of getting out of messes. Later we'll talk 2009-2019, which also has some implications for how we get out of the COVID economy troubles. jec.senate.gov/public/index.c…

• • •

Missing some Tweet in this thread? You can try to

force a refresh