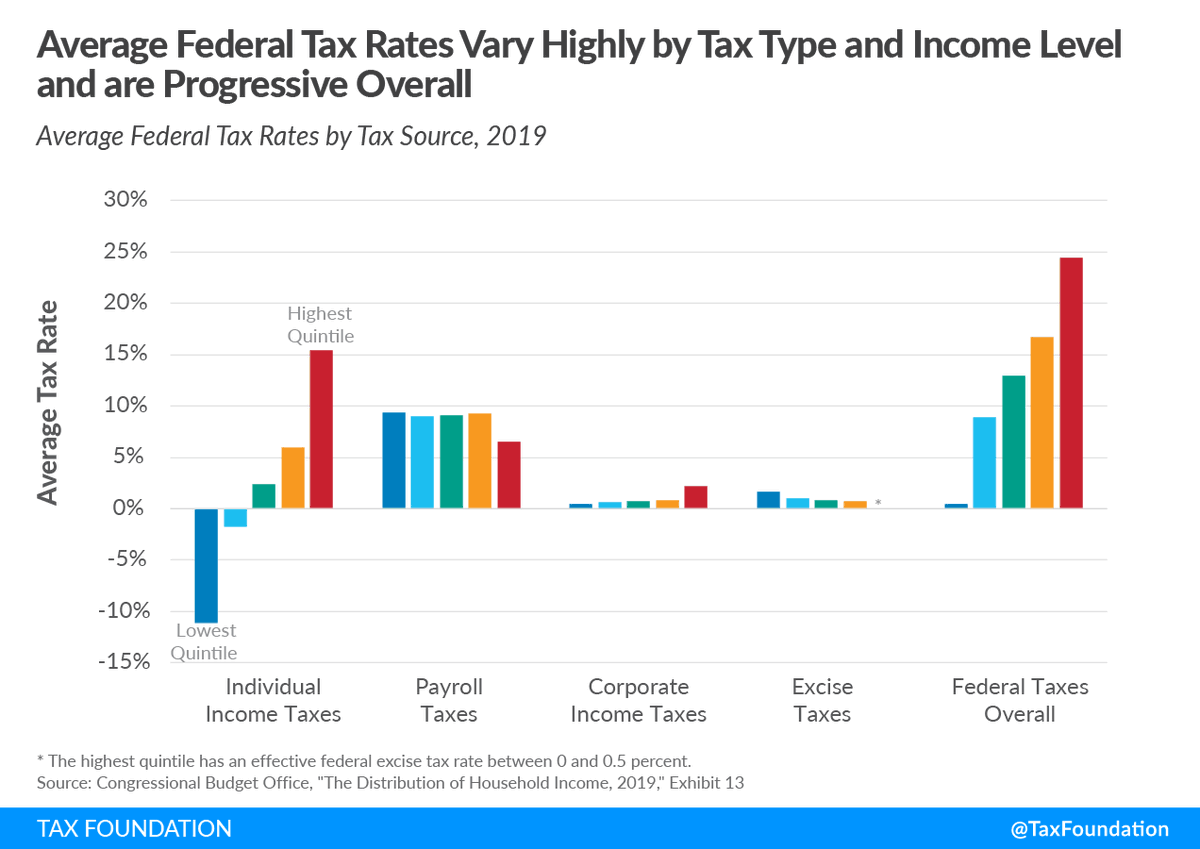

International and Federal Taxes @taxfoundation

High Priest of #DBCFT Twitter

3 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/robkhenderson/status/1993006889605751265I do think we should care about net-negative contributors, especially for immigration policy, but the linedrawing is non-obvious.

https://twitter.com/jeffreyatucker/status/1955071006357246293

Antoni looks into "owners' equivalent rent:" basically, the productive value of people getting to live in houses they already own.

Antoni looks into "owners' equivalent rent:" basically, the productive value of people getting to live in houses they already own.

https://twitter.com/MattZeitlin/status/1592881362612412416

The other time you see this fake choice is when people say there's a "revealed preference" for the suburbs.

The other time you see this fake choice is when people say there's a "revealed preference" for the suburbs.

Remember, public health officials back then were openly talking about herd immunity---and they seemed to be right to do so, at least with respect to the wild type!

Remember, public health officials back then were openly talking about herd immunity---and they seemed to be right to do so, at least with respect to the wild type!

https://twitter.com/AlanMCole/status/14534443812272988252. I wrote about some of my pessimism here.

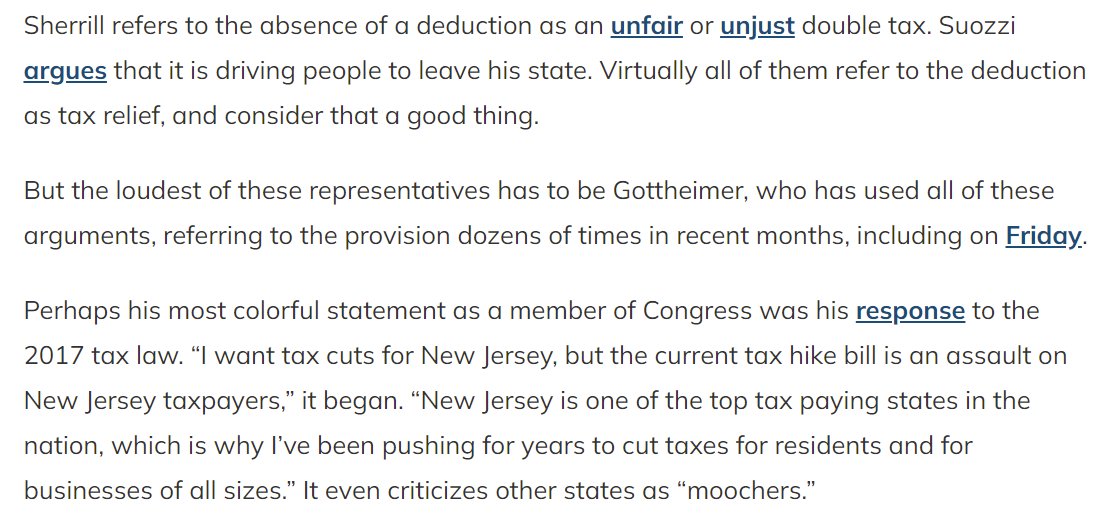

https://twitter.com/sahilkapur/status/1443259807444705285Full SALT is like $85 billion per year.

https://twitter.com/AlanMCole/status/1442937810856517632I don't worry about a slow response to the next pandemic, because obviously we've now seen that threat. (Kind of like how I don't worry about the precise 9-11 attack mechanism happening again.)

The story also went to the New York Times.

The story also went to the New York Times.