The decision is hardly surprising, but there are two interesting points in the panel report:

1. Whether the Phase 1 deal constitutes a mutually agreed solution;

2. whether the US tariffs could be justified under the public morals exception.

1. Whether the Phase 1 deal constitutes a mutually agreed solution;

2. whether the US tariffs could be justified under the public morals exception.

https://twitter.com/wto/status/1305871131354820608

The first one was easy, while the second one is more tricky, as the US measures were allegedly taken against IP theft, misappropriation and unfair competition by China. The Panel ruled against the US, not because the US couldn't do so, but due to the lack of nexus and necessity.

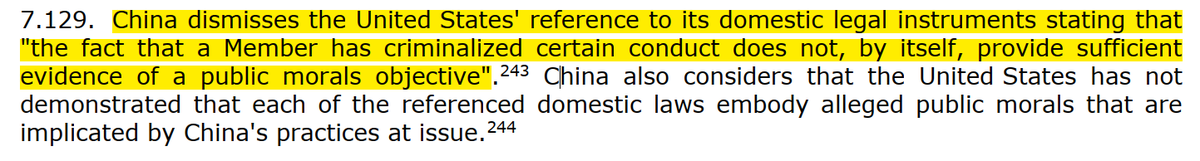

I'm most amused by the argument by China that the criminalization of a conduct under domestic law doesn't really provide sufficient justification for invoking public morals exception. I wonder if its lawyers ever realized that this argu could be used against China in another case

But I guess China is not alone in that regard, as the other WTO Members, who joined as 3rd Parties, also seemed to be confused, at least judged from their submissions in the case.

• • •

Missing some Tweet in this thread? You can try to

force a refresh