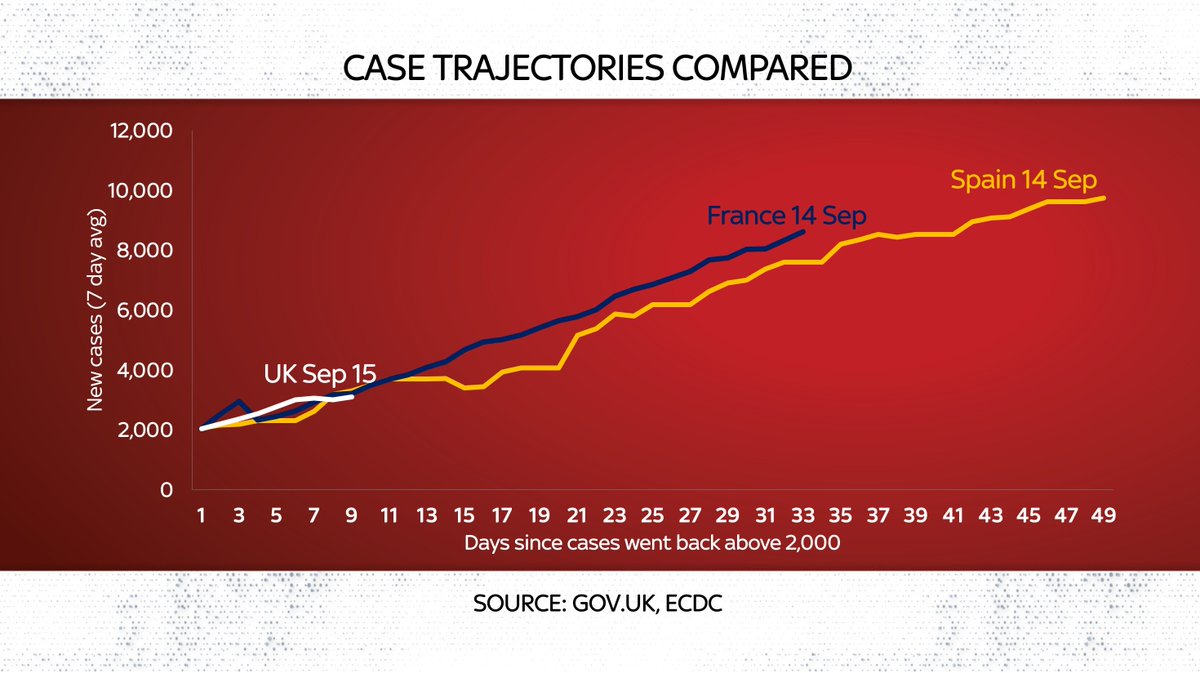

A further 3,105 #COVID19 cases in the UK over the past 24 hours. UK trajectory following pretty much bang in line with France & Spain. Should we be panicking already...? Quick thread (and short answer: no)

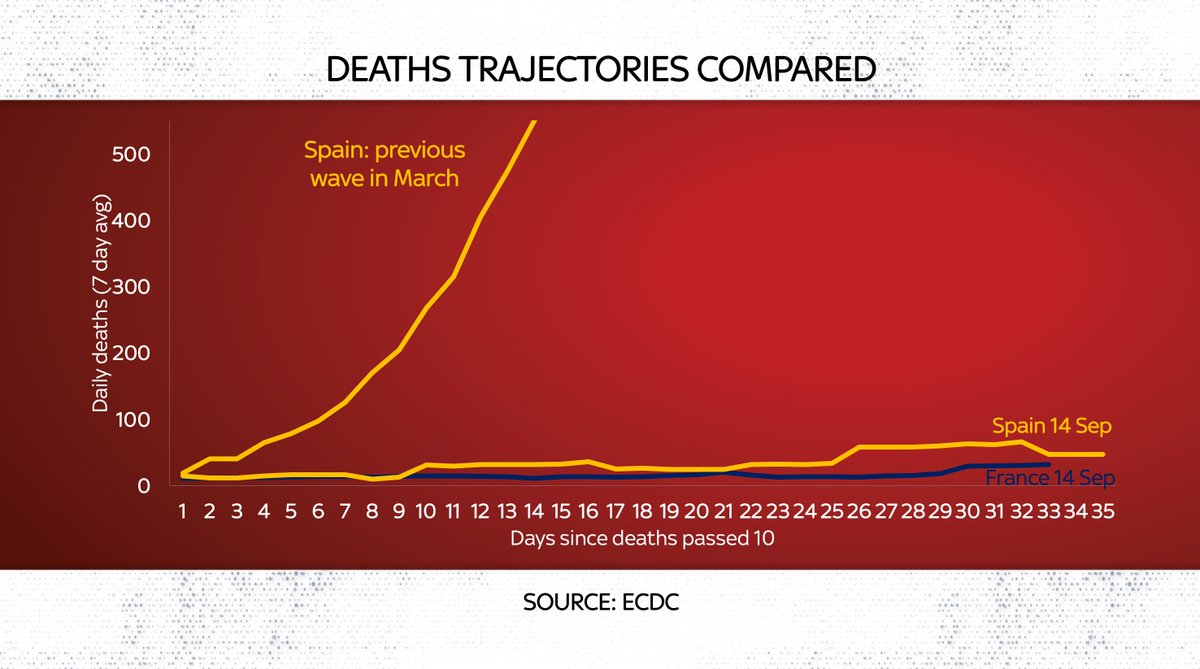

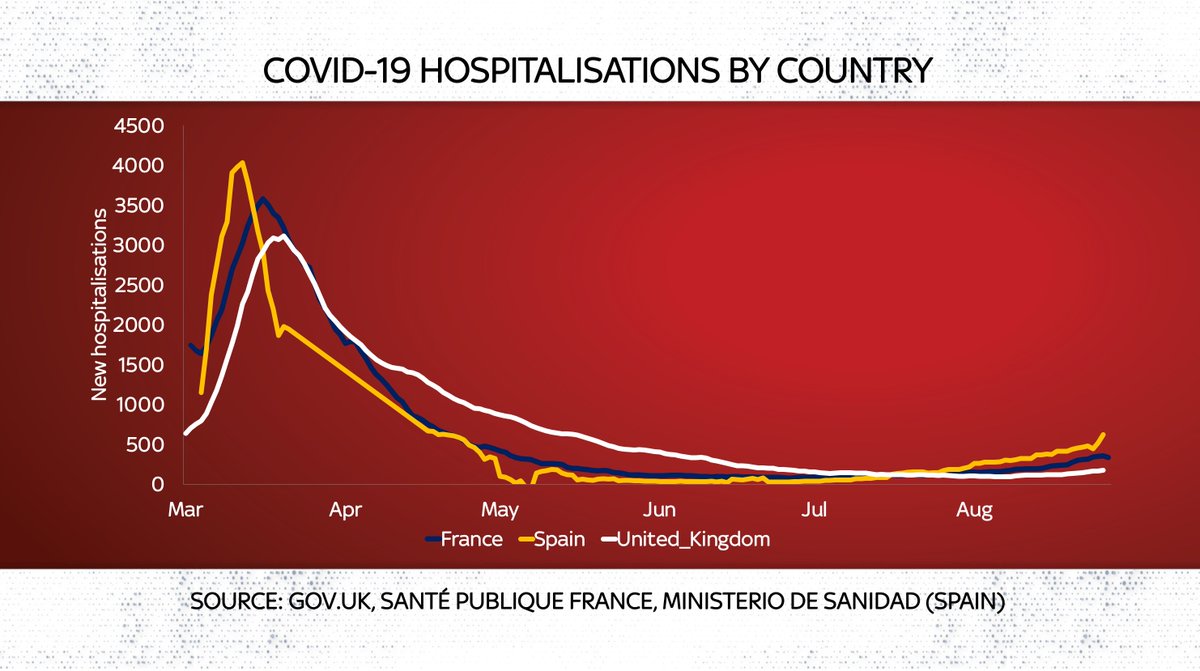

As in Mar/Apr, UK's epidemic seems to be following closely France & Spain. And what we are learning from there is that cases & deaths are rising but much less rapidly than in Apr/May. Just compare the death trajectories: Spain this time vs last time (the two yellow lines here)

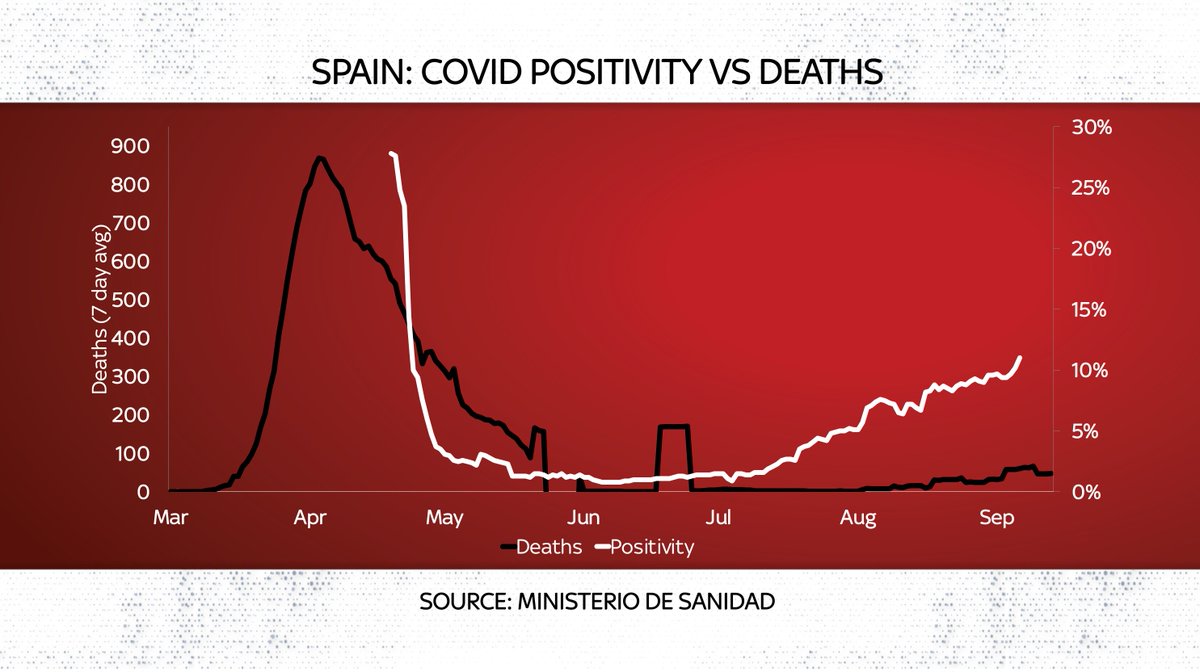

Side note: why am I using deaths to compare this episode with last time around👆? Because last time there was so little testing that the existing case figs don't give a good indication of the prevalence of the disease. So grisly as it is, deaths are a better yardstick

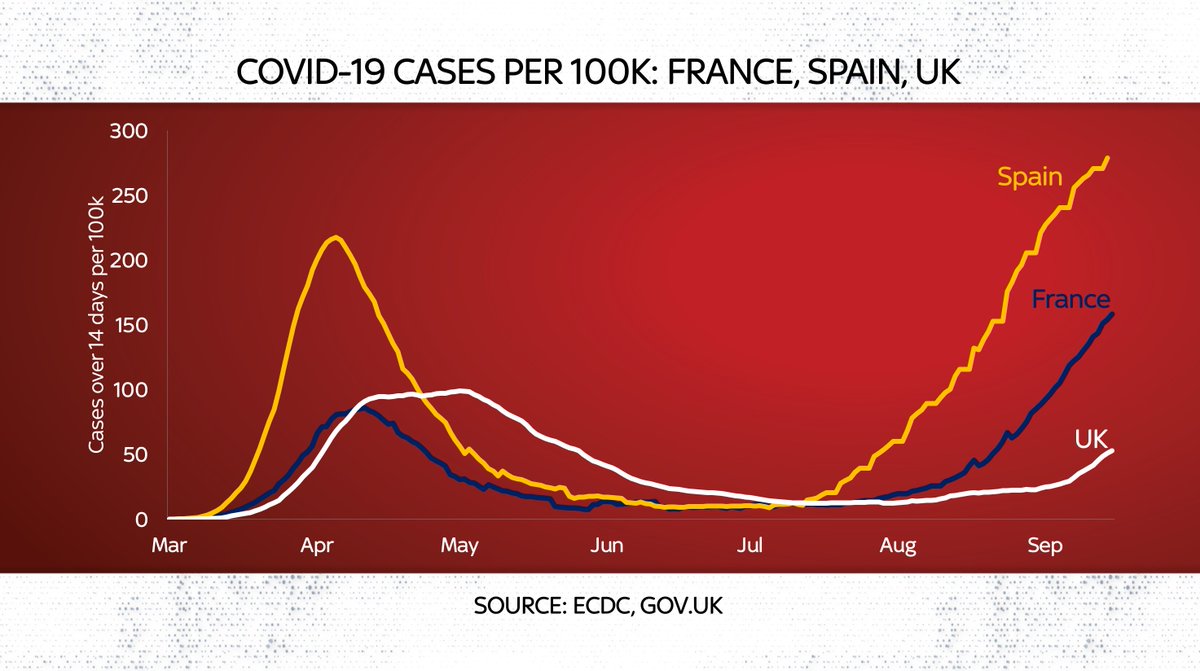

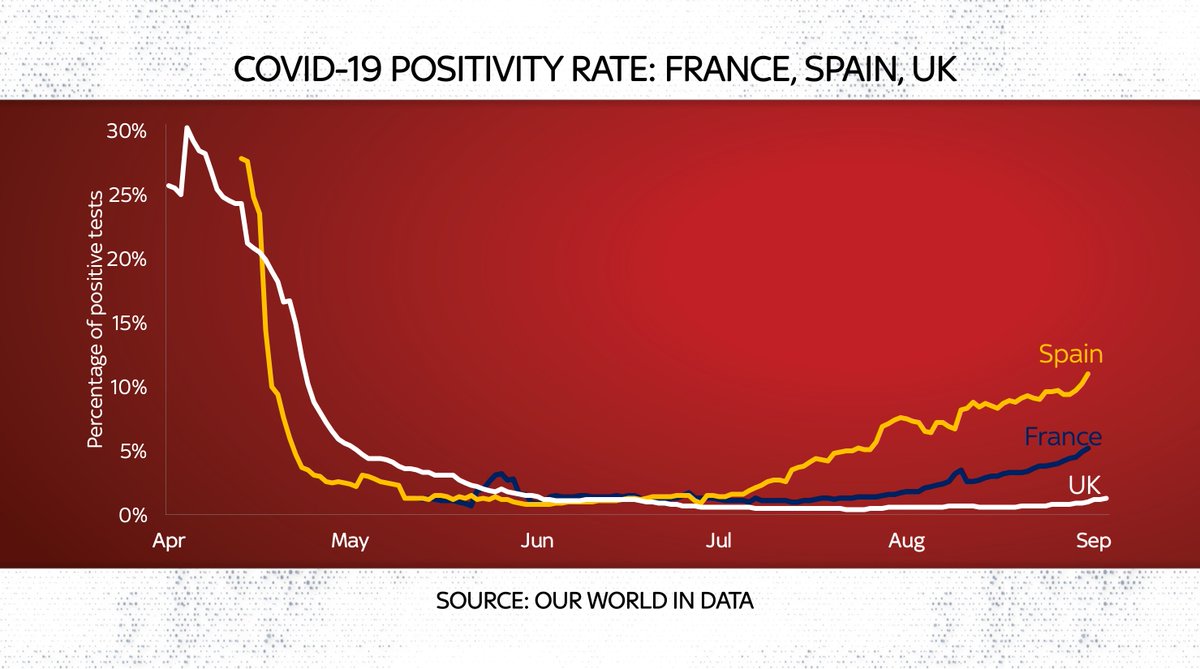

Sidenote 2: since case data from Mar/Apr wasn't v reliable, a better measure is % of positive cases. Compare these charts & u see what I mean. Look at cases alone and it looks like we are facing a bigger epidemic than in March. Look at positivity and we're well down on then.

Now it's possible cases may yet accelerate in Spain and France but we aren't seeing it. Latest numbers out of Madrid this pm: 9437 cases in past 24 hours. Sounds scary, but if you average out cases over the past week they're creeping up, not catapulting higher. That's v important

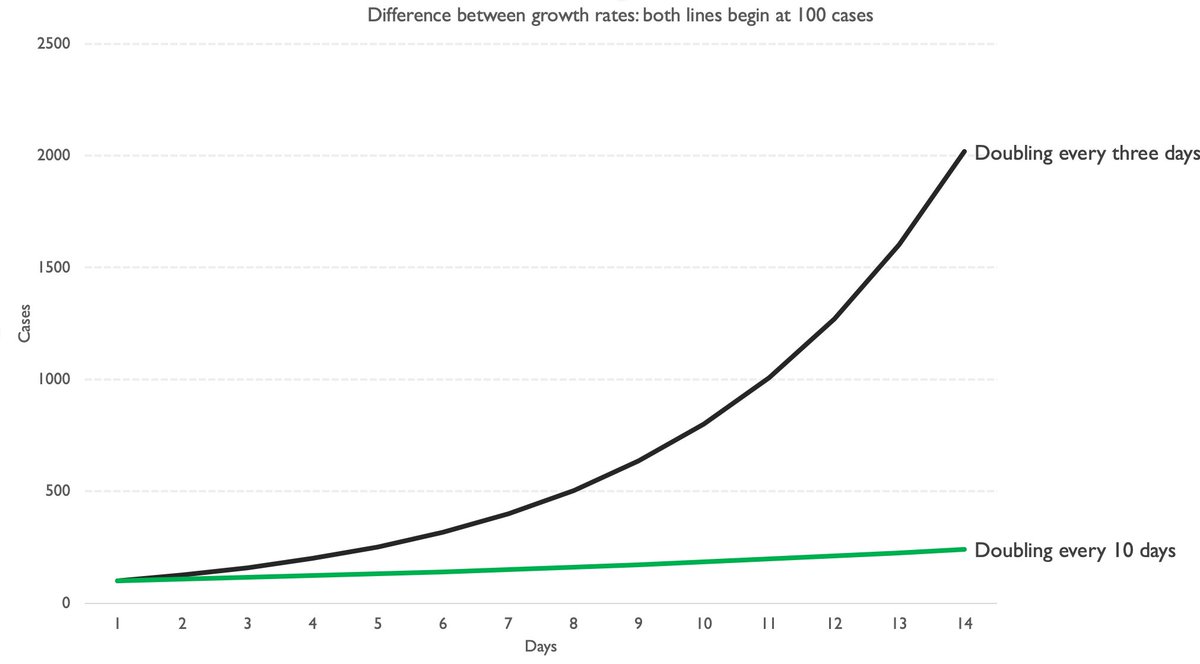

Last time around the prevalence of the disease (as best as we could determine) was doubling every 3/4 days. This time around it's doubling every 15 or so days. If you're wondering what kind of a difference that makes, it's enormous. Bigger than the gap between these two lines

Last time around, the trajectory of deaths seemed to follow the trajectory of cases. But look at the gap between black line (deaths) and white line (COVID positivity rate) this time around. The link seems to have been broken - though it's too early to be absolutely sure.

None of this is to dispute that hospitalisations and deaths are rising in Spain & France. But so far not as fast as in the spring. Exponentiality is what matters here. We need to keep remembering that. And keeping an eye on the data - as it's not impossible it worsens

Some conclusions:

1. UK cases of #COVID19 will continue to rise. Will prob be 10k within a few wks

2. Hospitalisations will rise

3. Deaths will rise

4. But the increases should, if it's anything like Spain/France, be gradual

5. These are ingredients for caution - but not panic

1. UK cases of #COVID19 will continue to rise. Will prob be 10k within a few wks

2. Hospitalisations will rise

3. Deaths will rise

4. But the increases should, if it's anything like Spain/France, be gradual

5. These are ingredients for caution - but not panic

There are crucial provisos. Spain's cases seem to be coming under control not in the absence of action but following measures imposed by govt. In Spain they have limited gatherings much like the UK via the "rule of 6" (their rule is, I think, 10). They are not "letting it rip"

Second, nothing in the above thread precludes the possibility of things going worse here than they are in France/Spain. If anyone is telling you with confidence they know what's going to happen, they DON'T.

Including me. I'm just keeping an eye on the numbers 🤓

Including me. I'm just keeping an eye on the numbers 🤓

Is it time to panic about the rise in #COVID19? Here’s a video which almost answers that question. It’s 14 minutes and the powers-that-be at @skynews say they’d be amazed if anyone kept watching beyond 3m. So now’s your opportunity to prove the MSM wrong!

• • •

Missing some Tweet in this thread? You can try to

force a refresh