Not going to try and parse the latest numbers; just read Ernie Tedeschi. One thing we should be aware of, however, is that economic numbers going into the election will be historically uninformative 1/

https://twitter.com/ernietedeschi/status/1306222092317319168

The problem is that we're living on Covid time, and things change so fast that normal data are vastly out of date compared with where we are 2/

The final pre-election employment report will be released early next month, but it will reflect data collected *last week* — ie, give almost no sense of where the job market is in the weeks before Election Day 3/

The GDP report on Oct. 29 will, as I understand it, reflect average GDP for the 3rd quarter, which roughly means growth from May-August, which we know was fast as the economy partly snapped back from lockdown; but we also suspect that growth has slowed a lot since then 4/

So we'll be going into the election with official data that, through nobody's fault, tells us very little about what's really going on 5/

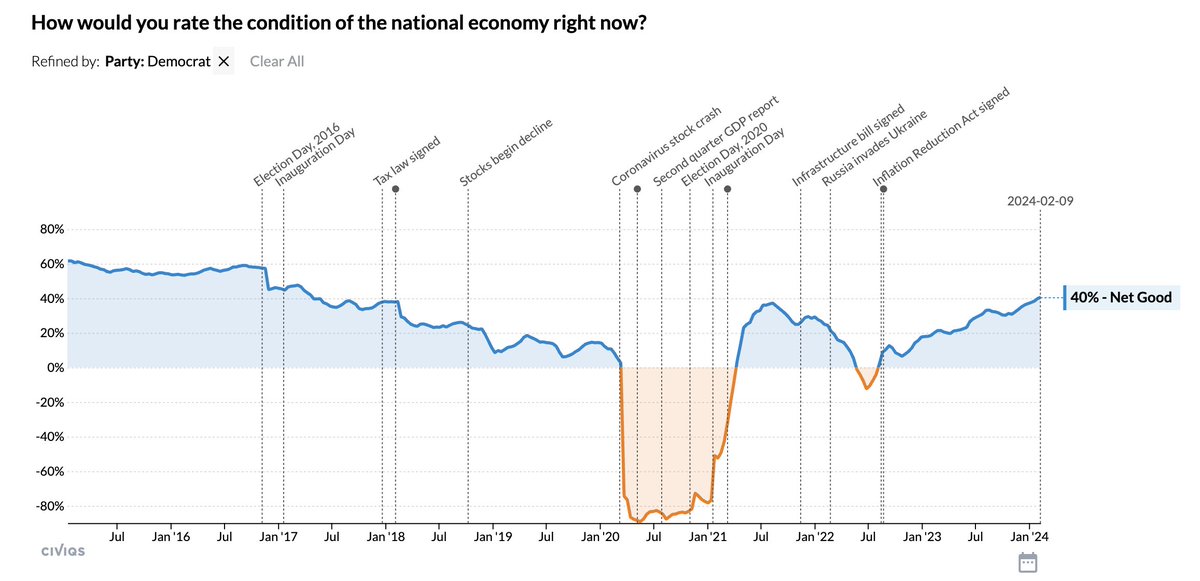

Now, real people don't read GDP reports. The public will on average come into the election with a sense that things have improved from the bottom but are still pretty bad — which is about right. 6/

This is, I think, bad news for Trump. The economy won't be bad enough to noticeably hurt him, unless that last job report is really bad; but it won't help him much either. And what else does he have? 7/

People believe (rightly) that he isn't even trying to save American lives, and his "scary antifa is coming for the suburbs" pitch doesn't seem to be working 8/

https://twitter.com/nickgourevitch/status/1306193583347838978

I guess we'll see what he and Barr come up with for an October surprise. But making the economy great again again isn't going to cut it 9/

• • •

Missing some Tweet in this thread? You can try to

force a refresh