Nobel laureate. Op-Ed columnist, @nytopinion. Author, “The Return of Depression Economics,” “The Great Unraveling,” "Arguing With Zombies," + more.

927 subscribers

How to get URL link on X (Twitter) App

https://twitter.com/paulkrugman/status/1801296665451593868Imports are about 14 percent of US GDP. Federal income tax revenue (not including payroll taxes) is about 8 %. So you might think replacing it would require a tariff rate of 8/14 or around 57 percent. But ... 2/

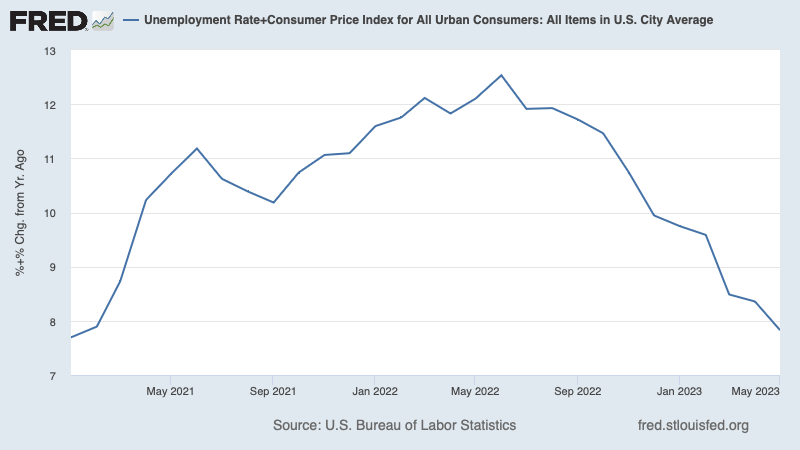

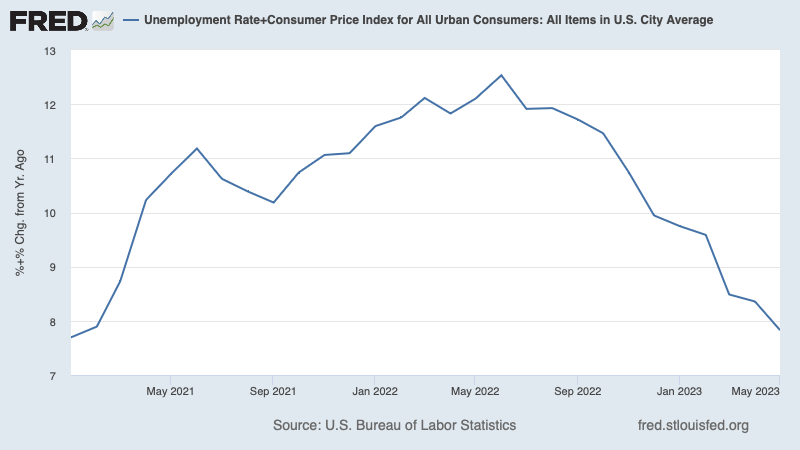

Using annual core CPI puts you way behind the curve, for 2 reasons. First, annual: even core CPI was 4.6 in the first half of 2023, 3.2 in the second half. Second, known lags in official shelter prices lagging far behind market rents 2/

Using annual core CPI puts you way behind the curve, for 2 reasons. First, annual: even core CPI was 4.6 in the first half of 2023, 3.2 in the second half. Second, known lags in official shelter prices lagging far behind market rents 2/

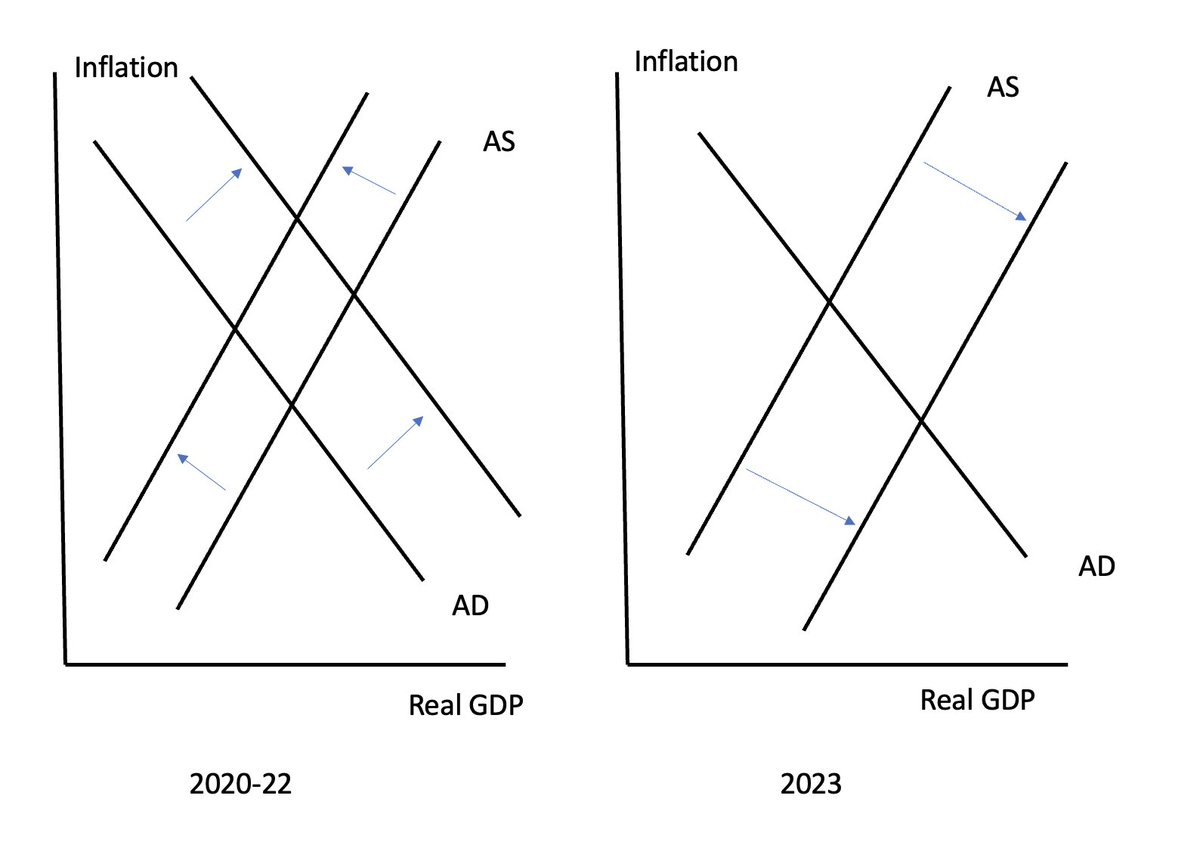

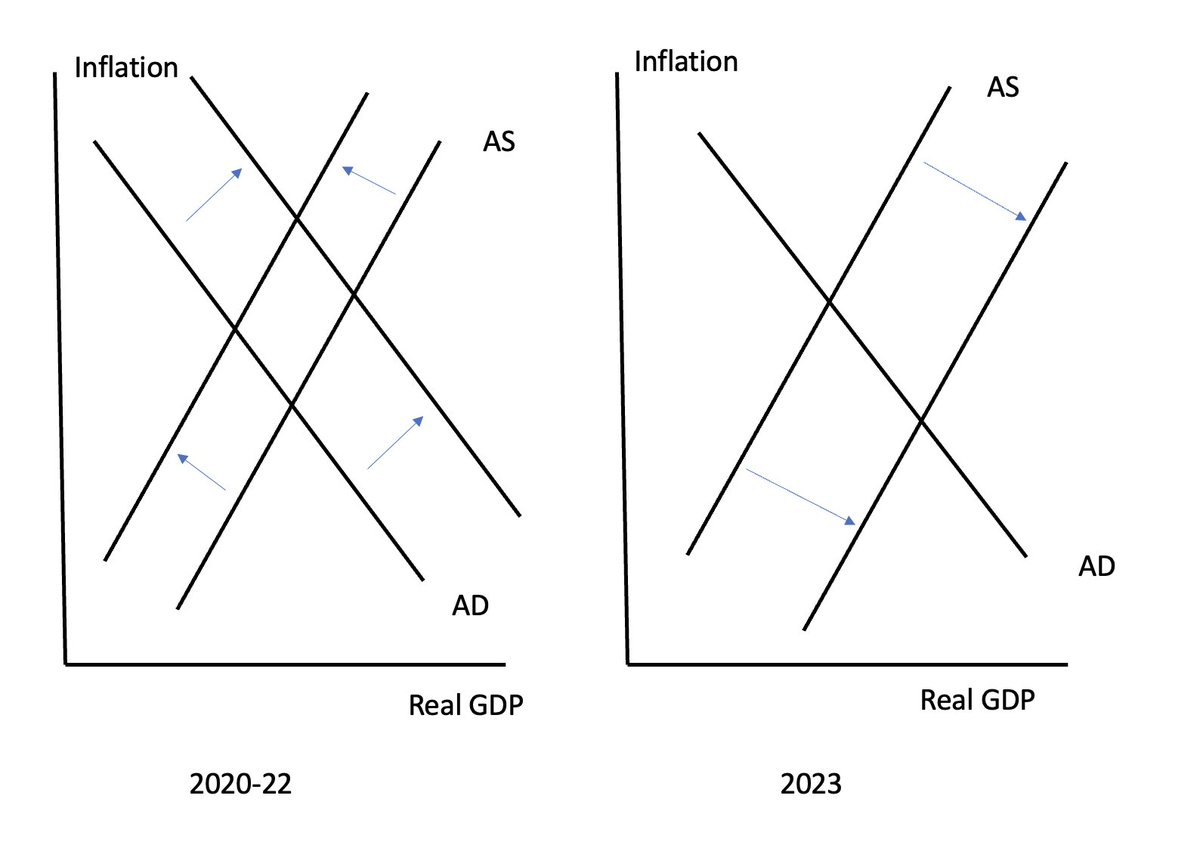

During the pandemic and early aftermath, we had a lot of fiscal stimulus. This sustained growth and employment despite an adverse supply shock, but doing so involved a temporary surge in inflation. Then the supply shock reversed, and we got immaculate disinflation 2/

During the pandemic and early aftermath, we had a lot of fiscal stimulus. This sustained growth and employment despite an adverse supply shock, but doing so involved a temporary surge in inflation. Then the supply shock reversed, and we got immaculate disinflation 2/

https://twitter.com/mtkonczal/status/1741276775378759807First off, I like the idea of a nonlinear Phillips curve, and was very partial to it as late as spring 2023. And it's one way to explain how we got more or less back to target inflation without a massive Summers-type bulge in unemployment 2/

https://twitter.com/mtkonczal/status/1707741086335025385Assertions that Biden's 2021 policies were a disaster rested on the proposition that they would cause inflation that would be very costly to bring down. In fact, inflation has come down painlessly, probably as pandemic-era kinks are worked out 2/

https://twitter.com/NateSilver538/status/1701965341105033598Some people saying that consumers don't care about inflation, only the level of prices. Bad news if true, because deflating back to price levels from the past would be a nightmare. But surely overstates the case 2/

https://twitter.com/MarkHertling/status/1693608430236258461Those of us who aren't military experts can't judge which is right; even actual experts may not have enough information to be sure 2/

https://twitter.com/ojblanchard1/status/1692882786099605766It has almost never been a debate about evidence, because the evidence for short-run sticky prices, set in an uncoordinated fashion — and against the view that central banks can drive prices without real effects — has always been overwhelming 2/

What's notable is that the spike took place mainly at the very long end; it has already been fully reversed for 10-years, although not for 30-years. This is really very odd 2/

What's notable is that the spike took place mainly at the very long end; it has already been fully reversed for 10-years, although not for 30-years. This is really very odd 2/

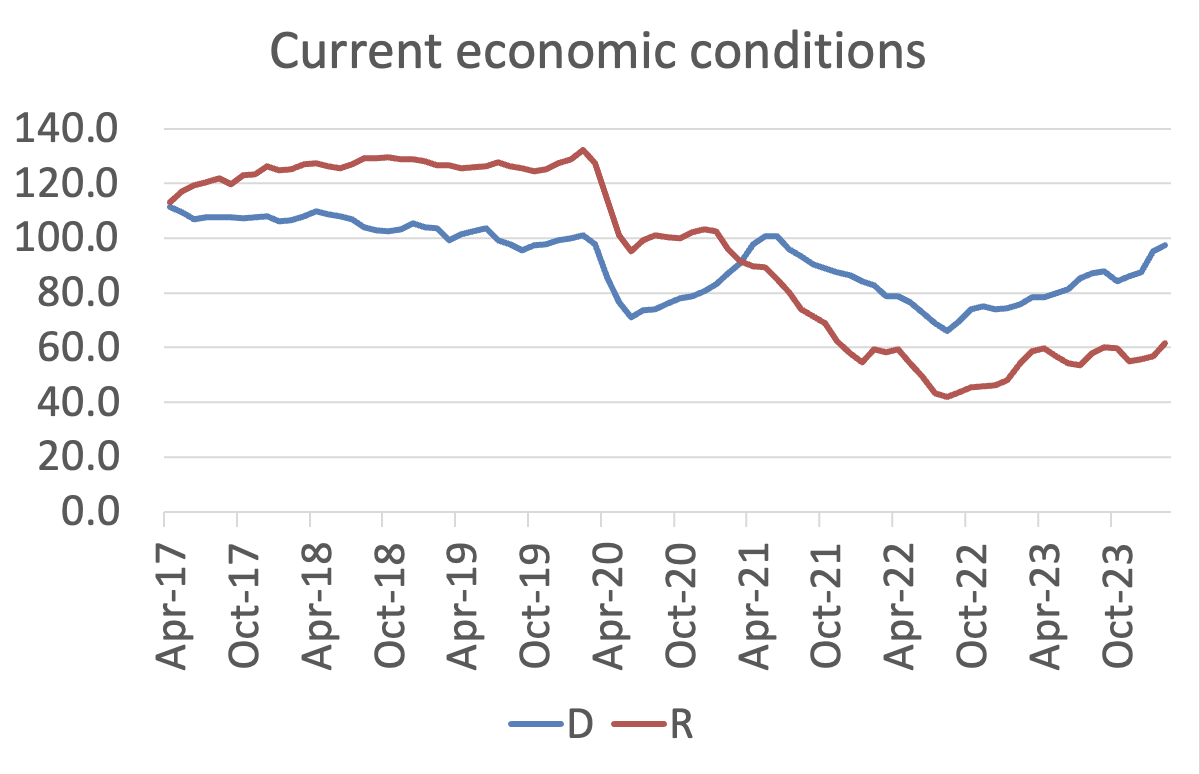

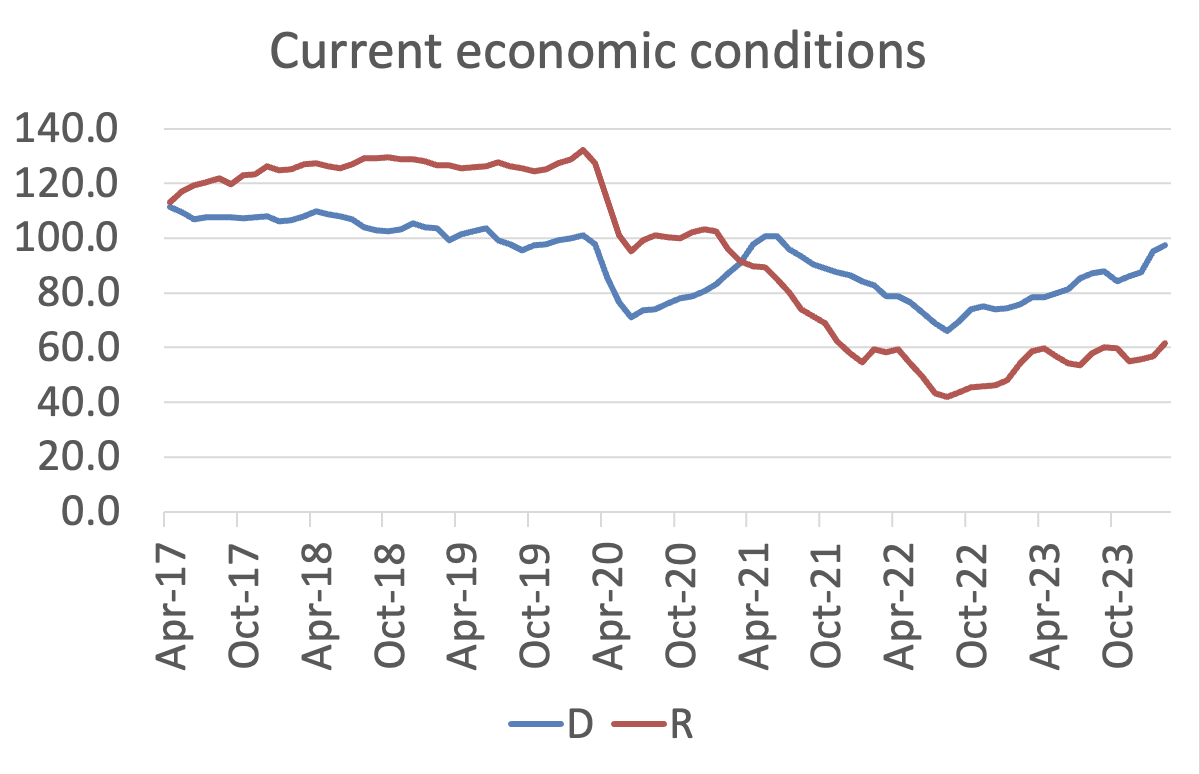

https://twitter.com/JosephPolitano/status/1677695635334524928First, how upset are people about the economy, really? The venerable Michigan survey says they view it as awful. But the Conference Board survey, which has been running for a long time, puts consumer confidence around where it was in 2018 2/

In an ironic twist, efforts to minimize progress now involve asserting that the decline in inflation is transitory. But you really have to engage in statistical contortions to make this claim 2/

In an ironic twist, efforts to minimize progress now involve asserting that the decline in inflation is transitory. But you really have to engage in statistical contortions to make this claim 2/