1/ It's interesting how much the the evolution of the French initiative can be explained using the basic game theory of conflict. Firstly, a common mistake made in analyzing Lebanese politics is that there is an organized system within which political negotiations take place.

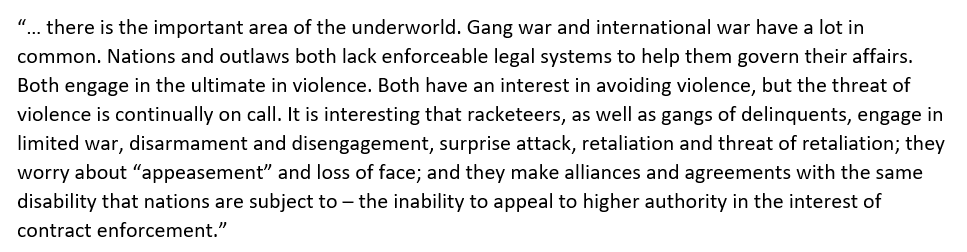

2/ Domestic Leb politics is probably better understood using the tools we have for analyzing anarchic systems, which govern relations between States or... between gangs. It is a system without a "higher authority" to enforce agreements and comes with its own rules of the game.

3/ Why is this important? Because it means there really are no "rules" that can be enforced by the "higher authority", and the game becomes one of threats/bluffs of violence/force by the different players. In this environment, the credibility of the threats made becomes paramount

4/ So under the French Initiative, the Leb political leadership was being asked to cede power. Someone explain to me why would they agree to do this? Power doesn't give itself up voluntarily in an anarchic system. It does so when it is threatened with force or given incentives.

5/ We heard that the French threat was sanctions. For threats to be effective, they have to be credible. Developing the credibility of threats is a whole field of study in international relations. It is not enough to simply say behind closed doors we may impose sanctions...

6/ ... sanctions that the French don't, in the first place, control - the US controls its own sanctions. The French sanctions threat, if true, was simply not credible. The US undermined that stick when it imposed its own sanctions last week and then Pompeo's statement after that

7/ For a threat to be credible, the threatening party has to be committed in a convincing way that it will execute the threat, but also able to NOT execute if the opposing party complies with the demand of the threatening party. France lost on both ends.

8/ The US undermined the French by showing that it doesn't control this important sanctions stick/carrot.

9/ The French threatening sanctions behind closed doors (& Macron being upset at the journalist who reported it) suggested France isn't committed to executing the threat by leaving itself a way out of having to carry it out.

9/ Finally, chaos in Lebanon is not in France's interest, so will it really impose crippling sanctions on politicians & risk the instability? What does France get out of it? France left itself so much room (if story is true) to *not* carry out the threat, making it ineffective.

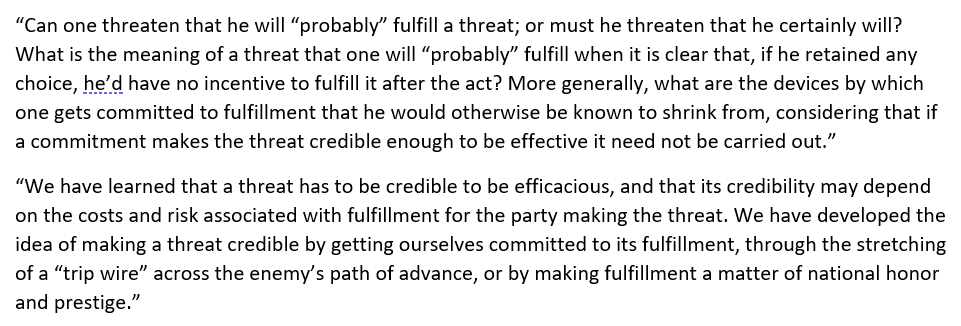

10/ Sanctions would only be effective if the cost on the party being threatened is greater than the cost of complying with the demands. Amal/HA have publicly and loudly committed to the need for them to control MOF as a fundamental part of the power sharing structure.

11/ This public commitment is done on purpose because once one side binds itself into a position from which it can't afford to deviate anymore, the position becomes "binding" or final and non-negotiable. In an anarchic system, losing face is a big cost...

12/ ... because it reduces your public support (shows weakness as you just said it's red-line) & makes your adversaries think you'll concede in the future on other matters. Your positions are no longer firm/credible if you concede (without rationalization) on a fundamental point

13/ Threats are also only effective if the adversary is rational. Sometimes, irrationality is the rational position for a party.Again, what incentive/threat was there for compliance w/ the demand to cede MOF?

"Madmen, like small children, can often not be controlled by threats."

"Madmen, like small children, can often not be controlled by threats."

14/ The more sophisticated player often plays at a disadvantage because it can't be reckless.

"Give me $10 or I'll cut myself" is a threat only the madman can make. France has an interest in stability in Lebanon (do sanctions hurt stability?) and is Leb side "madmen"?

"Give me $10 or I'll cut myself" is a threat only the madman can make. France has an interest in stability in Lebanon (do sanctions hurt stability?) and is Leb side "madmen"?

15/ The French "incentive" was international aid. But is this also credible? How much aid? Which aid? Will the US support or obstruct? Do certain Lebanese sides even need/want this aid at the cost of ceding power domestically and all of the costs that entails for them?

16/ Finally, if the French initiative fails, this is costly for French credibility, not only for its ability to influence events in Lebanon, but elsewhere in the E Med (esp if it doesn't follow through on sanctions, which we established may not be a credible threat).

17/ Countries like Turkey will be watching and will see whether France is willing to carry out its threats. The implications go further than just French credibility in Lebanon. It could affect it's ability to do statecraft in the region.

18/ Thus, it seems to me that it's the French who have the bigger incentive to compromise and concede on the issue of the MOF. It put too much of its credibility on the line. Amal/HA can wait it out and call out France's bluff. They already committed to their public not to budge.

19/ And the French threat is insufficient for reasons discussed above.

It seems to be that both sides will need a way for the other to "rationalize" conceding on this issue while saving face and not losing credibility. Which side will "win"? Or there will be stalemate.

It seems to be that both sides will need a way for the other to "rationalize" conceding on this issue while saving face and not losing credibility. Which side will "win"? Or there will be stalemate.

20/ Given these circumstances, it also seems to me that every party in Lebanon is incentivized to build up as much power on the ground to improve its bargaining power in any future deal. What is power on the ground in an anarchic system? It's military power.

21/ Parties will also be incentivized into locking themselves into very firm positions on important political issues (burning the bridge behind them). By increasing their power and locking in their positions, they improve their bargaining power in any future deal. Scary times.

22/ Read "The Strategy of Conflict" by Thomas Schelling for a good introduction.

• • •

Missing some Tweet in this thread? You can try to

force a refresh