Commentator on Lebanon’s never-ending financial crisis. International structured and project finance.

4 subscribers

How to get URL link on X (Twitter) App

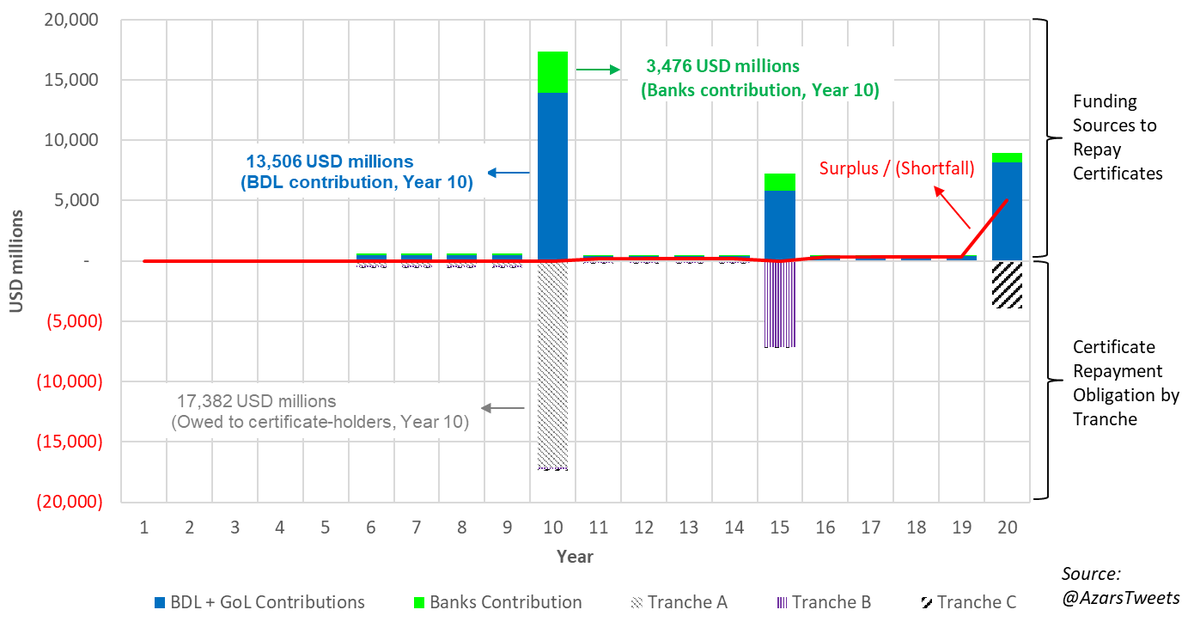

BDL and the Gov't assume there is $35B of ineligible deposits to be written off out of $66B. That number is absurdly large. The ineligible deposit write-offs are highly contested, and the amount is uncertain.

BDL and the Gov't assume there is $35B of ineligible deposits to be written off out of $66B. That number is absurdly large. The ineligible deposit write-offs are highly contested, and the amount is uncertain.

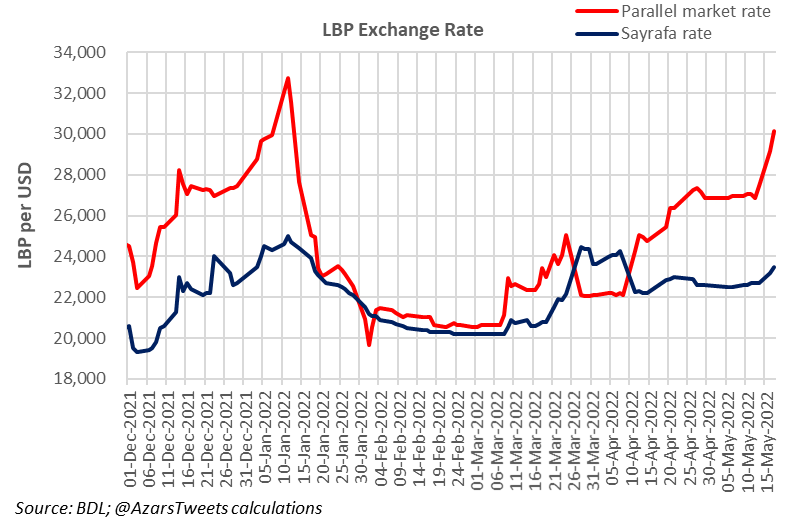

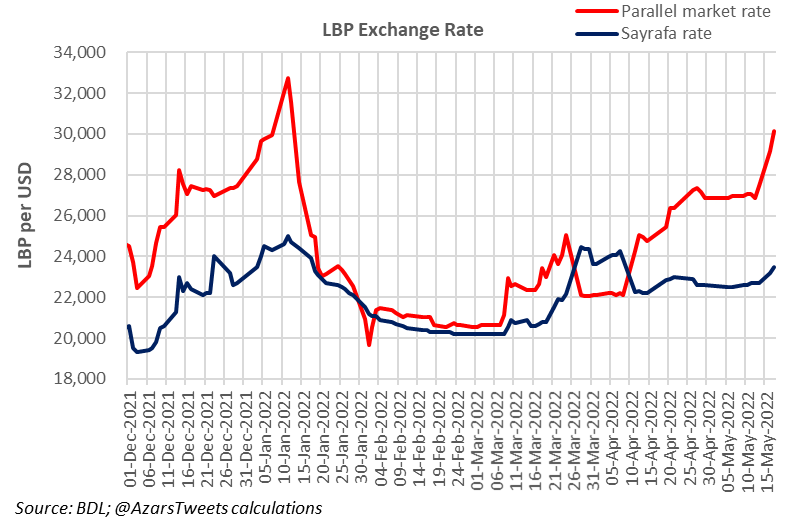

https://twitter.com/AzarsTweets/status/14349374983047127042/ Stabilizing the LBP is BDL's only objective. But it's unwilling to do what is needed to achieve sustainable currency stability and economic growth: restructuring the financial sector. So it stabilizes the LBP at the expense of public living standards and future generations.

https://twitter.com/MaucourantNada/status/1621049379648929792

2/ Firstly, the investigations were launched starting in 2020 as a result of the Panama Papers leak, a change in financial disclosure rules and related anti-money laundering laws in Europe, and, in some cases, complaints filed by watchdog organizations abroad, incl @NowActs.

2/ Firstly, the investigations were launched starting in 2020 as a result of the Panama Papers leak, a change in financial disclosure rules and related anti-money laundering laws in Europe, and, in some cases, complaints filed by watchdog organizations abroad, incl @NowActs.

https://twitter.com/Reuters/status/1620516156653146112- Financial sector losses should be resolved through a comprehensive bank resolution framework, not piecemeal circulars

https://twitter.com/AzarsTweets/status/1607337679515000832

2/ The balance of payments deficit was ~$3 bn, not much different from 2021. This is all financed using BDL reserves. Despite the continued devaluation of the LBP, the BOP deficit remains high and is not falling. It takes more than currency collapse to make a productive economy.

2/ The balance of payments deficit was ~$3 bn, not much different from 2021. This is all financed using BDL reserves. Despite the continued devaluation of the LBP, the BOP deficit remains high and is not falling. It takes more than currency collapse to make a productive economy.

https://twitter.com/CNBCMiddleEast/status/15870706343910195202/ The Precourse Curse (reading 1*) analyzes 236 instances when large oil and gas discoveries were made, and the economic growth trajectory in each country over the six-year period after such discovery was made.

2. Read the passage above. The economic arrangement is vague, open to interpretation, and could lead to disputes.

2. Read the passage above. The economic arrangement is vague, open to interpretation, and could lead to disputes.

https://twitter.com/timourazhari/status/15733687669433630732/ We still transfer more $ out of the country than we bring in. We are very import dependent and have too many $ deposits chasing too few real $.

This has been going on since day one. Here he is at the Elysee in Paris attending the PM's meetings with President Macron in September 2021, just weeks after the Government took office.

This has been going on since day one. Here he is at the Elysee in Paris attending the PM's meetings with President Macron in September 2021, just weeks after the Government took office.

2/ The hole in BDL's balance sheet ("the losses") continues to grow due to inaction on a reform program, which translates into the real value of money falling (deposits + LBP notes).

2/ The hole in BDL's balance sheet ("the losses") continues to grow due to inaction on a reform program, which translates into the real value of money falling (deposits + LBP notes).

Almost every article is tinged with a fear of Nazism and its potential spread to Lebanon.

Almost every article is tinged with a fear of Nazism and its potential spread to Lebanon.

Companies declare bankruptcy and go through a formal legal process under certain bankruptcy laws and are either liquidated or restructured. There are laws governing this process.

Companies declare bankruptcy and go through a formal legal process under certain bankruptcy laws and are either liquidated or restructured. There are laws governing this process.

https://twitter.com/Nazeerida/status/14330466411756380192/ Leb is buying the fuel at the market price in dollars, which may be converted to LBP at approximately the parallel market rate. Iraq isn't taking exchange rate risk. The payment is deferred for one year with interest. It looks less like a gift and more like a $ loan from Iraq.

https://twitter.com/IbrahimKanaan/status/1433384097750061057It's like saying it's OK if I borrow/spend $1 bn loan because it's zero interest in the first year. It's a huge problem. Unrealized losses on the book are a MAIN reason for the LBP deval. Increasing the withdrawal rate increases BDL's debts when it's already facing massive losses