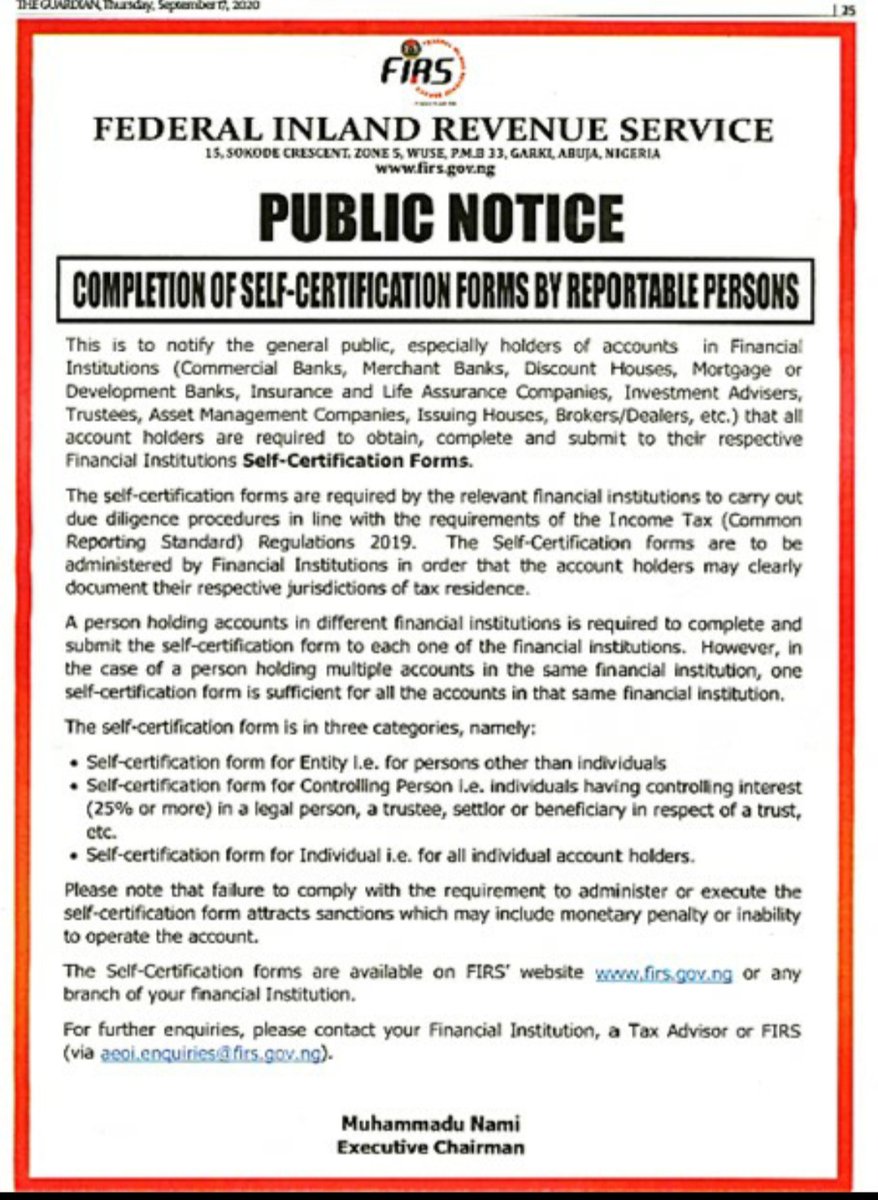

In case you’re wondering what FG is saying, this is in connection with the commencement of automatic exchange of taxpayers information between Nigeria with other countries.

https://twitter.com/nigeriagov/status/1306634568267640832

The information required is to enable reporting financial institutions determine the tax residency of their customers to know which countries to share your information with.

In the case of corporate accounts, the exercise is required to determine the beneficial ownership and control also for reporting purposes.

The FIRS has earlier shared communications with taxpayers regarding the commencement of exchange of information with other countries. The communication reads as follows:

“We are delighted to inform you that the AEOI-CRS (Automatic Exchange of Information - Common Reporting Standards) System Portal has gone Live!

All Reporting Financial Institutions are expected to file reports on or before 30th September 2020.

All Reporting Financial Institutions are expected to file reports on or before 30th September 2020.

The designated official of each Financial Institution is required to enroll on the AEOI-CRS System Portal, as a Primary user, to enable the Financial Institution, file its CRS reports.

To enroll as a Primary user and have access to related AEOI-CRS documents, please visit the FIRS website at firs.gov.ng and navigate the menu tab on Automatic Exchange of Information.”

See @firsNigeria notice here

You can also watch the interview with Mr. Gbonjubola, Head of Tax Policy and Mr Edga Head of AEOI at FIRS for further details.

You can read the regulation here for more details

firs.gov.ng/sites/Authorin…

firs.gov.ng/sites/Authorin…

This form is for controlling persons, that is, individuals who control 25% or more of the interest in a company, a trustee, settlor or beneficiary of a trust etc firs.gov.ng/sites/Authorin…

UPDATE:

Many people are justifiably angry about this development.

Here is my take ...

The exchange of information initiative is good. It will enable govt obtain information from other countries regarding financial information about Nigerian residents.

Many people are justifiably angry about this development.

Here is my take ...

The exchange of information initiative is good. It will enable govt obtain information from other countries regarding financial information about Nigerian residents.

In exchange, Nigerian govt must provide information about persons in Nigeria who are tax resident in other jurisdictions to the relevant countries.

The FG could have done a better job of simplifying the process and communicating more effectively.

The FG could have done a better job of simplifying the process and communicating more effectively.

A simple analogy is like asking everyone to make a self declaration so that govt can determine how many Nigerians have attended a foreign university onsite when a simple information filtering will show that we need not bother 99% of Nigerians about it.

The mere fact that govt is asking Nigerians to provide this declaration is a reflection that the country poorly handles data management. The same reason why many countries were able to easily administer palliatives to their citizens during this pandemic and we couldn't.

My 2 cents (or kobo):

Your bank has an interest in getting this right so you can wait until they reach out to you.

Banks have done a similar thing before under the US FATCA and they didn't ask everyone to make a declaration.

Your bank has an interest in getting this right so you can wait until they reach out to you.

Banks have done a similar thing before under the US FATCA and they didn't ask everyone to make a declaration.

I am hopeful that banks will be able to do the same this time around.

Caveat:

I do not speak for govt o, just playing my own part beyond complaining on social media.

I do not speak for govt o, just playing my own part beyond complaining on social media.

I will also be reaching out to govt to share my thoughts on how to simplify the process and make it more effective.

Here is a clarification by @firsNigeria

https://twitter.com/firsNigeria/status/1306754572166279171?s=19

The retraction and apology by @NigeriaGov

https://twitter.com/NigeriaGov/status/1306879556503117824?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh