Chairman, Presidential Committee on Fiscal Policy and Tax Reforms

6 subscribers

How to get URL link on X (Twitter) App

In a broader sense, cash is synonymous to money which includes currency and cash equivalents such as deposits in your bank account, money market instruments etc. Let's call this broader cash excluding currency, "Soft Cash” or “e-Cash".

In a broader sense, cash is synonymous to money which includes currency and cash equivalents such as deposits in your bank account, money market instruments etc. Let's call this broader cash excluding currency, "Soft Cash” or “e-Cash".

2. The major aim was to tackle black money especially counterfeiting, corruption and tax evasion. Also, the policy was meant to facilitate India’s transition to digital, cashless world at a time when over 190m adults had no bank accounts many of whom are illiterate

2. The major aim was to tackle black money especially counterfeiting, corruption and tax evasion. Also, the policy was meant to facilitate India’s transition to digital, cashless world at a time when over 190m adults had no bank accounts many of whom are illiterate

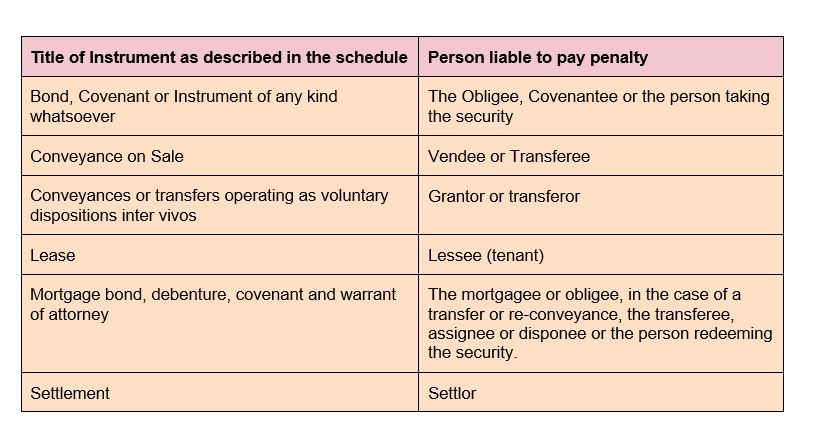

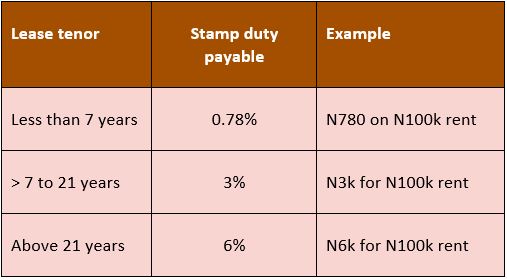

This will trigger various tax obligations including:

This will trigger various tax obligations including:

... have huge social implications if implemented. It will stretch the police in terms of enforcement and will worsen the economic conditions of many law-abiding riders and their households.

... have huge social implications if implemented. It will stretch the police in terms of enforcement and will worsen the economic conditions of many law-abiding riders and their households.

Creativity means using your imagination to create something new. It includes the work of artists, as much as that of CEOs or computer programmers. There is room for creativity in every career.

Creativity means using your imagination to create something new. It includes the work of artists, as much as that of CEOs or computer programmers. There is room for creativity in every career.

Then he announced that whoever reaches first would get all the sweets in the basket.

Then he announced that whoever reaches first would get all the sweets in the basket.

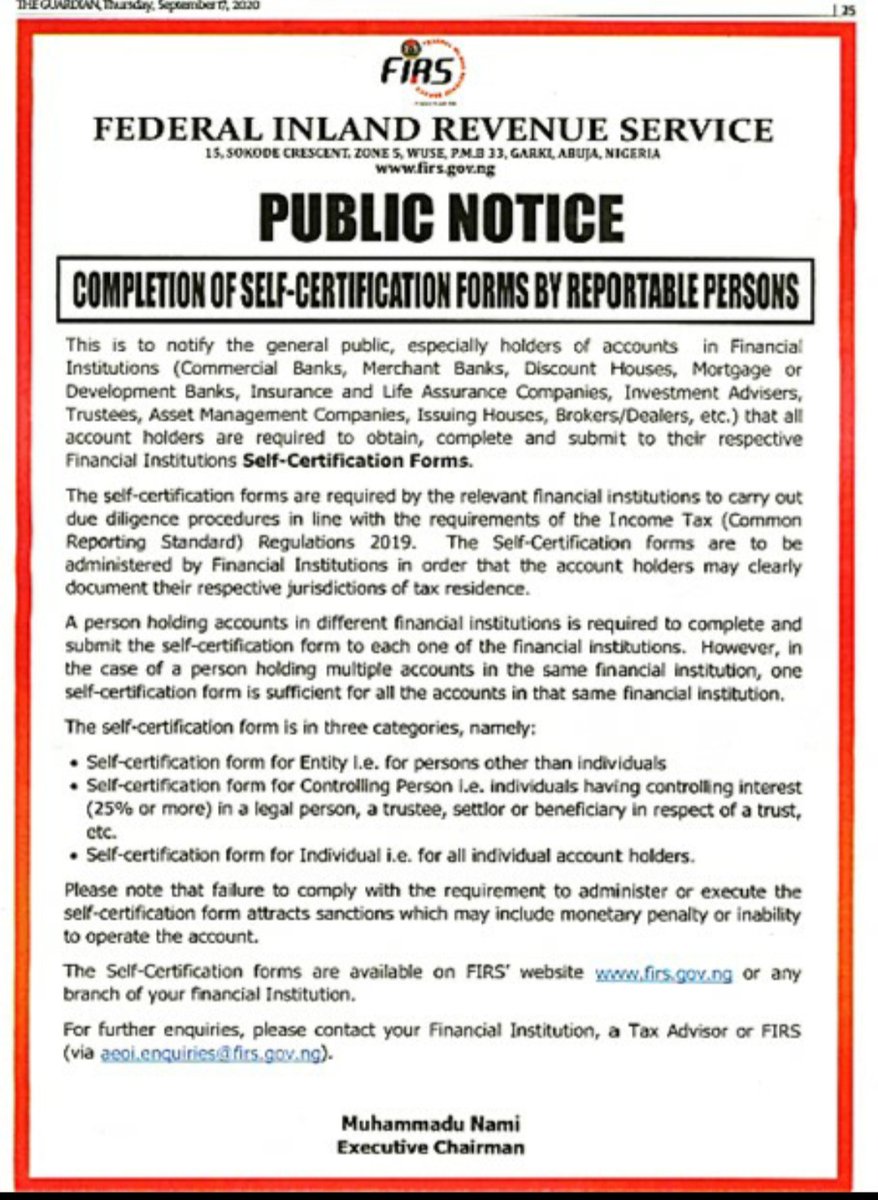

https://twitter.com/nigeriagov/status/1306634568267640832The information required is to enable reporting financial institutions determine the tax residency of their customers to know which countries to share your information with.

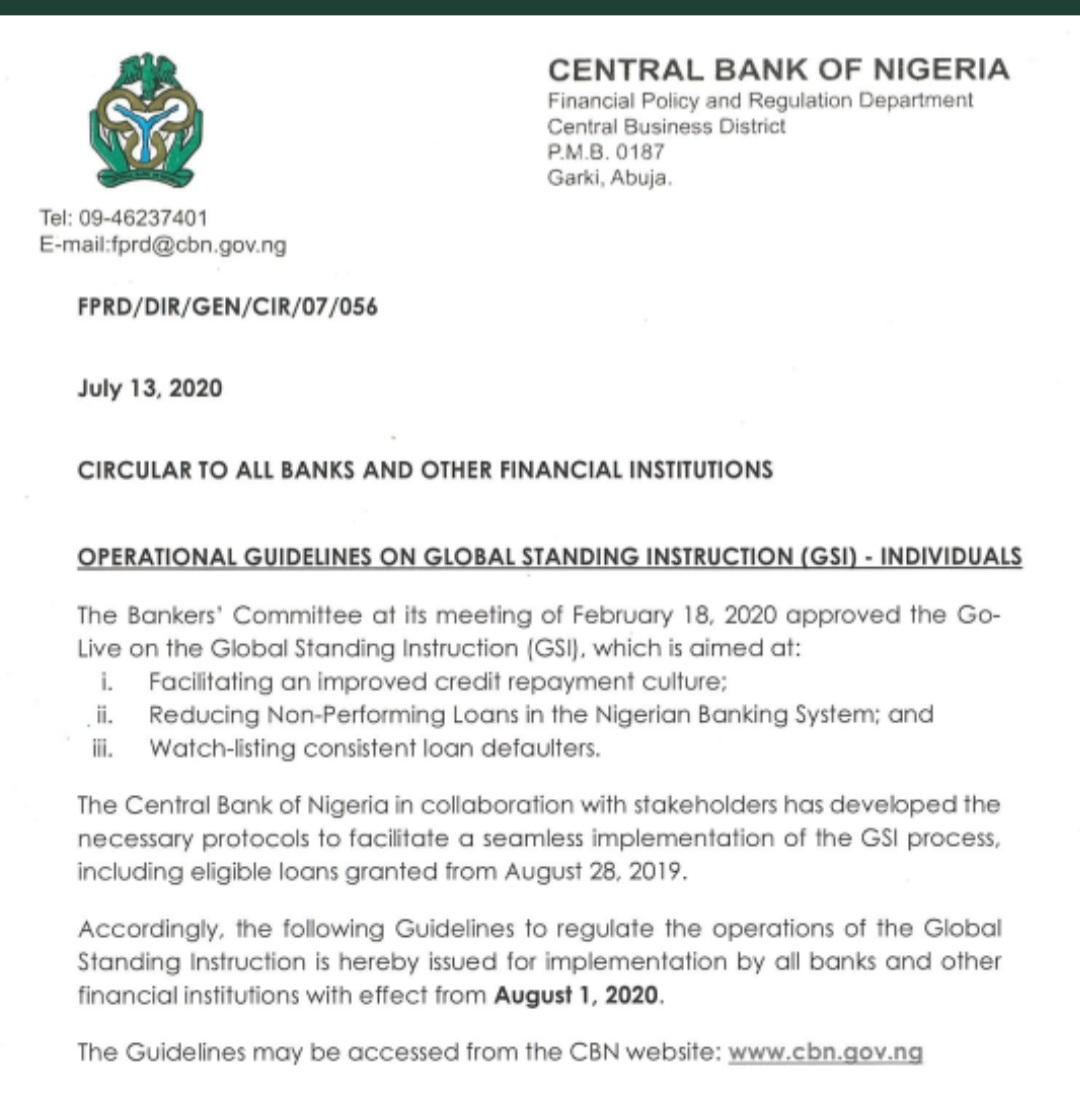

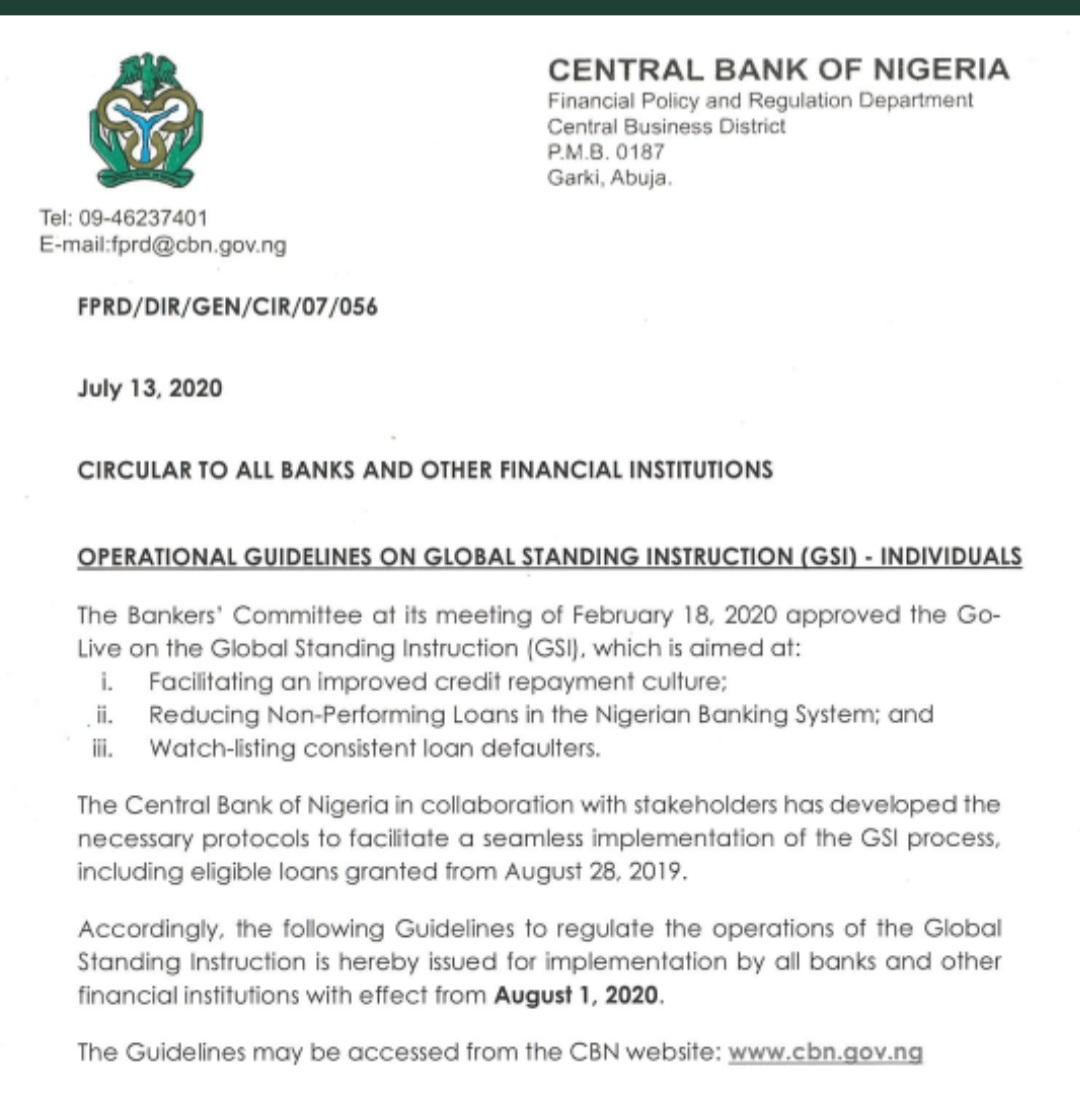

https://twitter.com/cenbank/status/1283085554129788930

The rule applies to loans granted from 28 Aug 2019 while implementation is effective from 1 Aug 2020.

The rule applies to loans granted from 28 Aug 2019 while implementation is effective from 1 Aug 2020.