📲India's Super-App: Jio?

Still many of us are guessing Jio is just an another mobile & e-commerce service provider..

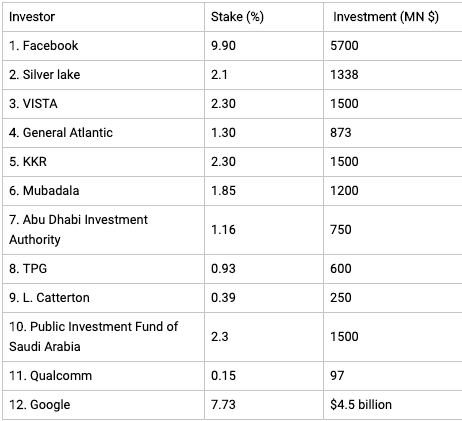

If that's the case why so many well known brands - FB, Google, Qualcomm, Silver Lake, Vista, KKR & many other invested in Jio?

Thread 👇 1/17...

Still many of us are guessing Jio is just an another mobile & e-commerce service provider..

If that's the case why so many well known brands - FB, Google, Qualcomm, Silver Lake, Vista, KKR & many other invested in Jio?

Thread 👇 1/17...

2/ What I observed is the categories of people - grapes are sour intellects & limited insight analysts keep ranting that Jio is one more Airtel or BigBasket with poor services, whats so great about it.

Not many of us are aware, why these investments in Jio 👇

Not many of us are aware, why these investments in Jio 👇

3/ What could be the reason behind Jio's strategic stake sale, lets understand the concept of "Super-App"

What is "Super-App or Mini-Programs"

What is "Super-App or Mini-Programs"

4/ It wont surprises u if I say, 'u can do anything u want with one single device (smart-phone)'

but u give a thought if I say, 'u can do anything u want with one single app'

But u guess, its not a good idea, v have apps example Just Dial, how many of us use it?

but u give a thought if I say, 'u can do anything u want with one single app'

But u guess, its not a good idea, v have apps example Just Dial, how many of us use it?

5/ Lets understand in detail Super-App Concept& WeChat Super-App

A super app is many apps within an Umbrella App. Its having OneApp for chatting, video calling, media sharing, social media, shopping, grocery, food, movie-event booking, cab, payment, commerce & many others.

A super app is many apps within an Umbrella App. Its having OneApp for chatting, video calling, media sharing, social media, shopping, grocery, food, movie-event booking, cab, payment, commerce & many others.

6/ *WeChat*

A largest gaming co & 5th largest internet co in the world.

Its parent Tencent - a Chinese conglomerate with many investments in

Social Network Payment System

Media Entertainment

Smartphone e-comm

Ads & many others

A largest gaming co & 5th largest internet co in the world.

Its parent Tencent - a Chinese conglomerate with many investments in

Social Network Payment System

Media Entertainment

Smartphone e-comm

Ads & many others

7/ Tencent has given returns of 11,000% since it went public on Hong-Kong stock exchange, analysts here in India are worried about RIL's over-valuation before any Re-Rating.

Lets understand Tencent Offerings 👇

Lets understand Tencent Offerings 👇

8/ Tencent Offers the following:

1. Social Network

2. Digital Payment

3. Entertainment

4. Information & News

5. Cloud Providers

6. Artificial Intelligence

7. & few strategic investments in Tesla, Snapchat, start ups - Flying Cars & Astroid Mining.

Does Joi has all these?👇

1. Social Network

2. Digital Payment

3. Entertainment

4. Information & News

5. Cloud Providers

6. Artificial Intelligence

7. & few strategic investments in Tesla, Snapchat, start ups - Flying Cars & Astroid Mining.

Does Joi has all these?👇

9/ About WeChat & Business Model

WeChat was launched in 2011 a messenger app like WA. It was reported that WeChat was on the brink of purchasing then rival WA in2014. Untimely surgery of CEO Pony Ma of Tencent allowed Zuckerberg to get in there first.

WeChat was launched in 2011 a messenger app like WA. It was reported that WeChat was on the brink of purchasing then rival WA in2014. Untimely surgery of CEO Pony Ma of Tencent allowed Zuckerberg to get in there first.

10/ How WeChat evolved as a SuperApp. Many sub-apps added within WeChat ecosystem called Mini-Programs

These r basically d tiny apps within WeChat, access in <5 seconds. Many hav developed mini programs on WeChat, eg ~ Tesla, JD.com &Mobike (shared-bike services)

These r basically d tiny apps within WeChat, access in <5 seconds. Many hav developed mini programs on WeChat, eg ~ Tesla, JD.com &Mobike (shared-bike services)

11/ Does it make sense to use tiny app with existence of native apps like Uber, Zomato, Uber, Oyo, Quicker, Amazon, Flipkart & many others in one single app called “Super App”?

Why not? If I get everything quickly onWhatsApp, why I should spend time on multiple native apps

Why not? If I get everything quickly onWhatsApp, why I should spend time on multiple native apps

12/ Youzan – a SaaS solution provider says a user access to Mini Program via:

•WeChat Official Account menu

•Embedded into WeChat article

•Discover tab of WeChat

•Sharing card on WeChat groups

•Scan of Mini Program QRcode

•Search

Here is the % distribution..

•WeChat Official Account menu

•Embedded into WeChat article

•Discover tab of WeChat

•Sharing card on WeChat groups

•Scan of Mini Program QRcode

•Search

Here is the % distribution..

13/ LY active user base & time spent on mini programs grew by 60% & 23%. 746 million monthly users monthly time spent 64 mins

Now the question is, does Mini-Program replace or beat native app? It may not, but definitely take away the major traffic from them (market share).

Now the question is, does Mini-Program replace or beat native app? It may not, but definitely take away the major traffic from them (market share).

14/ Let us check, e-commerce industry distribution, the major industries r Grocery, Cloths & Shoes, Living Goods & Transportation.

No doubt why Jio WhatsApp chose to integrate grocery shops in first place.

Refer distribution chart & fastest growing social commerce category

No doubt why Jio WhatsApp chose to integrate grocery shops in first place.

Refer distribution chart & fastest growing social commerce category

15/ WeChat

Active Users: 1.1 B

MCap $ 500 B ($ 83.6 B in 2015)

Not sure if Jio WhatsApp planning to replicate here, if “YES” why FB tied-up with Jio, they wld hav done this on their own?

Reasons could be~

Local Presence

logistics/infra

Working with Local Govt

Data

Active Users: 1.1 B

MCap $ 500 B ($ 83.6 B in 2015)

Not sure if Jio WhatsApp planning to replicate here, if “YES” why FB tied-up with Jio, they wld hav done this on their own?

Reasons could be~

Local Presence

logistics/infra

Working with Local Govt

Data

16/ Disclaimer: Invested in RIL, I am not an employee of RIL.

The above thread is my insight & opinion only that Jio may be an India's Super App.

*not a recommendation to invest*

The above thread is my insight & opinion only that Jio may be an India's Super App.

*not a recommendation to invest*

Opportunity for Jio?👇

https://twitter.com/NBCNews/status/1307084759336714240?s=19

Forbes say, it’s replicated Jack Ma and Alibaba’s strategy in China..

forbes.com/sites/enriqued…

forbes.com/sites/enriqued…

Reliance Jio in talks with Facebook to build a ‘super app’ similar to China’s WeChat

thehindubusinessline.com/info-tech/reli…

thehindubusinessline.com/info-tech/reli…

More on RIL & FB Strategic Partnership, beautifully articulated 👇

https://twitter.com/iramneek/status/1253305972233105409?s=19

• • •

Missing some Tweet in this thread? You can try to

force a refresh