1/ The fight over MOF is, I think, a much more consequential conflict than people assume.

Each side has firmly committed to a position using all its symbols of national prestige (Batrak/heads of parties vs. Qabalan/Amal/HA). They've both made it an existential issue to them.

Each side has firmly committed to a position using all its symbols of national prestige (Batrak/heads of parties vs. Qabalan/Amal/HA). They've both made it an existential issue to them.

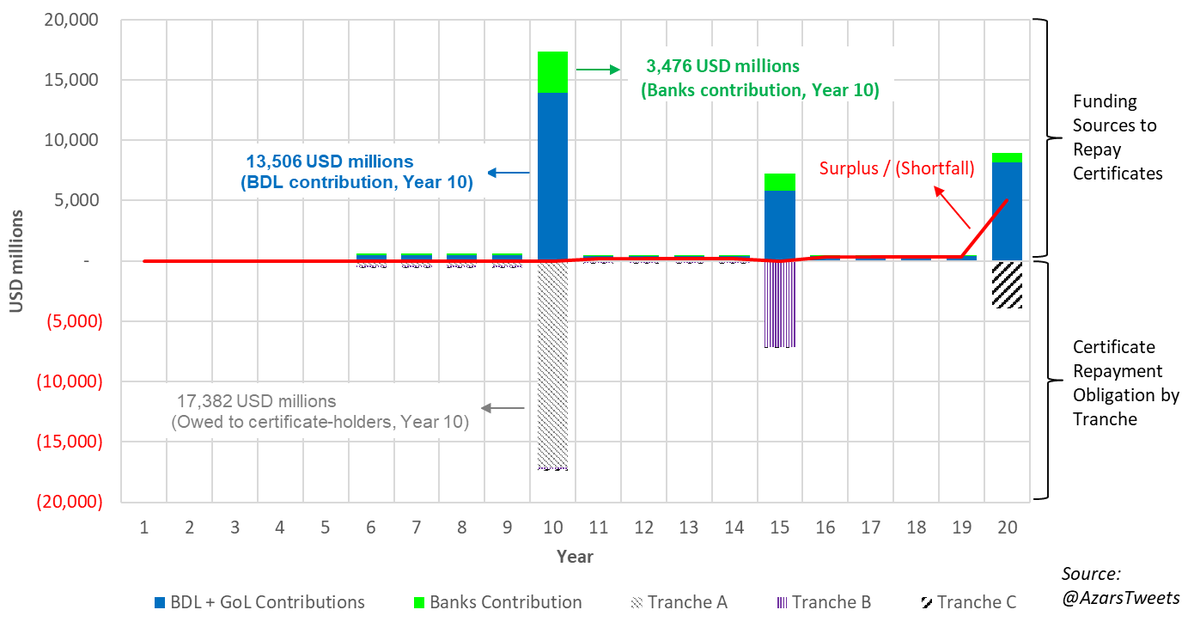

https://twitter.com/AzarsTweets/status/1306539345638285314

2/ This means, in effect, that neither side is able to back down anymore without a costly loss of face or "national prestige", which would have long-term consequences on its ability to bargain in the future by showing its "firm" positions aren't so firm after all.

3/ This is the fundamental problem with and benefit of burning the bridge behind you. You force the opposing side to "take it or leave it" as you've made yourself unable to concede. But if the other side has done the same, then the result is stalemate or escalation of threats.

4/ It seems to me the 2 scenarios are:

a. Stalemate and no government until (b) eventually happens; and

b. Escalation of threats from one/both sides to force the other to concede (possibly while offering it a rationalization for such concession if one can be found)

a. Stalemate and no government until (b) eventually happens; and

b. Escalation of threats from one/both sides to force the other to concede (possibly while offering it a rationalization for such concession if one can be found)

5/

(a) will lead to delays that the people/country can't afford.

(b) will lead to the more powerful side (which can impose its will) winning out and, possibly, violence if the escalation of threats needed to break the other side leads to that.

(a) will lead to delays that the people/country can't afford.

(b) will lead to the more powerful side (which can impose its will) winning out and, possibly, violence if the escalation of threats needed to break the other side leads to that.

6/ Given that Biden currently has a ~77% chance of winning the US elections, and one side betting on some radical geopolitical changes in the region if Biden wins (US-Iran deal), this suggests to me that one side clearly has a greater incentive for stalemate and/or escalation.

7/ The economic meltdown or possibility of aid are incentives to make a deal, but I don't think it's enough to cause one side to concede because well "the other side can concede instead of us" is what we're seeing happen right now. Why should we expect this to change?

8/ The loss of face of the side that concedes could lead to it taking steps to avoid such a scenario re-occurring. Does each "party" then have an incentive (if it can) to increase its power [arm itself] to improve its future bargaining position when a deal is eventually struck?

9/ Moments like this can be very precarious and things can escalate much quicker than we think. Will we have stalemate for the time being or will one/both sides find a way to back down without losing face?

• • •

Missing some Tweet in this thread? You can try to

force a refresh