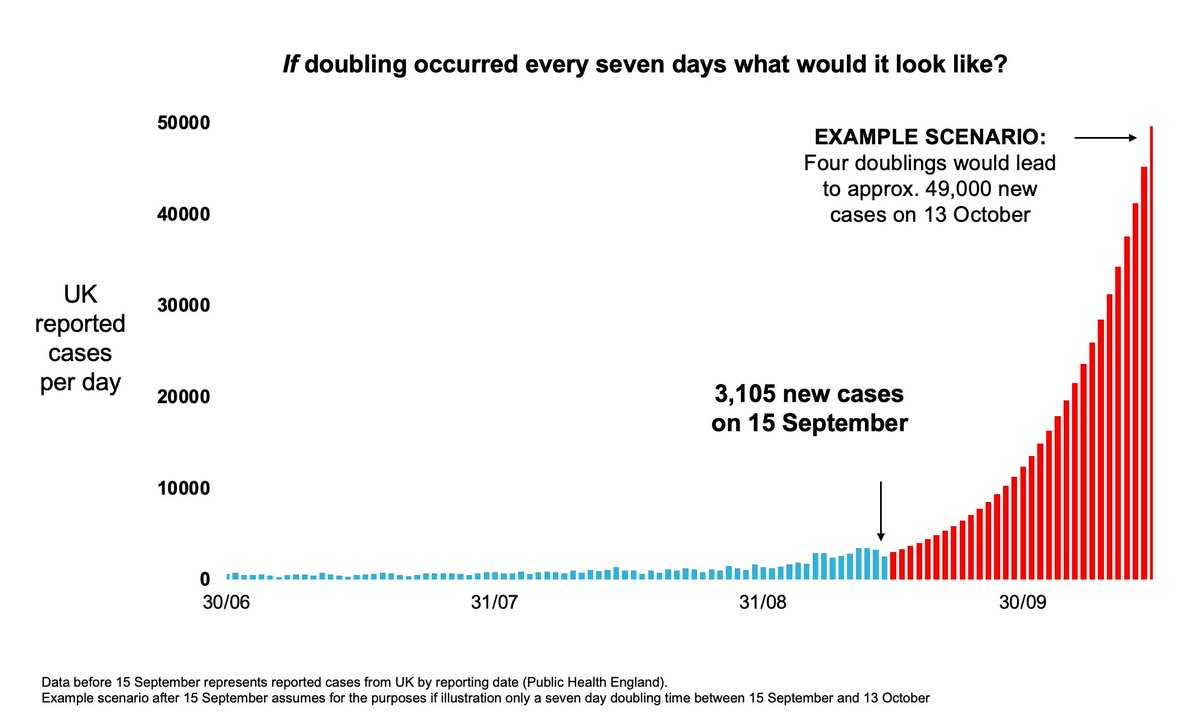

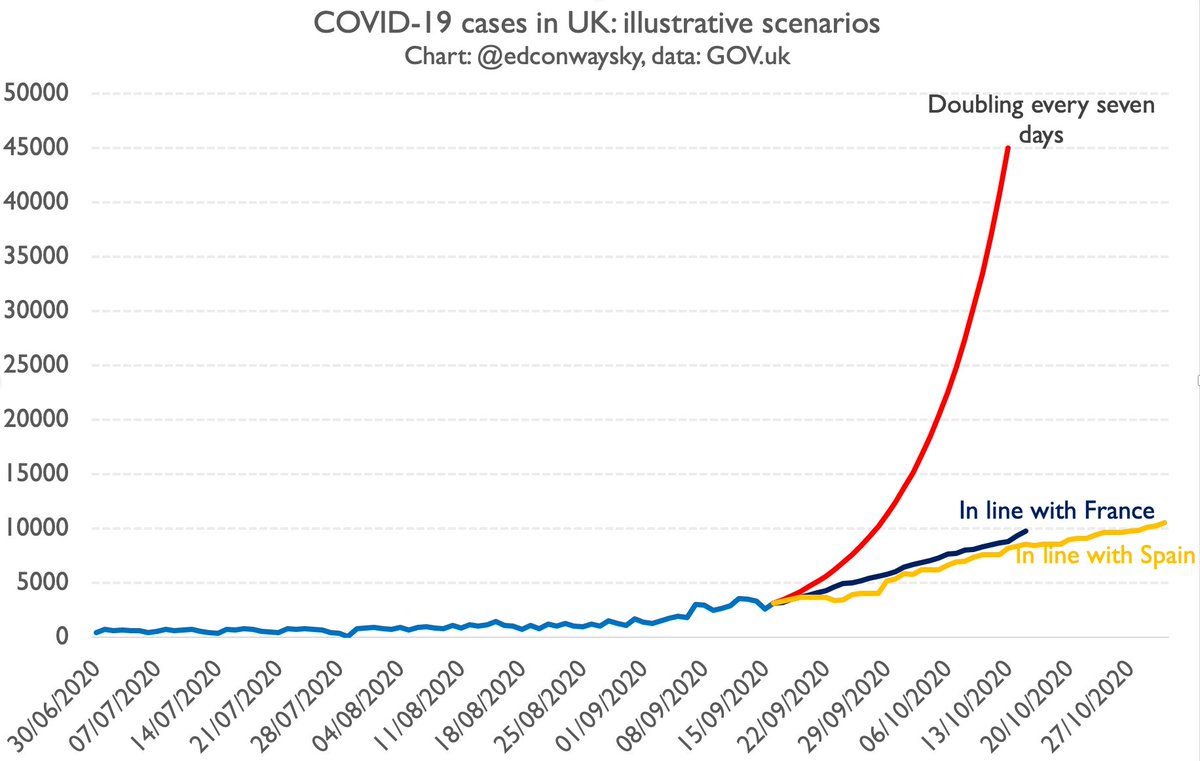

You’ll probably see this chart a lot today. It’s the one @uksciencechief just showed at the @10DowningStreet briefing today. It’s v v scary & implies if the current growth rate of #COVID19 continues we'll face 49k cases a day by mid October. So. Is this really plausible...?

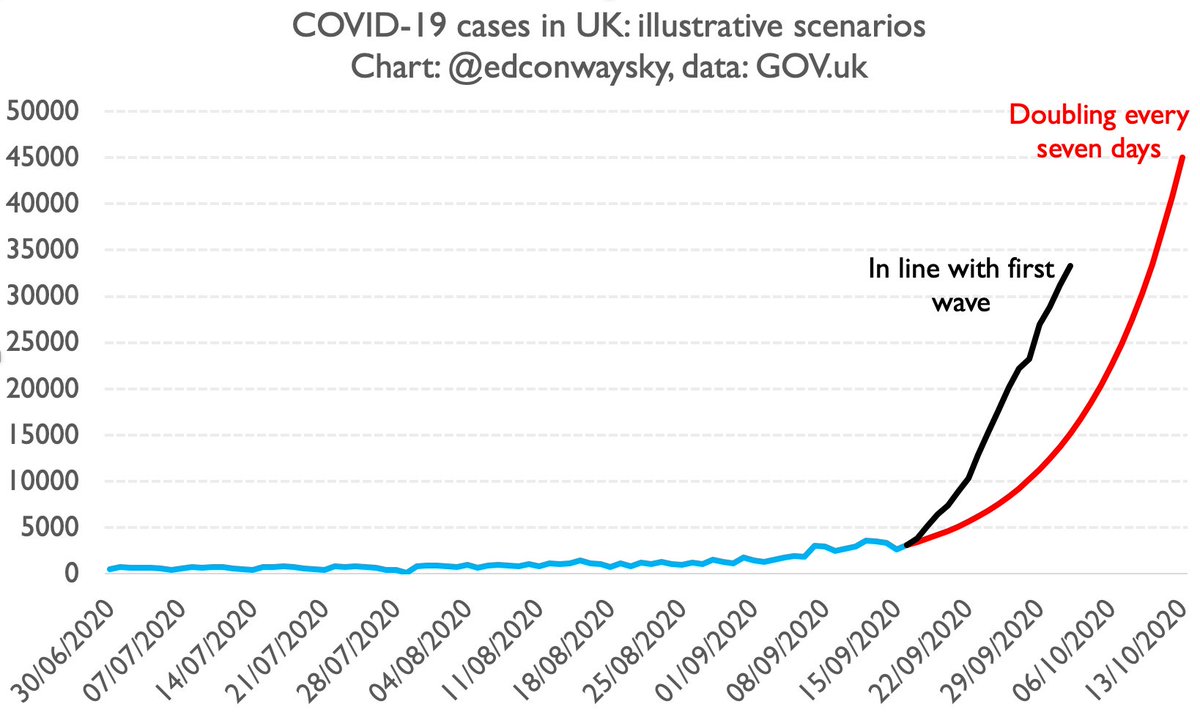

Well in strict mathematical terms, yes it is. Exponential growth rates are scary. This is precisely the problem with diseases like #COVID19. In the first wave deaths were for a time doubling every 3/4 days. Here's what that chart might look like if we followed last wave. Scarier!

But here's the big problem with @uksciencechief's scary illustrative chart: it's predicated on two presumptions. 1) that we are indeed seeing the disease double every 7 days. 2) it presumes that growth rate will continue. There are quite important challenges to both assumptions.

Let's take 1. first.

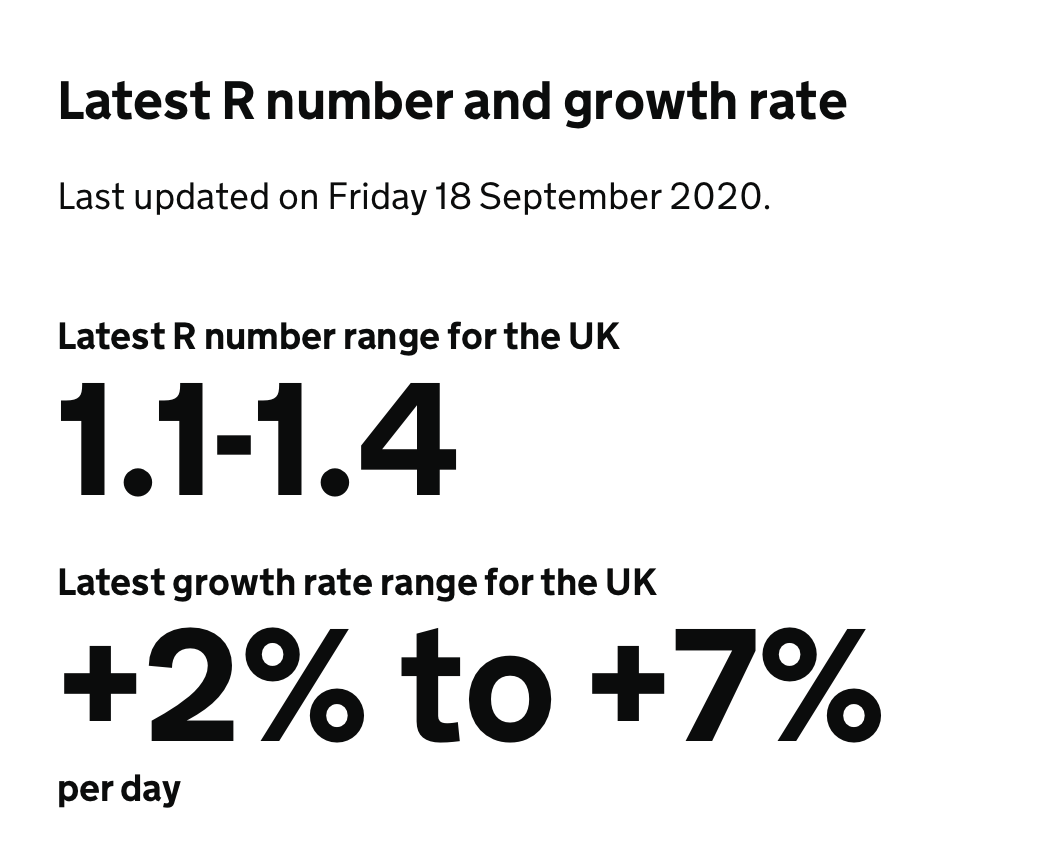

Doubling every 7 days works out at about 10.4% daily growth on average. Yet the govt's own estimate of the disease's growth rate, as per the latest R number release on fri, is 2-7%. Odd. Do they have data they're not telling us about? gov.uk/guidance/the-r…

Doubling every 7 days works out at about 10.4% daily growth on average. Yet the govt's own estimate of the disease's growth rate, as per the latest R number release on fri, is 2-7%. Odd. Do they have data they're not telling us about? gov.uk/guidance/the-r…

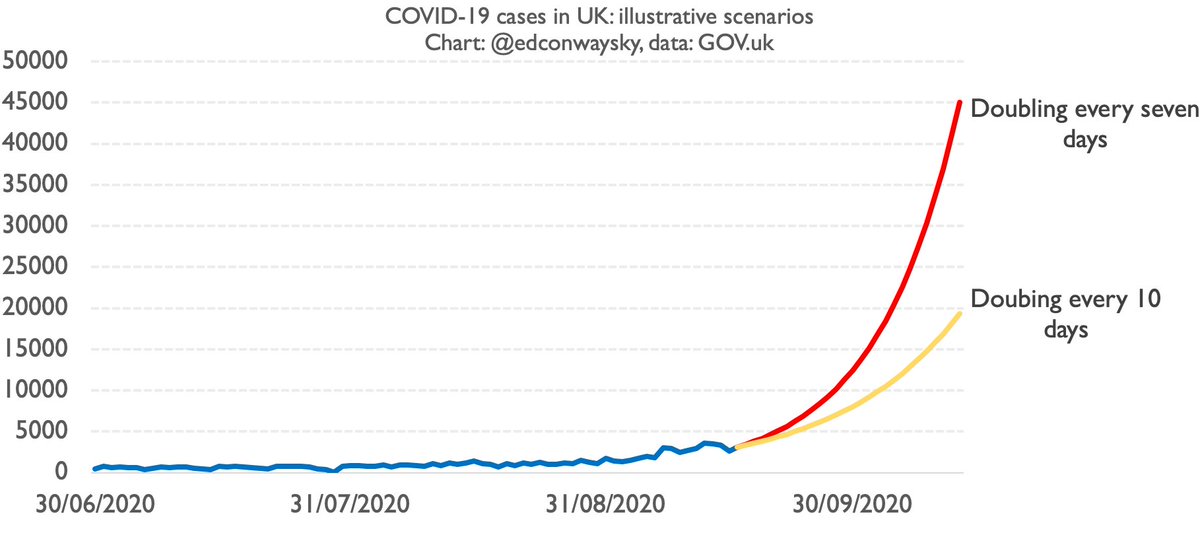

In an exponential world, smallish differences between % growth rates can make a big difference. Here's doubling every 10 days (yellow) vs doubling every 7 days, as per @uksciencechief's line (red).

Still grim. Up to 20k cases a day by mid Oct. But that's barely HALF the level.

Still grim. Up to 20k cases a day by mid Oct. But that's barely HALF the level.

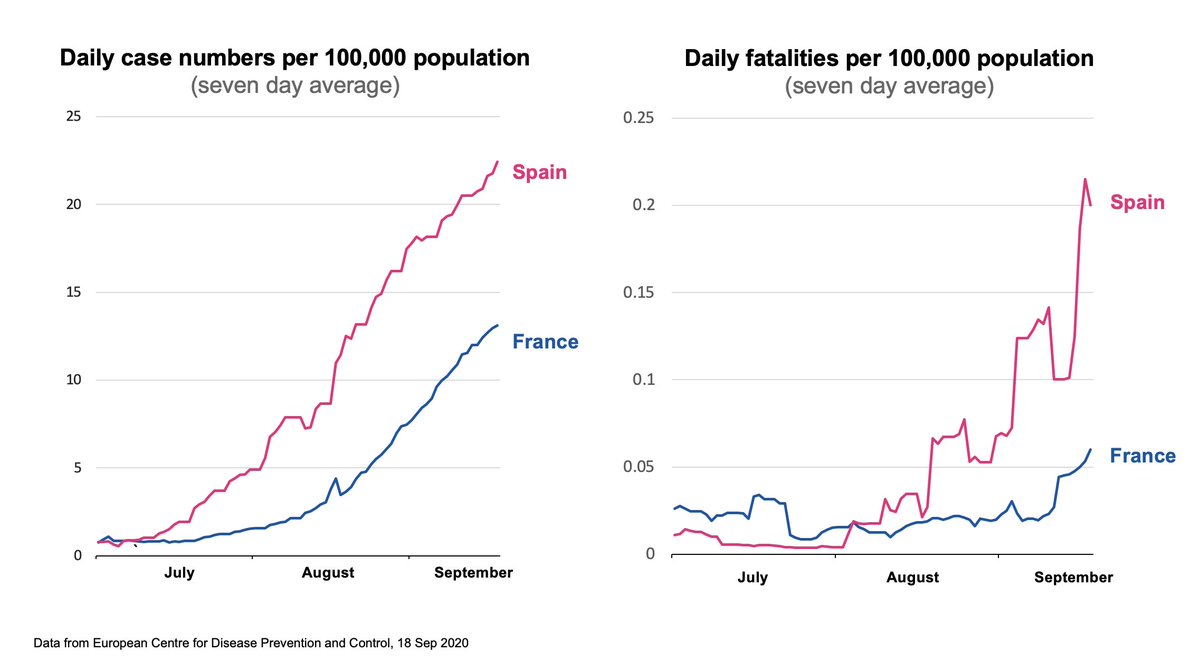

But just as important as q1 (the growth rate) is q2: the assumption the rate will not change over time. As @uksciencechief mentioned in his presentation, the UK is not the only country in Europe facing a rise in #COVID19 cases. There's also France and Spain...

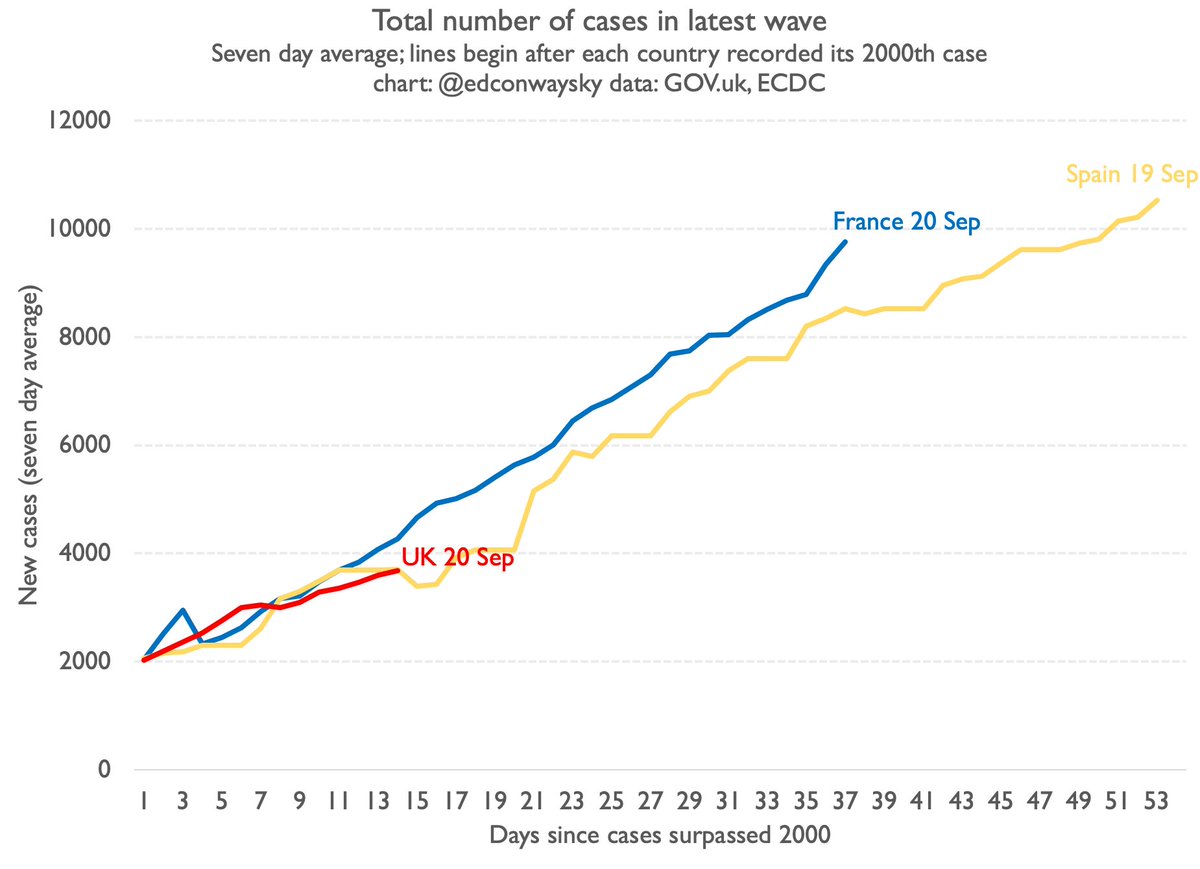

In fact, as I've pointed out a fair few times now, Britain's #COVID19 trajectory this time around is eerily similar so far to what we've seen in both France and Spain. Here's where we are now: about 2/3 weeks behind France/Spain. What happens if that continued?

If our #COVID19 growth followed France or Spain (as it has been so far) we'd be at around 10k cases a day by mid October. Not 45k or so.

This is an enormous difference.

10k cases is scary enough. It implies many more deaths & hospitalisations. But 45k cases is way, way worse.

This is an enormous difference.

10k cases is scary enough. It implies many more deaths & hospitalisations. But 45k cases is way, way worse.

Clearly it's not impossible our case trajectory suddenly leaps as per @uksciencechief's chart. Perhaps he has data we don't have. Though so far there's no sign our trajectory is dramatically different from the ones in France and Spain. If that changes I will of course 🚨

UPDATE: another 4,368 positive #COVID19 cases in the UK in the past 24 hours.

Does that change the overarching picture - that the UK’s cases are following the French/Spanish trajectory - rather than the much steeper illustration from @uksciencechief?

No. Updated chart:

Does that change the overarching picture - that the UK’s cases are following the French/Spanish trajectory - rather than the much steeper illustration from @uksciencechief?

No. Updated chart:

• • •

Missing some Tweet in this thread? You can try to

force a refresh